There’s no doubt the economic environment is unusual. It has been for some time.

We recently saw trillions of dollars in stimulus payments as Washington experimented with giving money directly to individuals and businesses. Before that, we saw trillions of dollars in quantitative easing as the Federal Reserve gave money to large banks.

Those factors have led to unusual conditions for the past 13 years. A return to normal is overdue. But adjustment will be painful.

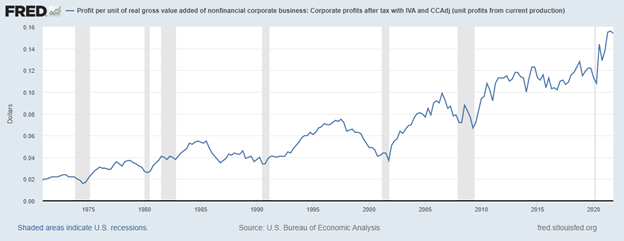

Distortions in the monetary supply affected many economic indicators. One that stands out is profit margins. The profit margin is the amount of money a company earns on every dollar of sales. The chart below shows the long-term trend in profit margins for the economy.

Profit Margins Have Soared Higher

Source: Federal Reserve.

Shrinking Profit Margins Is Required for a New Normal

The chart shows a long-term uptrend. As the economy recovered from pandemic shutdowns and consumers spent stimulus checks, margins soared. At the end of 2019, the margin stood at 12.2%, six times higher than its average in the early 1970s.

After peaking at 15.6% in the third quarter of 2021, last week’s GDP report revealed a small decline to 15.4%.

An average margin of 15% for the entire economy may be excessive. This is an average which means some companies have significantly higher margins while others operate with lower margins.

Among publicly traded companies, Visa’s margin tops 50%, while Walmart stands out with a 2.4% margin. Many small businesses on Main Street are below Walmart’s.

It’s almost certain that profit margins will decline in the next few quarters. For investors, the question is how far they drop.

Bottom line: Without easy money from the Fed, a margin of 8% to 10% for the economy could be appropriate. While this will help consumers through lower prices, it will hurt company earnings. That should lead to lower stock prices and is another reason to be wary of the current market.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.