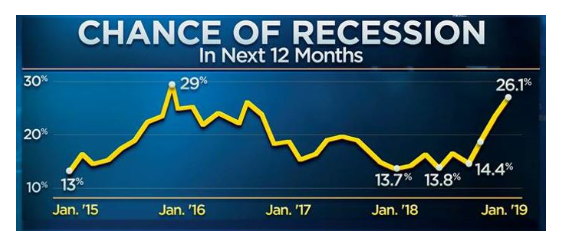

Fed rate hikes, the market sell-off, trade tensions and a record-long government shutdown has the chances of a recession in the next 12 months hitting their highest level in three years, according to the latest CNBC Fed Survey.

The survey was conducted last week amid the government shutdown over President Donald Trump’s long-promised border wall between the U.S. and Mexico. The probability of a recession in the next 12 months at 26 percent, the third straight increase.

The last time the probability was this high was in January of 2016 following another big market sell-off that pushed the chances to 29 percent.

Per CNBC:

“When you look at the slide in global growth, it is hard to think that, in a matter of time, the U.S. won’t join the slide,” Kevin Giddis, Head of Fixed Income Capital Markets at Raymond James Financial, wrote in response to the survey. “This prospect has only been enhanced by a lack of a trade deal, the government shutdown, and a completely inefficient cooperation in Washington.”

Neither the 2016 spike, nor the one that saw the series hit the all-time of 36 percent in 2011, preceded a recession. But the Fed reacted both times to the deterioration in underlying conditions: it launched its third round of quantitative easing in 2012 and delayed rate hikes for a year in 2016.

Similarly, the 46 respondents to the Fed Survey believe the Fed will now hike just once in 2019, down from a forecast of two in the December survey. And just 48 percent of respondents believe the Fed will hike in 2020, while 37 percent believe the Fed will cut rates.

“The FOMC policy statement will shift to a dovish tone that aligns with recent Fed speak,” Kathy Bostjancic, head of U.S. Macro Investor Services at Oxford Economics USA, wrote about the January meeting. “It will signal a pause in rate hikes by removing the reference to ‘some further gradual’ rate increases and modifying or removing the balance of risks assessment.”

One hundred percent of respondents expect no rate hike from the January meeting, the first where Fed Chairman Jerome Powell will hold a press conference after every meeting.

Respondents also forecast modest stock gains of just more than 4 percent and just 3.5 percent for 2020, pushing the S&P 500 to 2,846. Recent market volatility, global economic weakness and the ongoing trade war are the catalysts behind the muted growth.

Twenty–seven percent say the Fed gives short-run changes in bond and stock markets too much consideration, while 53 percent say the Fed pays the right amount of attention to it; 18 percent say it’s not enough.

Meanwhile, approval of President Donald Trump’s handling of the economy fell nearly 10 points to just 43 percent, a low percentage in a survey where respondents have given the president high marks for his economic stewardship. Protectionist economic policies, global economic weakness and a Fed policy mistake are seen as the biggest threats to the expansion. Yet, respondents to the CNBC Fed Survey actually raised their forecast for 2019 growth to 2.4 percent from 2.3 percent in the prior survey and from 1.8 percent to 2.05 percent for 2020. Unemployment is seen edging higher this year.

“The political concerns are outweighing the economic ones and once the chaos in Washington is cleared, the markets should rebound and interest rates rise sharply to reflect the true underlying strength of the economy,” wrote Joel L. Naroff, President, Naroff Economic Advisors.

The 10-year note yield is forecast to rise to just over 3 percent this year.