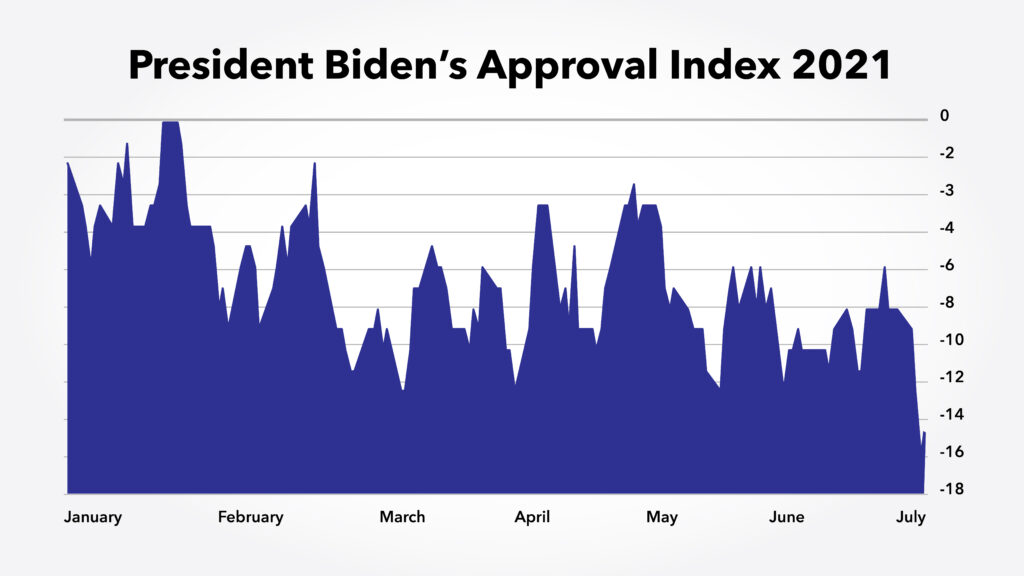

Recent data indicates that President Joe Biden’s approval numbers are declining. The stock market says this shouldn’t be the case.

According to The Hill, Biden’s approval rating is “fairly solid early in his administration, but there are some warning signs. Just as his positive polling and election win were based mostly on dislike of former President Trump, his current polling advantages may be just as shallow.

Biden should be doing well — in fact he should be polling very strongly. The economy is improving, the coronavirus is — at least for now — in retreat and there is none of the Trump White House drama the public so detested.”

Source: Rasmussen Reports.

Biden’s Approval Isn’t Following the Stock Market

The decline is worrying to political pundits, but it is especially puzzling to stock market analysts. Declining approval ratings are generally associated with declining stock prices.

Presidential approval ratings and trends in the stock market have been widely studied. Researchers have found that there is a link, but the link begins in the stock market:

Since the 1970s research has demonstrated a strong relationship between national economic performance and presidential approval. Traditionally, these popularity models rely on macroeconomic conditions; however, other economic performance measures may more fully capture the direction of the economy.

One such measure, the stock market index, captures elements of national and household economic well-being. Therefore, market performance should impact presidential ratings. Our presidential approval model, based on quarterly data covering 1960–2011, demonstrates that approval is highly sensitive to the stock market’s acceleration or deceleration, even with strong controls in the model for the other economic and political determinants of popularity. A rapid fall in the stock market index reduces president approval, while a sharp acceleration in the index growth boosts U.S. presidential approval.

Biden’s approval fell despite a sharp acceleration in the S&P 500 Index. This spells trouble for the president.

I don’t like working more than I have to.

That’s why I found a way to beat the market by making one simple trade per week.

Last year, this trade helped me beat the market eight times over.

It’s a great way to accelerate your gains. Click here, and I’ll show you how it works.

Michael Carr is a Chartered Market Technician for Banyan Hill Publishing and the Editor of One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Mr. Carr is also the former editor of the CMT Association newsletter, Technically Speaking.

Follow him on Twitter @MichaelCarrGuru.