It’s been a tough year for restaurant and bar owners.

With social distancing requirements still limiting in-person capacity, most traditional eating and drinking establishments have seen their sales drop. And patrons that brave restaurants and bars are staying for shorter periods of time and ordering less.

While 2020 has been a disaster for full-service restaurants, it’s been far kinder to fast-casual eateries better tailored to carry-out.

Fast-casual restaurants are something of a hybrid between fast food and full-service. There’s no waiter, and they tend to offer higher-quality food with more customization than your typical burger joint.

As a case in point, let’s take a look at Chipotle Mexican Grill Inc. (NYSE: CMG).

Chipotle was an early adopter of the fast-casual model and has become a ubiquitous part of America’s dining landscape. It’s hard to remember what life was like before Chipotle’s enormous burritos became part of our national diet.

Not only was Chipotle a pioneer in the fast-casual model, but it also pioneered ordering through a mobile app. Chipotle’s app allows you to order ahead and skip the line. That was convenient pre-COVID-19. Now, it could literally be considered a lifesaver.

Chipotle’s revenues are down slightly during the pandemic. Revenues for the second quarter came in at $1.365 billion vs. $1.434 billion in the same quarter last year. This is despite many Chipotle locations closing in April and May.

Interestingly, a little over 60% of revenues for the quarter came from its mobile app and other digital initiatives, with that figure split around 50/50 between delivery and carry-out. We can’t know what Chipotle’s revenues would have looked like without its app, but it’s likely they would have been a lot lower.

Life is getting close to normal by the day, but habits taken up during the pandemic will stick around. Once you get used to mobile ordering, you don’t want to go back to standing in a long line.

With all of this as background, let’s see how Chipotle stacks up using Adam O’Dell’s Green Zone Ratings system.

Chipotle’s Stock Rating

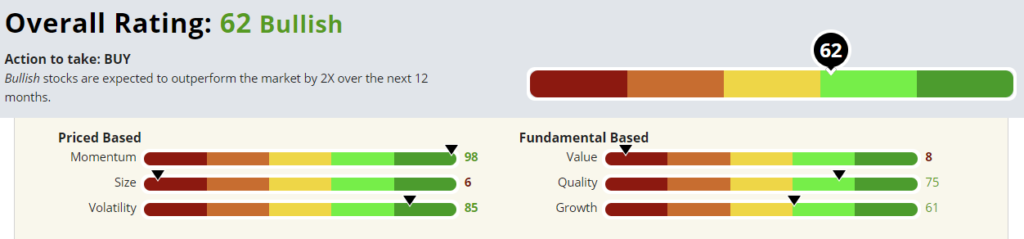

Chipotle’s Green Zone Rating on October 9, 2020.

Chipotle boasts an overall rating of 62 out of 100, which puts it in the “Bullish” bracket. Historically, stocks rated as Bullish have outperformed the market by an average of two times over the following 12 months. Let’s unwrap this burrito to see what’s driving the rating.

Momentum — Chipotle rates highest on momentum, at 98. This is remarkable considering it isn’t a tech stock. The momentum trade in 2020 has been dominated by large-cap tech names. So, Chipotle’s high rating here is all the more noteworthy.

Volatility — Low-volatility stocks tend to outperform high-volatility stocks over time. So, a high rating here means that a stock has low volatility. Chipotle rates an 85 here.

Quality — We rate stocks for quality based on various metrics, but most tend to focus on profitability and balance sheet strength. Chipotle rates a 75 in quality, and that is exceptional for a restaurant stock. Restaurants tend to have thin margins. Chipotle is an exception.

Growth — Chipotle rates a respectable 61 in growth. This comes despite a dip in revenue this year. Chipotle’s rapid growth of the past 10 years helps buoy its rating. Considering that Chipotle has been a common fixture in the American dining landscape for well over two decades, its continued high growth is impressive.

Value — Unfortunately, Chipotle isn’t cheap. Based on our value composite, Chipotle rates at just 8.

Size — Likewise, Chipotle rates poorly on size at 6. Chipotle has a market cap of $36 billion. While that is small relative to, say, McDonald’s $167 billion market cap, it’s still very large for a restaurant stock.

Bottom line: Despite rolling burritos rather than coding software, Chipotle shares a similar stock profile to the large-cap tech giants dominating the post-COVID market. It’s a high-quality, low-volatility stock with solid momentum and growth. But we’re paying top dollar for these qualities, as the stock is expensive.

Valuation matters over long time periods but tends to have little impact over shorter windows. This suggests that, despite being expensive, Chipotle could have further to run based on its Green Zone Rating.

Money & Markets contributor Charles Sizemore specializes in income and retirement topics. Charles is a regular on The Bull & The Bear podcast. He is also a frequent guest on CNBC, Bloomberg and Fox Business.

Follow Charles on Twitter @CharlesSizemore.