Colleges might be missing students, but there are more employees than ever. This sounds confusing, so let’s dig into the data.

National Student Clearinghouse Research Center data shows undergraduate enrollment is now 9.4% lower than before the pandemic. That’s almost 1.4 million fewer students.

The study found:

While all institutional sectors experienced varying degrees of enrollment declines, the public sector (two- and four-year colleges combined), which enrolled 71 percent of all students this spring, suffered the steepest drop, over 604,000 students (-5.0%; ). In particular, community colleges fell by 7.8 percent (351,000 students), representing more than half of the total postsecondary enrollment losses this spring. Community colleges have now lost over 827,000 students since spring 2020.

Community college enrollment suffered the worst decline. These colleges often focus on delivering practical training. Lower enrollment explains why many small businesses can find qualified job candidates, as individuals choose work over college.

Larger state colleges saw enrollment decline by 298,831 students, or 3.9%.

But employment at these schools is at new highs.

Fewer Students, More Employees

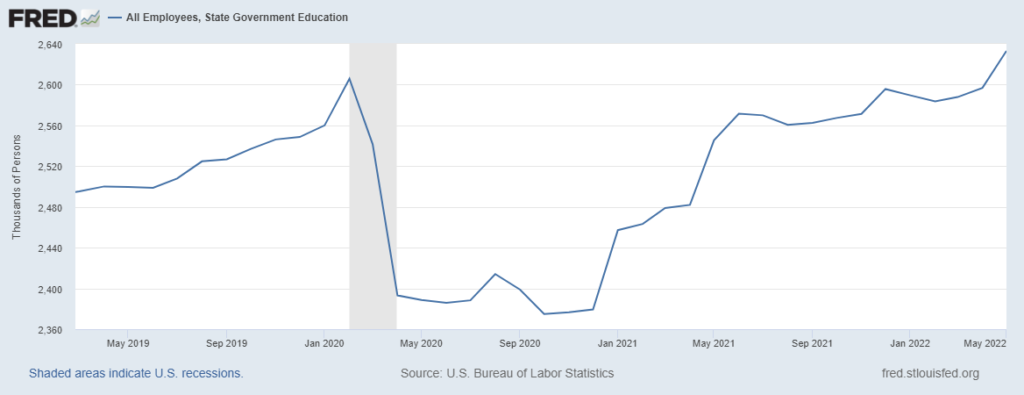

The chart below is from the monthly employment report. It shows the number of employees in the state government education sector.

State Government Education Employment Report

Source: Federal Reserve.

The chart’s primary focus is on state government jobs, from professors at state public colleges to administrators at those schools.

The local education sector is below its pre-pandemic employment peak.

This includes community college employment, often at the county level. Local education includes K-12 teachers.

Good News for Employees, Bad News for Taxpayers

Employment recovery is good news for the workers holding these jobs. They get generous benefits and often lifetime pensions.

It’s reasonable to ask why taxpayers should fund these new employees when enrollment is down.

These are national trends, and it’s clear there are some schools with more students that need more professors.

Bottom line: The trend is troubling for taxpayers. Increased government spending lowers

This could worsen the upcoming economic recession for struggling taxpayers who lack generous benefits and pensions.

P.S. There’s a lot of recession talk cropping up lately. That’s understandable.

But investors are still looking for (and finding) ways to stay greedy — even as markets sink.

My new indicator finds ways to capitalize on this greed during the current down market. To find out how, click here to watch my “Greed Gauge Revealed” presentation now.

In this brand-new presentation, I show you how I use my latest indicator to watch every stock in the S&P 500 to see where investors are getting greedy at any moment.

It’s a strategy that has beaten the S&P 500 3-to-1 since 2000 through my extensive backtesting.

This system has found winning trades in 253 of the last 256 months even!

To find out how I’ll use my Greed Gauge to find more opportunities for you, click here to watch my new presentation now.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.