Coinbase stock offers a way to invest in the cryptocurrency industry without buying digital currencies. But is COIN worth a look after the recent crypto collapse?

We’ll look at our proprietary Stock Power Ratings system to determine that.

Coinbase is a cryptocurrency exchange platform that allows people to buy, sell, and store digital assets.

Founded in 2012 by Brian Armstrong and Fred Ehrsam, it has become a leader in the world of cryptocurrency exchanges. It’s now one of the largest exchanges, with 103 million users worldwide.

In this blog post, we’ll take a look at Coinbase’s history, current state and future outlook using Stock Power Ratings as a guide.

The History of Coinbase

Coinbase was founded in 2012 with a mission to create an open financial system for the world.

At first, it offered only one product to trade — bitcoin — but soon expanded to offer other cryptocurrencies such as ethereum and litecoin.

Over time, Coinbase added more services such as trading, wallet management, merchant tools and digital asset custody.

By 2017, it was the largest crypto exchange in the U.S. by volume and had raised over $500 million in venture capital funding from investors including Andreessen Horowitz and Union Square Ventures.

Coinbase stock’s initial public offering launched in April 2021. We’ll look more at the ticker’s performance further down in this article.

The Current State of Coinbase

Today Coinbase is still one of the most popular exchanges for buying and selling digital assets. It offers support for over 200 different cryptocurrencies as well as access to global markets across more than 100 countries worldwide.

Its platform also includes features such as margin trading, staking rewards programs for customers who hold their coins in their wallets on the exchange, and over-the-counter trading desks for institutional investors.

Coinbase also acquired Neutrino which will allow it to provide blockchain analysis services to institutions who are looking to invest in digital assets or use them for payments processing solutions.

Now it is expanding its product offerings beyond just trading into areas such as lending, payments processing solutions with stablecoins like USDC and staking services for proof-of-stake tokens like Tezos (XTZ).

All these additions are aimed at making Coinbase an all-in-one destination for managing your entire portfolio of digital assets on one platform. And that could be a benefit for Coinbase stock.

Coinbase Stock’s Outlook for 2023

Coinbase is well positioned to be at the forefront of innovation when it comes to cryptocurrency exchanges over the next few years.

It has made several strategic acquisitions that will help it become even more competitive going forward; it is also expanding into areas such as lending which should help increase customer engagement on its platform even further.

But even if Coinbase is a leader among crypto exchanges, it’s dealing in an industry that is rife with issues at the moment.

And that’s reflected in Coinbase stock’s rating within our system.

Coinbase Stock Power Ratings

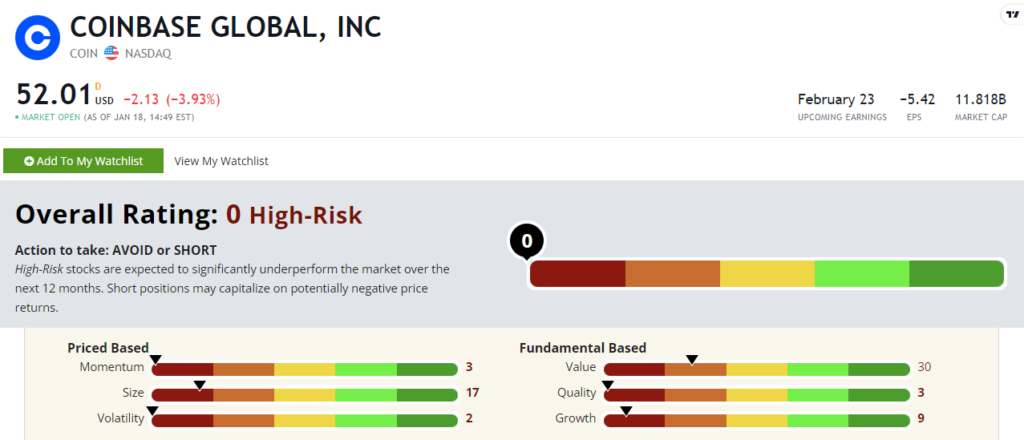

Coinbase stock rates a “High-Risk” 0 out of 100. That means our system expects the stock to underperform the broader market over the next 12 months!

COIN is one of the worst stocks of the 8,000 companies we rate.

It scores in the single digits on four of six factors.

It’s 3 out of 100 on momentum is reflected in its stock trajectory. Over the last 12 months, Coinbase stock has lost 77% of its value.

Even so, this may be a stock to at least watch. The crypto market seems to be stabilizing after the FTX debacle.

And COIN’s recent momentum is impressive. It’s actually up 45% year to date.

Just know it could be a wild ride from here.

If you’re looking for more analysis of Coinbase stock, check out this story from Adam O’Dell. It’s from April 2022, but Adam pretty much nailed COIN’s collapse.