Many people like the idea of “FIRE” — financial independence, retire early.

The idea is to spend as little as possible and invest as much as possible for the future.

Maybe that works for some people.

But it doesn’t work for countries overall.

Chinese households have followed the principle of FIRE for decades.

Their savings rate of 44% is double the global average of 22%.

There are rational reasons for that.

Reasons Behind China’s Desire for FIRE

Hundreds of millions of Chinese workers who moved from the countryside to work in urban factories don’t qualify for government benefits.

They need savings to pay for their retirements and health care.

Another factor is China’s one-child policy.

For much of the past 40 years, that policy limited population growth.

It also meant parents couldn’t count on help from their children in old age.

The high savings rate may have prevented many from enjoying life while they were young.

It’s also prevented China from achieving sustainable growth.

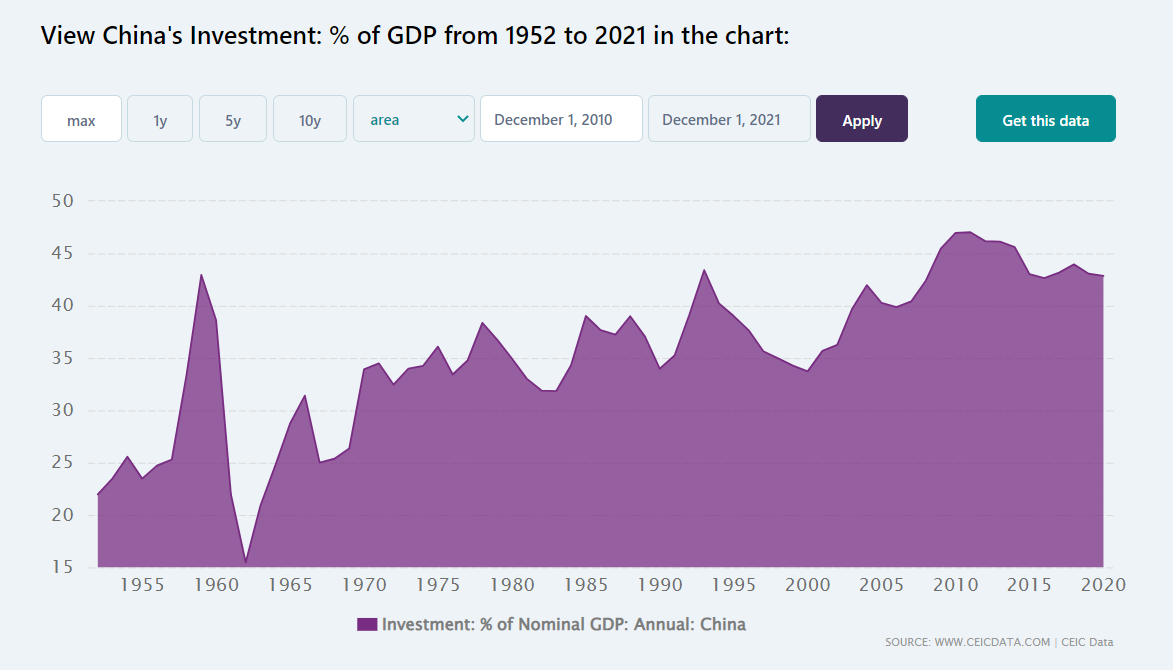

The investment rate of more than 40% is well above the typical U.S. rate of 17% to 20%.

Source: CEIC Data.

This has led to spending large amounts on factories and property development.

Those investments don’t always lead to economic growth.

And that is why China’s economy is slowing.

The Chinese government needs to address this problem.

How Chinese Officials May Address Economic Crisis

Officials can shift investments from property development to infrastructure.

This may not boost growth, since it just shifts resources to different nonproductive uses.

The government can adopt policies to rebalance the economy to emphasize consumption.

This would mean more consumer spending.

It’s not probable for this to happen because it requires Communist Party officials to give more resources to households.

That would mean less for them. The odds of this seem low.

The final option is to accept slow growth.

Though this seems like the easiest outcome for China, it carries risks.

Slow growth often precedes uprisings and political change.

To prevent that, China may increase the powers of the police state.

Bottom line: This will impact global markets and is one reason investors should pay attention to this week’s National Congress of the Communist Party.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.