Barron’s, a weekly Wall Street publication known for its rich data and dense articles, wrote about weddings in a recent issue.

Specifically, it noted:

This year will be a banner year for weddings, with some 25% more couples saying “I do” in the U.S. than usual, according to industry estimates. For businesses, the boom is a much-needed second wind after two years of pandemic-related restrictions and delays. Vendors and venues are stretched to capacity, booked out months or even years in advance.

This is welcome news for the wedding business.

The data has been skewed by the pandemic, but weddings account for an estimated $60 billion in revenue each year. The wedding businesses that survived the past two years may get back to where they were in 2019 after this season.

But the biggest winner from this reversal could be the housing market. Many newlyweds buy a house before or after the big day.

Or at least they try to…

Newlyweds Face a Tight Housing Market

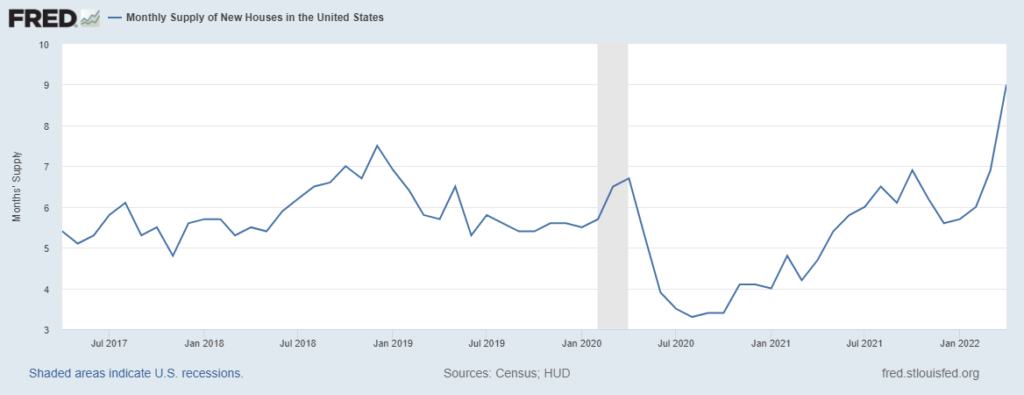

Supply chain issues have wreaked havoc in the construction industry. Builder inventory reflects the rapid changes in supply.

Home Supply Is Up

Source: Federal Reserve.

The supply of new homes is able to meet nine months’ worth of demand, according to the latest data. This is up sharply from a 3.3-month supply after the economic shutdown ended less than two years ago.

But all those weddings in the pipeline indicate a surge of buying is coming. This should soak up the available supply and keep demand high for at least the next few months.

Bottom line: A crowded wedding season is a sign that life is returning to normal.

Unfortunately, the economy is far from normal. New families will face challenges in finding affordable houses, but the housing market should remain strong as they hunt for homes.

This benefits existing homeowners, just like almost every factor affecting housing has over the past few years. Until supply expands, that trend is likely to continue.

P.S. The housing market looks bullish as supply remains tight.

But my colleague and fellow Chart of the Day contributor, Michael Carr, has a new indictor that targets the greediest pockets of the market.

Click here to watch his “Greed Gauge Revealed” presentation now.

He’ll show you how his newest indicator is perfect for this market environment. Thorough back testing revealed Mike’s Greed Gauge revealed remarkable results:

- A TON of winning trades in 2021: including 88% … 143% … 226% … even up to 775%… And every one of these trades occurred in 31 days or less.

- Since 2000, this has beat the S&P 500 3-to-1.

And he’s already finding more opportunities now.

If you’re ready to get greedy in this market, click here.

Click here to join True Options Masters.