Money & Markets Week Ahead for the week of August 9, 2021: Coinbase earnings will provide a peek inside the cryptocurrency market. A key report on the state of inflation will also drop on Wednesday.

I also look into a regional bank IPO.

Here’s what to watch in the week ahead on Wall Street:

On the IPO Front: Southern States Bancshares

After Robinhood Market Inc.’s (Nasdaq: HOOD) wild debut last week, this week’s initial public offerings (IPOs) are light in comparison.

Southern States Bancshares plans to price its IPO on Thursday under the ticker symbol SSBK on the Nasdaq.

What it is: Established in 2007, Southern States Bancshares is a bank holding company that operates through its community banking subsidiary Southern States Bank. It operates 15 branches in Alabama and Georgia, providing deposits, loans and other banking-related products for individuals and businesses. It also produces loans through an office in Atlanta.

Its assets totaled $1.5 billion as of March 31, 2021. In 2016, the company reported total assets of $629 million. In five years, Southern States grew its asset base by 131%, according to the company’s prospectus filing with the Securities and Exchange Commission.

Its gross loans total $1.1 billion, and its total deposits equal $1.3 billion as of March 31, 2021.

The offering: This is a smaller IPO. Southern States plans to sell 2 million shares at a price range of $19 to $21 per share. The intent is to raise around $48 million with the offering.

According to Renaissance Capital, at a midpoint of $20 per share, the company would have a market value of $174 million.

Deep Dive: Coinbase Earnings

Despite some of the biggest earnings calls for this season behind us, there are still a few quarterly reports to keep on your radar.

I want to highlight Coinbase Global Inc. (Nasdaq: COIN) now that the cryptocurrency exchange has traded publicly for a few months. The Coinbase earnings call falls on Tuesday.

This is only the second quarter that Coinbase has had to divulge its financials to investors, so there isn’t a lot of data to go off of. Its reported earnings-per-share (EPS) for the first quarter of 2021 were in line with expectations at $3.05.

COIN is playing with a lot of new money. On the first day of its IPO, Coinbase’s stock rose nearly 32%, valuing it around $86 billion. That led to a 276% EPS gain between Q4 2020 and Q1 2021, but those numbers should normalize as the stock continues to trade on the public market.

Analysts hedged expectations a bit for the second quarter of 2021. The average EPS forecast is only $2.31, and that is likely because of one thing: the recent drawdown in cryptocurrency prices.

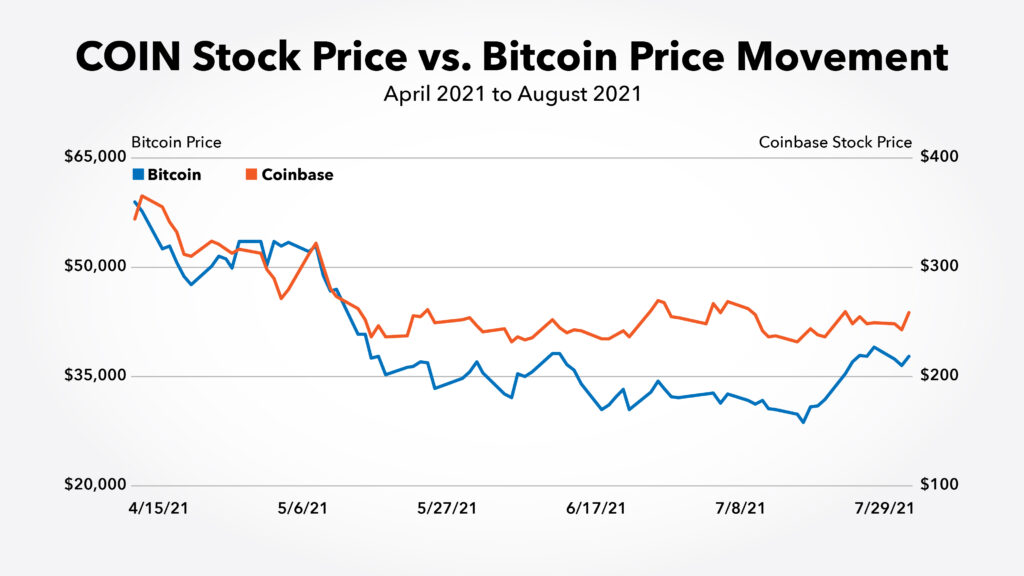

Coinbase is a cryptocurrency exchange, so its performance (and stock price) is tied to how well cryptos like Bitcoin are doing. You can see that in the chart below.

When bitcoin’s value goes up, COIN tends to follow the same pattern.

Analysts forecasted $1.81 billion in revenue in Q1, but Coinbase came in just under that, at $1.8 billion. Analysts now expect $1.77 billion in revenue for Coinbase in Q2.

Coinbase Earnings: What to Watch

With reduced expectations, it might be easy for Coinbase earnings to beat Wall Street’s outlook. But this is a pretty volatile stock, and anything can happen after it reports on Tuesday.

I would pay attention to what Coinbase executives have to say about competition in the cryptocurrency exchange space. Some smaller players could be a threat — not to mention the larger brokerages offering clients access to crypto trading as well.

Coinbase made a splash with its IPO, but it might be a tough road ahead for its stock.

Data Dump: Consumer Price Index

One of the best gauges of short-term inflation trends is the U.S. Core Consumer Price Index (CPI). July’s numbers drop on Wednesday.

The CPI, released monthly by the U.S. Bureau of Labor Statistics, measures price changes of goods and services, excluding energy and food. It provides insight into how consumers are spending within the economy.

The CPI was positive and beat forecasts in the last four months. Economic has ramped up following months of subdued spending amid COVID-19. The CPI in June increased 0.9%, more than double the forecasted 0.4%.

CPI Is Surging Higher

The skinny: July’s data will likely be more of the same. Economists are projecting a 0.5% rise, and I wouldn’t be surprised if the CPI comes in higher than that again.

Earnings Reports

To finish off the Money & Markets Week Ahead, here’s a look at some of the key earnings reports due out this week:

Monday

BioNTech SE (Nasdaq: BNTX)

Barrick Gold Corp. (NYSE: GOLD)

AMC Entertainment Holdings Inc. (NYSE: AMC)

Curaleaf Holdings Inc. (OTC: CURLF)

Tilray Inc. (Nasdaq: TLRY)

Tuesday

Softbank Group Corp. (OTC: SFTBF)

Coinbase Global Inc. (Nasdaq: COIN)

Plug Power Inc. (Nasdaq: PLUG)

Wednesday

NetEase Inc. (Nasdaq: NTES)

Prudential Public Limited Co. (NYSE: PUK)

eBay Inc. (Nasdaq:EBAY)

Thursday

Walt Disney Co. (NYSE: DIS)

Airbnb Inc. (Nasdaq: ABNB)

Macy’s Inc. (NYSE: M)

GrowGeneration Corp. (Nasdaq: GRWG)

Friday

FUJIFILM Holdings Corp. (OTC: FUJIY)

Cresco Labs Inc. (OTC: CRLBF)

Best,

Chad Stone

Assistant Managing Editor, Money & Markets