The U.S. market has been in a state of flux for months now as the topsy-turvy China trade war continues and an inverted yield curve started to scare investors in September.

All of the uncertainty led analysts to suggest a recession is right around the corner.

But not so fast.

The Labor Department unveiled its November jobs report on Friday and employers added 266,000 jobs during the month and unemployment fell to 3.5% — its lowest level in 50 years.

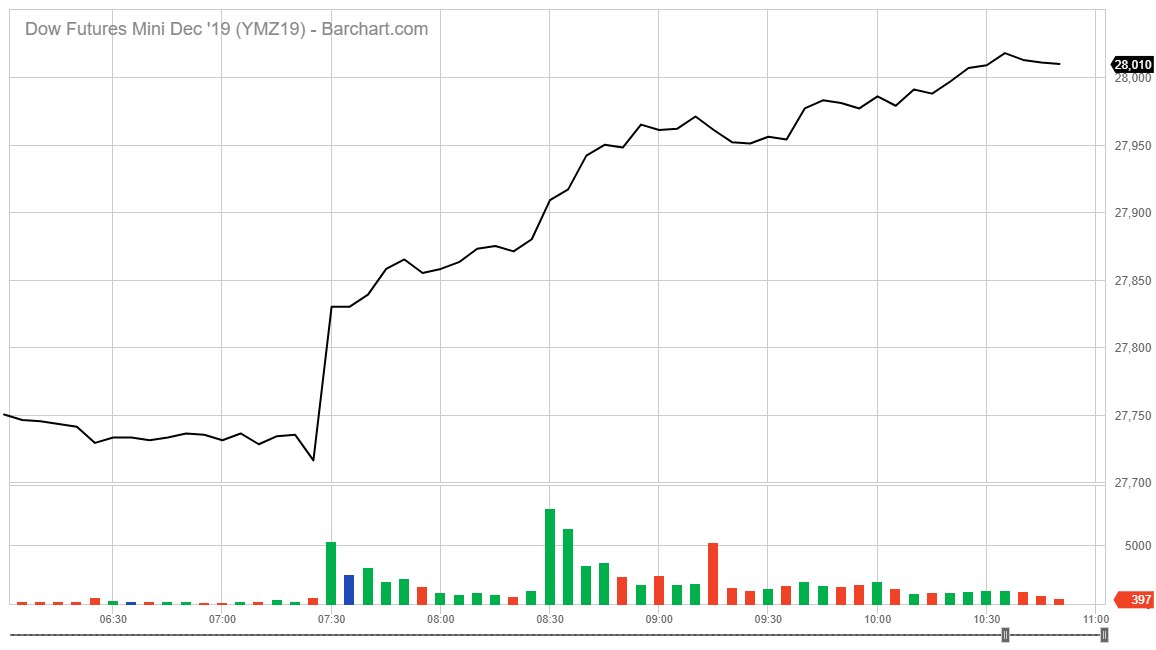

Stock futures and government bond yields were all up Friday after the news was released.

Courtesy of Barchart.com

The S&P 500 jumped 0.86% while the Dow Jones Industrial Index was up 1.03% and the Nasdaq 100 Index climbed 0.90% in midday trading Friday.

“Today’s report shows the economy continues to flourish,” Labor Secretary Eugene Scalia said in a news release. “But we must continue to seek more expansion and opportunities for all Americans — and a critical step in that direction is enactment, now, of the United States-Mexico-Canada Agreement.”

The market was in need of a jump-start following another volatile week in trade talks after U.S. President Donald Trump said a deal with China may not happen until after the 2020 presidential election.

While the jobs report is good news for workers, it should also go a long way to assuage fears of a coming recession.

Over the last three months, U.S. companies have grown by an average of 205,000 jobs per month. It’s still slightly less than 223,000 jobs added, on average, over the same time a year ago.

The growth has beaten forecasts by a lot — analysts anticipated the unemployment rate to be 3.6% in November.

Despite the fact that manufacturing growth has simmered and gross domestic product only increased by 2.1% in the third quarter, the job gains continue to shock analysts.

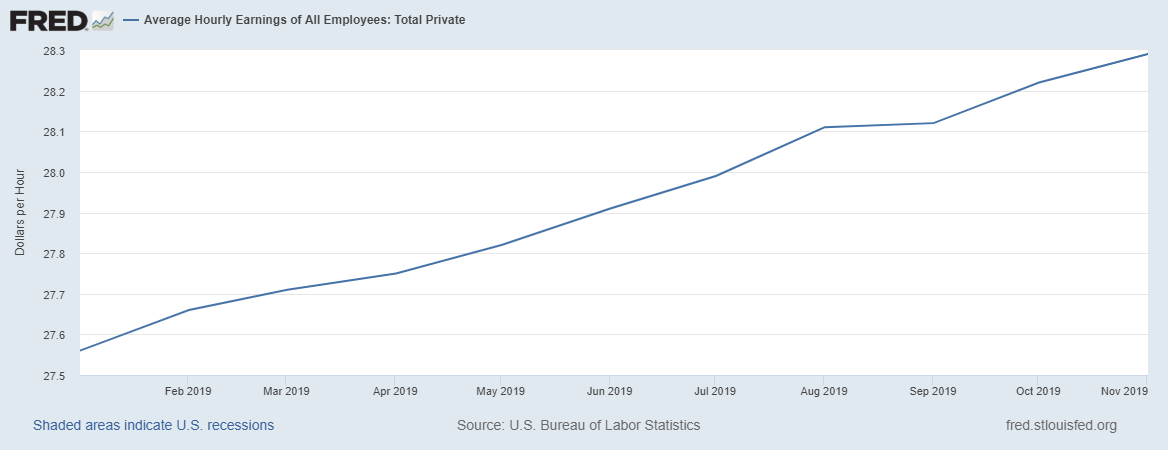

Not just the labor market, but wages have also grown. According to the St. Louis Federal Reserve, average hourly earnings for all employees jumped from around $27.60 in January to near $28.30 in November.

Source: Federal Reserve Bank of St. Louis.

CNBC analyst Jim Cramer said Friday “there’s no denying we’re living in the best labor market in more than a generation.”

Job growth should translate to a cooling of recession talk — unless the trade talks blow up — as growth continues despite various headwinds.

Basically, the labor market continues to grow even as uncertainly over a trade war resolution remains distant, the manufacturing sector drops and economic growth has seen some slowdown.

We are still spending money as consumers — the University of Michigan’s consumer sentiment jumped from 96.8 in November to 99.2 in December — meaning our confidence remains high as shoppers.

“This is the best number I’ve ever seen in my life,” Cramer said, zeroing in on the unemployment rate. “Fifty years ago, that number was a curse. Now it’s a blessing. I don’t see inflation. I don’t see recession.”

So there’s likely no reason to think a recession is coming in the near future.

Markets are up, businesses are hiring and wages are better than they ever have been.

Now, can you imagine what it will be like once there’s a resolution to the trade war with China?