When I was a kid, I begged my mother to take me to the store every week.

I worked extra chores because I always had my eye on the same thing.

Every week, I spent my allowance — plus cash I earned for doing odd jobs — on small packs of baseball cards.

The packs had 10-15 cards and a long stick of gum that was pretty much unchewable.

But I wasn’t getting the packs for the gum … it was for the cards. I memorized the stats and biographies of each player on the backs of those cards.

You see, I loved baseball. (Still do!)

Those cards were a connection to the game.

I also loved reading the quarterly magazines that detailed the value of each card.

It was like my own stock portfolio. I used to underline the cards I owned to see how much they were worth.

Recently, my grandfather mailed me my old baseball card collection.

I was shocked to see just how many cards I had collected.

I went back to my youth and started to check the value of some of my cards.

I was equally shocked.

That favorite pastime of mine — and millions of other kids — has led to a valuable collectibles stock investment.

The Money Is in the Rookies

I was a kid in the 1980s when card collecting as at its height.

Three major companies produced cards at that time:

- Topps.

- Fleer.

- Donruss.

And, like other kids my age, I had my favorite. I was a Topps collector.

But all three companies enjoyed massive sales in their heydays. By 2006 — before the company went private — Topps’ annual revenue was $312 million.

In terms of baseball cards, however, collectors make the biggest money in rookie cards — the cards issued during a player’s first season.

In 2019, a Mickey Mantle rookie card from 1952 sold for $69,000.

Just think … $69,000 for a picture on a piece of cardboard. That’s a fully decked-out, long-range Tesla Model S.

To fetch that kind of money, however, you can’t just expect a buyer to pay the price you ask. Your card has to be verified as authentic and without errors. It has to be in mint condition.

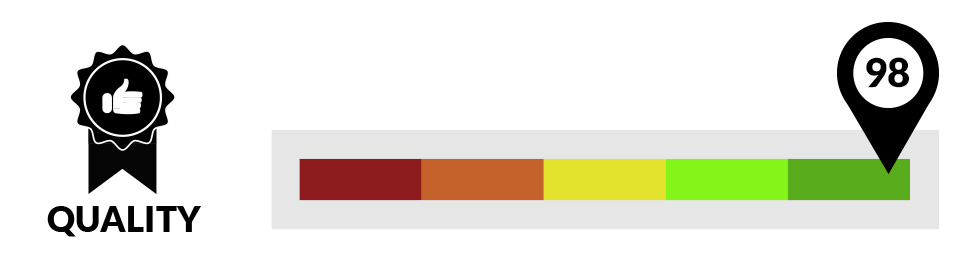

That leads us to a unique company. Adam O’Dell’s — Money & Markets Chief Investment Strategist — proprietary stock rating system tells us this is a high-quality stock.

This Collectibles Stock Is All About Quality

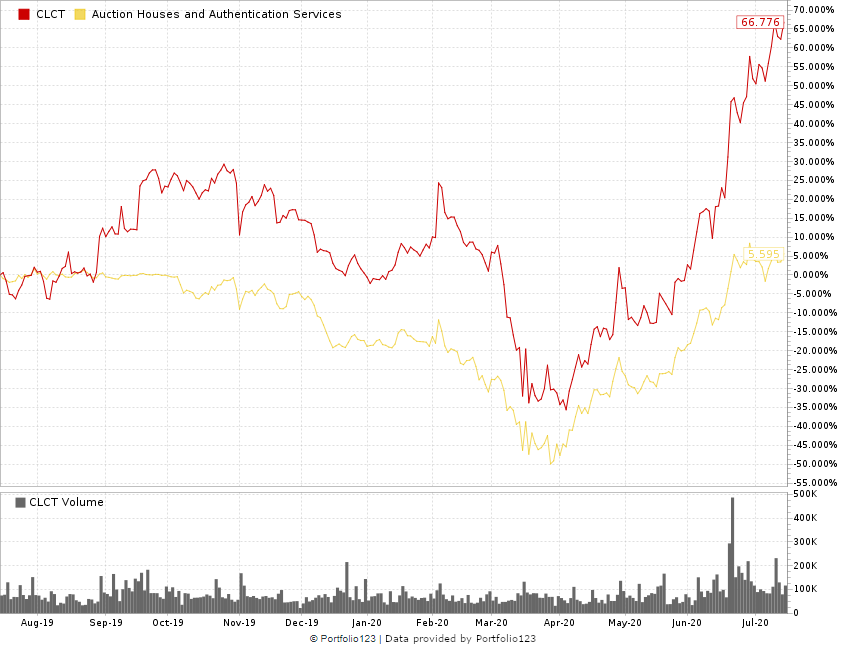

Adam’s system found that Collectors Universe Inc. (Nasdaq: CLCT) is a strong buy based on its quality and momentum.

The company provides authentication and grading services to dealers and collectors of coins, trading cards, autographs and other historical and sports memorabilia in the U.S.

CLCT Rises Higher Than Its Peers

Basically, you take your card to CLCT. They analyze it for any defects and authenticity. They’ll give your merchandise a “grade” (A, B, etc.), which determines how much you can charge for the item.

CLCT makes its money from those grading services for individuals. It offers the service on a subscription basis for dealers, and it publishes market prices for collectibles.

The company’s sales were $72 million in 2019 — an 80% increase from 2010!

Here’s what we found:

- Quality — CLCT rated a 98 in quality, meaning that only 2% of the stock market ranks higher. The company’s returns on investment, equity and assets are all outstanding — especially when we compare them to the rest of the authentication industry. Its returns rated 99% better than all other stocks. And it provides those returns with only mild volatility. What’s more, its profit margins rate a 92 — only 8% of the market is better!

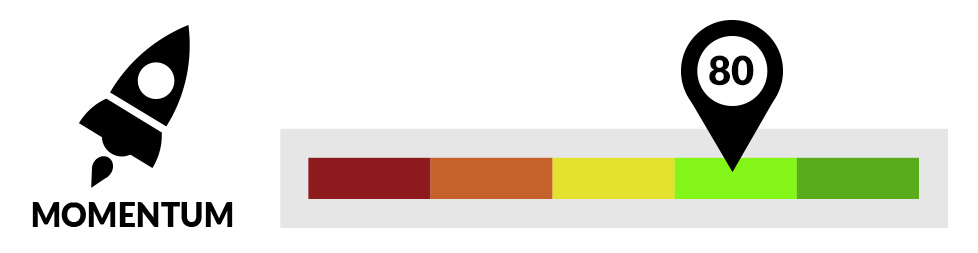

- Momentum — CLCT’s momentum rated better than 80% of all other stocks. Its trailing returns are better than 79% of the rest of the market.

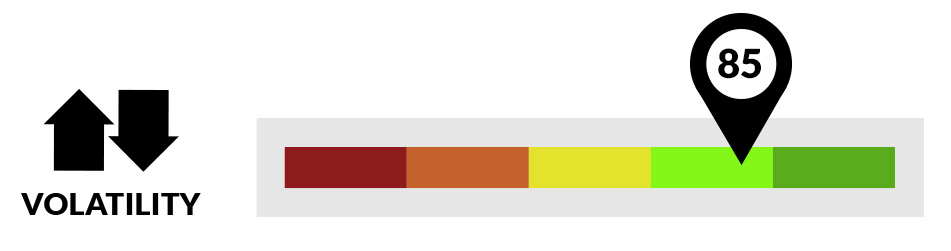

- Volatility —CLCT’s strong returns come with only mild volatility. The stock’s risk-adjusted returns rate 85 out of 100!

What You Should Do Now

More people my age and older are digging into their baseball card collections to find cards of value … whether to sell or to hang on to.

As they find those cards, they’ll need Collectors Universe to authenticate those cards for resale.

Adam’s system found that this high-quality collectibles stock offers investors the opportunity for big gains.

You want to get in now to realize those profits.