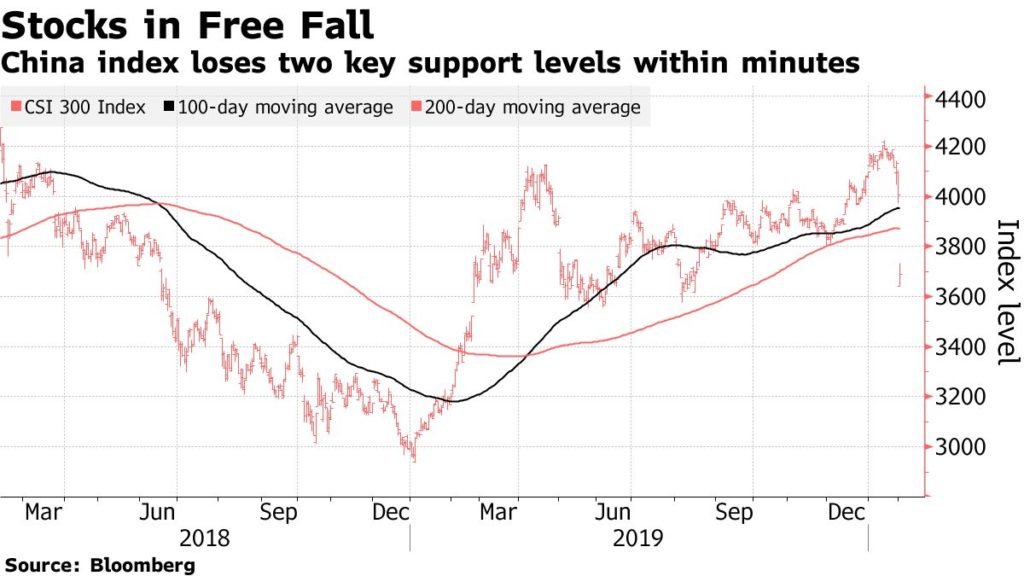

With Chinese markets finally opening back up after an extended holiday fueled by coronavirus fears, the sell-off was brutal for the $7.5 trillion market, which fell as much as 9.1%, the most since 2015.

Thousands of Chinese shares fell the maximum daily limit allowed by the government within minutes of the markets’ open. All but 162 of nearly 4,000 stocks in the Shanghai and Shenzhen stock exchanges notched losses, with a staggering 90% of them falling the maximum allowed.

Health care companies made up most of the exchange’s small number of gains based on the belief they stand the most to gain from the outbreak of the coronavirus, which is now responsible for a reported 360 deaths, spreading to more than 17,000 people in China alone.

“The sell-off was so quick and intense,” Snowball Wealth Managing Director Li Changmin said, according to Bloomberg. “We’ll be busy dealing with risk controls and even liquidation pressure if stocks keep falling.”

China also blasted the U.S. for “consistently creating and spreading fear” about the deadly virus.

“The U.S. government hasn’t provided any substantial assistance to us, but it was the first to evacuate personnel from its consulate in Wuhan, the first to suggest partial withdrawal of its embassy staff and the first to impose a travel ban on Chinese travelers,” foreign ministry spokesperson Hua Chunying said.

The virus originated in Wuhan, which is in central China, but it has now spread to more than 20 other countries.

Things were so bad it will take days for investors to execute their sell orders due to the daily loss limits in place.

“I was anxious before the market opened, and had made plans on what to sell and by how much last Friday,” Frankling Templeton SinoAm Securities Investment Management Inc. fund manager Bruce Yu told Bloomberg. “Some of my trades weren’t made today — we’ll see if we can sell them tomorrow.”

Chinese Markets Open for First Time Since January Due to Holiday, Coronavirus

Monday marked the first day of trading in China since Jan. 23 because of the country’s Lunar New Year break, which was extended over the spread of the coronavirus.

The sell-off included everything from iron ore to crude oil, and the yuan also weakened past a key level compared to the U.S. dollar, according to Bloomberg.

But not everyone was enamored by the thought of selling off equities at a massive discount.

“I had a look at stocks at the open, grabbed my fishing pole right after and left home,” Baptized Capital Vice President of Investment Yin Ming told Bloomberg. “What else can you do? I knew the market would be ugly today but didn’t expect a drop of this magnitude.”

The Chinese central bank began taking its first steps toward stabilizing the market, giving short-term funding to banks and cutting interest rates, and some traders saw the sell-off as a great time to BTD — buy the dip.

“Buying is all I’m doing,” Frontsea Asset Management’s Hou Anyang said. “I’ve been through the circuit-breaker of 2016 and other big routs — as a professional investor, this is a huge opportunity.”

China also took steps to limit short sellers, according to a report by Reuters.

Meanwhile, U.S. markets were largely up big Monday morning.

As of 10:30 a.m. EST, the S&P 500 and Dow Jones Industrial Average were both up 1.3%, and the Nasdaq was up 1.6%.

Among the biggest movers was once again Tesla (Nasdaq: TSLA), which was up more than 10% at 10:30 a.m. EST. Video communications company Zoom (Nasdaq: ZM) also was up more than 10% through early trading Monday.