I admit, when it comes to work, I’ve always preferred to be in the office.

Sure, I’ve dreamt of a time when I could stay at home all day and work. But, mentally, I never accepted that as a part of my make-up.

I live to collaborate face-to-face.

In March, however, that all changed when the coronavirus took hold of the country and forced us to make some pretty difficult decisions.

If COVID-19 taught us anything, it’s that we need to be adaptable.

Millions of Americans and thousands of businesses were forced to be nimble when it came to how they worked.

Me included.

Now, eight months into the virus, working from home seems normal.

We are now used to video calls, file sharing and collaboration from a distance.

Technology has made this shift possible.

As investors, finding a way to buy into this trend is the key to outsized gains.

I’ve found a cloud computing ETF that benefits significantly from this shift in how we work.

And, it’s one that will continue to grow, even after COVID-19 is long gone.

And it could even triple the market’s overall gains in 12-24 months.

I’ll tell you about it in a sec, but first, I want to talk about why I think this particular tech sector is going to rocket higher than it already has.

This Tech Market Is Set to Explode

When it comes to growing a business … or even operating a business in the age of the coronavirus … it comes down to one thing: management.

And I don’t just mean managing employees.

I’m talking about more than that.

Managing operations, logistics, human resources and data.

If you don’t have a handle on that, your business won’t be successful.

To manage all of those things, businesses have turned to the cloud.

The cloud is a place where software and storage come together as one.

Employees can remotely access documents, platforms and other management functions more efficiently and at less cost than before.

And companies that provide these cloud services have become increasingly popular among smart investors. They realize the value cloud computing companies have on the total business landscape.

Cloud Services Sector to Jump 150% by 2022

As this chart shows, the public cloud services market dipped in 2017 to around $145.3 billion.

The dip was short-lived, and the market is expected to grow by 150% into 2022.

That’s huge!

In April 2020, I wrote about three cloud computing companies I believed were on the verge of a big breakout. Those three companies have gained nearly 30% since my recommendation to buy — including one that’s up nearly 40%. You can see that article here.

I’ve found an exchange-traded fund (ETF) that has grown even faster than the market.

I think it will continue on that path and provide investors with unbelievable gains in the next 12 months.

This Cloud Computing ETF Will Soar Higher

There are a lot of companies that provide cloud computing … I mean a lot.

Instead of trying to pick out that diamond in the rough, I’ve found a cloud computing ETF that gives you the most bang for the buck. It gives you a strong position within the sector.

The WisdomTree Cloud Computing Fund (Nasdaq: WCLD) invests in global cloud computing companies like Zoom Video Communications Inc. (Nasdaq: ZM), Cloudfare Inc. (NYSE: NET) and Paycom Software Inc. (NYSE: PAYC).

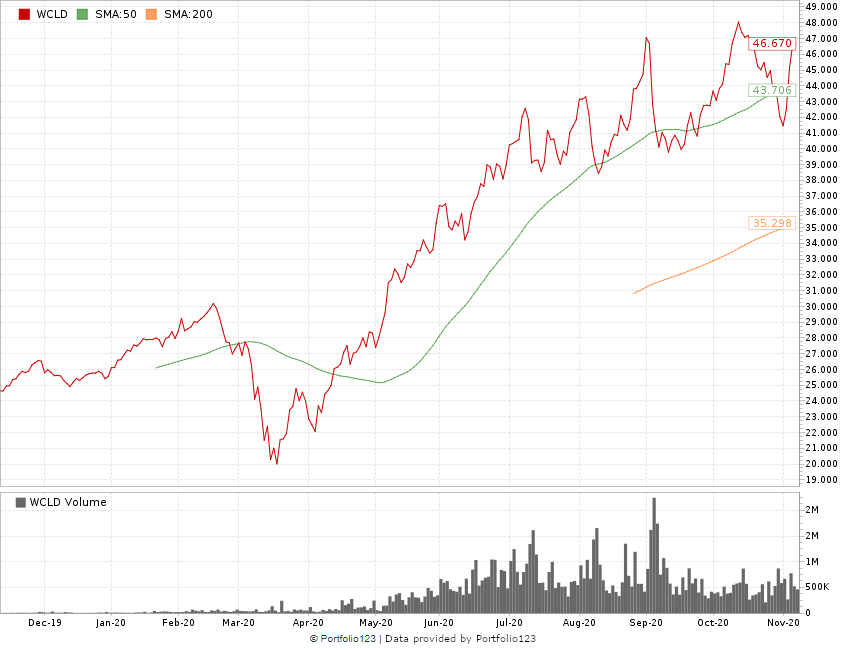

WCLD Moves 127% Higher Since March 2020

As you can see, after hitting a low of around $20 in March 2020, shares of WCLD have rocketed up 127%. That’s in part due to the push for business-to-business cloud computing during COVID-19 lockdowns.

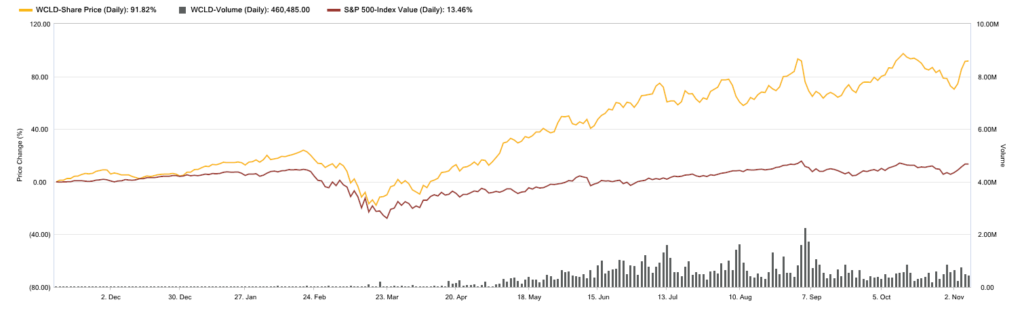

Over the last 12 months, this cloud computing ETF has seen a 92% increase in share price compared to the S&P 500, which has grown just 13.4% over the same time.

WCLD Outpaces S&P 500 By a Wide Margin

What to Do With WCLD

Chief Investment Strategist Adam O’Dell’s six-factor Green Zone Ratings system doesn’t rate ETFs because ETFs don’t have the same technical data that traditional stocks do (think returns on investment, assets and equity as well as price-to ratios).

But Adam and I still think ETFs are a great way to diversify and capitalize on market trends.

And if Green Zone Ratings did rate this cloud computing ETF, we would be “strong bullish” on it.

It has strong momentum, a $0.00 expense ratio and it’s blowing the doors off the S&P 500.

The bottom line: We don’t know what’s going to happen next with COVID-19 … more lockdowns, scaled lockdowns, etc.

But the virus has taught businesses the importance of managing their operations and data from anywhere in the world.

That’s why cloud computing companies are so important.

Because working remotely has become the norm, these cloud computing companies are only going to continue to grow.

Smart investors like you see this trend. Adding WCLD to your portfolio is a great way to realize 3X gains compared to the overall market in the next 12 months.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.