When I was a kid, I spent all the money I earned doing chores around the house on the same thing every week: packs of baseball cards.

Every Friday, after I got paid, I’d walk two miles to the nearest baseball card store and buy a pack of cards.

As the years went on, I bought magazines to find out the value of cards.

I never had a card worth more than a couple of bucks, but I knew of people who owned cards worth hundreds.

Now that I spend my time looking at stock market trends, I’ve found another way to make money off the billion-dollar baseball card industry.

Authentication Companies

In February of this year, my grandfather found my baseball card collection in the basement of my mom’s old house in Wichita.

He mailed more than 1,000 cards to me here in Florida.

So, I went to work researching to see if I had any cards of value.

That’s when I found out that some companies specialize in authenticating the condition and value of collectibles, like baseball cards.

The light bulb went off:

I wonder if there is a company that stands above the rest in this specialized sector.

Sure enough, I found one … and its stock has had a great year.

The No. 1 Collectibles Stock

Using Chief Investment Strategist Adam’s Green Zone Ratings system, I found, and first wrote about, Collectors Universe Inc. (Nasdaq: CLCT) in July.

It’s a company that provides authentication and grading services to dealers and collectors of coins, trading cards, autographs and other historical and sports memorabilia in the U.S.

Basically, you take your card to CLCT. You pay them a fee to analyze it for any defects and authenticity.

They give your merchandise a “grade” (A, B, etc.), which determines how much you can charge for the item.

CLCT makes its money from those grading services for individuals. It offers the service on a subscription basis for dealers, and it publishes market prices for collectibles.

The company’s sales were $72 million in 2019 — an 80% increase from 2010!

Think of it this way…

You have a 1952 Mickey Mantle rookie card that’s not authenticated by a company like Collectors Universe.

When you go to sell it, potential buyers will likely offer much less than what the card is worth if it were authenticated.

That “grade” gives proof to potential buyers that the card is authentic and is of a certain condition (think: good, average or poor).

Consider that a recent Mantle rookie card — authenticated — sold for a windfall of $69,000!

See why there’s money in companies like Collectors Universe?

Collectibles Stock Is All About Quality and Momentum

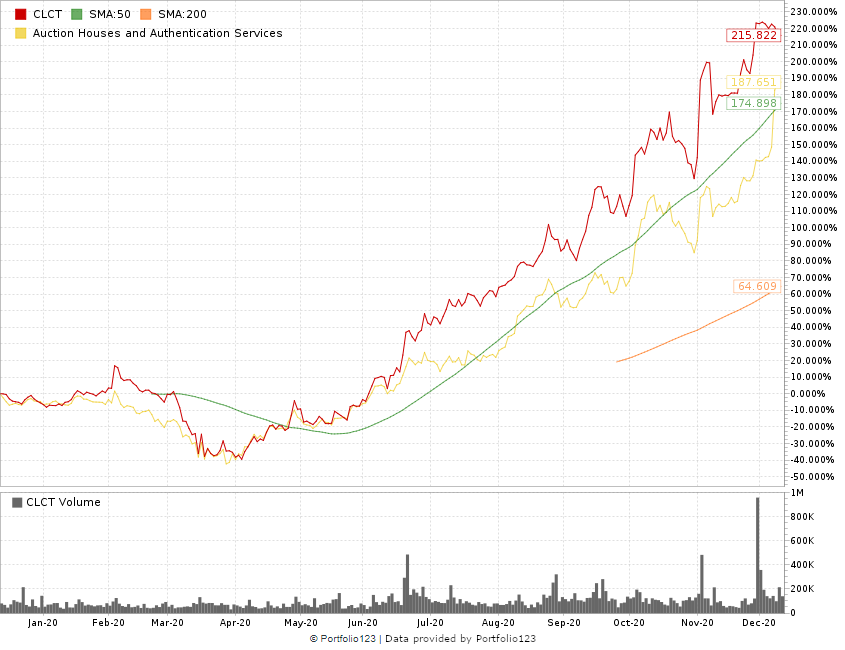

Collectors Universe stock first appeared on our radar on July 7, 2020. At the time, its shares sold for $34.14.

Adam’s Green Zone Ratings system rated Collectors Universe stock an 85 overall. That meant we were “strong bullish” on the stock, and only 15% of all other stocks rated higher at the time.

Well, it hasn’t disappointed:

CLCT Shares Skyrocket in 2020

Since July, shares of Collectors Universe have shot up 121%!

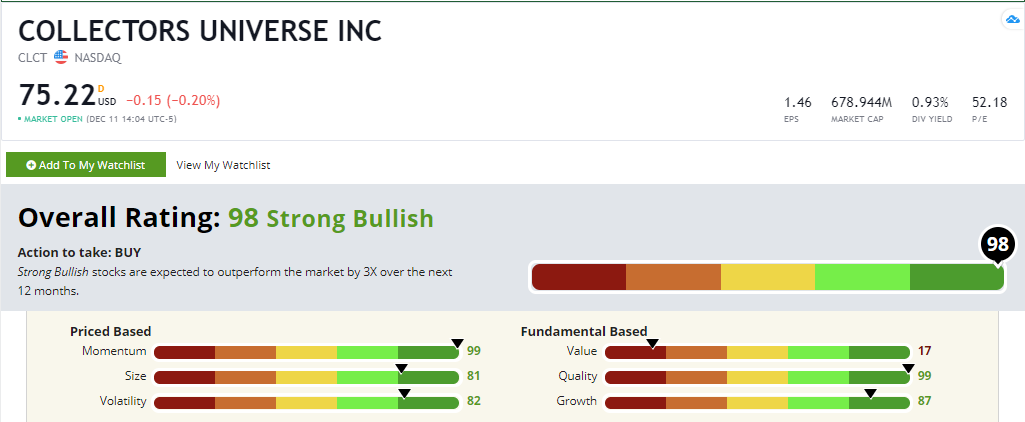

The stock rated a 98 on Quality, with strong returns on investment, equity and assets. (Its returns rated 99% better than all other stocks.)

It also scored high in Momentum.

Ranking an 80 on the metric meant it was already in an uptrend, placing it in our “buy high, sell higher” category.

In the last 12 months, Collectors Universe has jumped more than 200%!

And there is still room to go for CLCT.

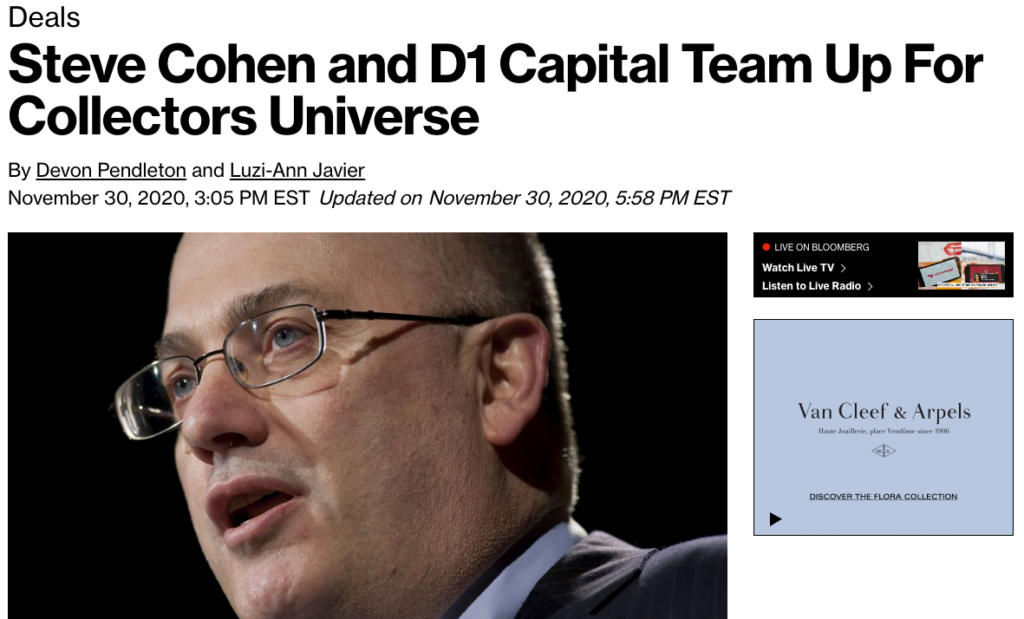

A few weeks ago, Cohen Private Ventures, a hedge fund run by billionaire Steve Cohen, proposed to buy Collectors Universe for around $700 million:

He and Dan Sundheim’s D1 Capital Partners, along with collector Nat Turner, would take CLCT private.

The day the news came out, Collectors Universe stock shot up 6.3%.

Investors follow the smart money.

If someone like Steve Cohen sees the value in a company like Collectors Universe, you can bet other investors do too.

Its Green Zone Rating today proves that this stock’s run is nowhere near over. Check out that Momentum rating of 99!

Collectors Universe’s Green Zone Rating on December 11, 2020.

The Green Zone Ratings system saw it first. It projected CLCT beating the market by three times in 12 months. The stock went beyond that in even less time.

Since July, the S&P 500 has returned just 19%.

So, Collectors Universe stock beat the market by 536% in the same time.

This stock is on fire, but Chief Investment Strategist Adam O’Dell and his team of experts just zeroed in on an even more profitable company that’s set to soar in the New Year!

Go here now to see how to get all the details on their latest stock, plus receive exclusive access to Adam’s Millionaire Master Class report filled with all his trading secrets for just $1!

To join this elite investing community right now, click here.

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.