Meme stocks create the impression that the stock market has changed.

In this new market, millions of investors go online and talk to each other about which stocks to buy. Then they act in unison and push the prices higher, defying analysts’ fundamentals and expectations.

The original meme stock was GameStop Corp. (NYSE: GME). A group on Reddit pushed the stock up with some participating to punish short sellers. It was a nice story, but two large investors provided funds to the short seller who is still operating his hedge fund and raising money for a new fund.

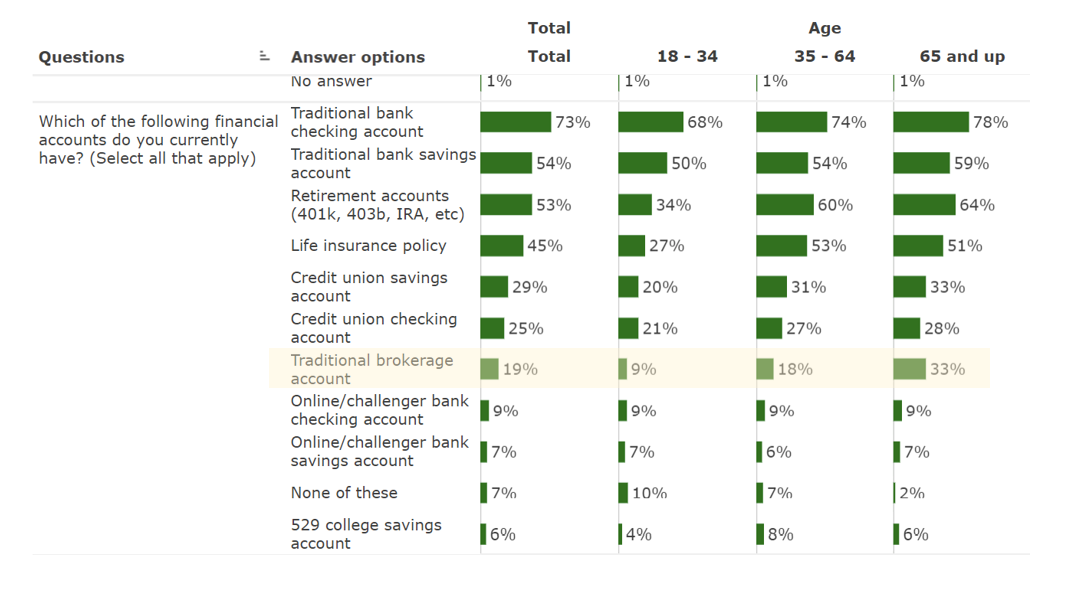

New data shows that the millennial influence on the stock market may be nothing more than a meme. A CNBC poll revealed that just 9% of the youngest generation hold a brokerage account.

Millennial Investors Lag Older Cohorts in Brokerage Numbers

Source: CNBC.

Millennial Investors Don’t Drive the Stock Market

The data is unsurprising. It largely reflects the traditional fact that young people stretch their money as they begin their careers and start families. Many don’t have the funds to invest, so they defer opening brokerage accounts until they are more financially stable.

This conflicts with the hype around online brokerages. It is now possible to open an account online in seconds. Investors can fund those accounts with as little as $5. It’s even possible to trade with that small amount of money since there are no commissions.

The fact that so many 18- to 34-year-olds are more focused on paying bills than the stock market confirms that some things are predictable. As this group ages, more will open brokerage accounts.

It’s always been that way, and technology can’t change that since investing is something that requires time and strong finances.

That doesn’t mean there won’t be meme stocks. Smaller groups have always been able to influence stock prices. It means the broad market averages will continue to trade as they always have.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.