Now that the $1.9 trillion COVID-19 relief bill is on the fast track to approval, the Biden administration’s next priority is infrastructure.

The administration is eyeing a “New Deal-esque” $2 trillion plan to build up the nation’s roads, bridges, energy, schools and internet.

Last week, the American Society of Civil Engineers gave the U.S. infrastructure a grade of “C-,” which was only slightly higher than the “D+” it earned in 2017.

Eleven of the 17 categories earned a “D” or below.

That means our infrastructure … our roads, bridges and schools … are in horrendous shape.

An infrastructure package will help fix those issues. It will also help the companies working on that infrastructure … and their investors.

I’ve found just such a company.

But first, I want to tell you about a trend I discovered in heavy construction.

New Highs in Heavy Construction

Heavy construction includes the construction of anything big: roads, bridges and large buildings.

Even before the 2020 election, when Biden announced his infrastructure plan, spending on heavy construction was expected to reach new highs.

Heavy Construction Spending Projected At $371.6 billion

As this chart shows, spending on civil engineering projects was expected to jump 47% between 2011 and 2023.

That was before Biden’s emphasis on repairing the nation’s infrastructure.

Those projections would be an all-time high in heavy construction spending.

A new infusion of federal dollars into building and improving roads, bridges and schools will tack on billions more to that figure.

The Key to Heavy Construction: Metal

On the surface, our roads, bridges and schools are made from asphalt, cement and brick.

Under that, there is one component that gives those things their shape: metal.

More specifically, rebar.

Rebar, or reinforcing bar, is used to help reinforce concrete, masonry and asphalt.

These steel bars give the structure its shape and strengthen building materials under tension.

Every improvement or new construction requires more rebar, so these roads, bridges and buildings stand the test of time for decades.

Using Adam O’Dell’s six-factor Green Zone Ratings system, I found one company that supplies rebar for massive projects.

And its stock will beat the market by three times over the next 12 months.

Commercial Metals Co. Is a Rebar Leader

Commercial Metals Co. (NYSE: CMC) makes fabricated steel products used in the construction of buildings, industrial plants, highways, bridges and dams.

All the things included in infrastructure improvement.

Some of the projects its products have been used for include:

- Boone Pickens Cancer Hospital.

- Margaret McDermott Bridge.

- George W. Bush Presidential Center.

- The Pentagon (post 9/11 rebuild).

- Presidio Parkway.

- Apple Inc. Campus.

Its operations have even expanded into Central and Eastern Europe, resulting in huge company growth.

CMC Revenue To Reach $6 Billion

Commercial Metals is estimated to grow its total revenue by 8% from 2020 to 2021.

By 2023, CMC’s total revenue is projected to reach more than $6 billion — a 10% increase from 2020.

And that’s without estimates for new federal spending on infrastructure.

Commercial Metal Stock’s Green Zone Story

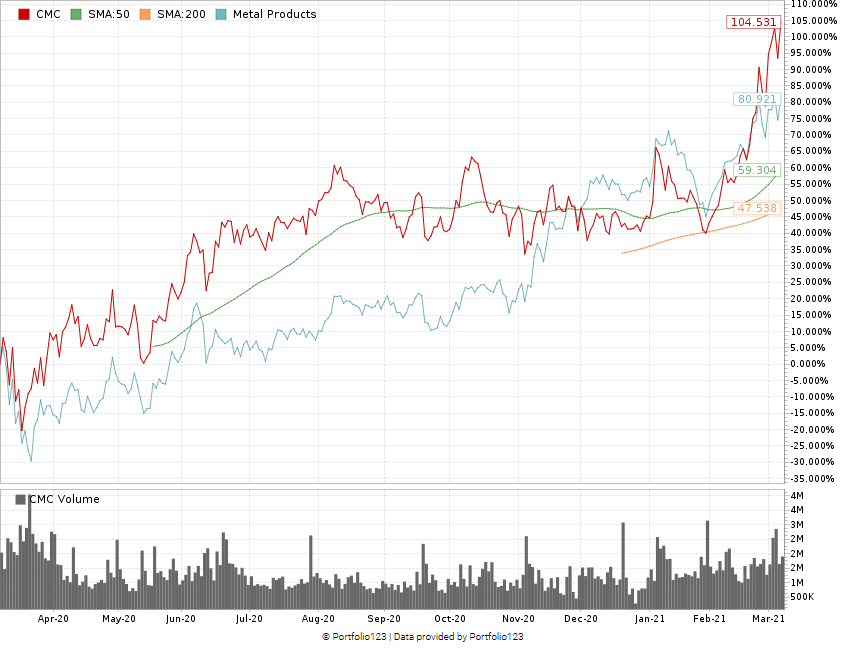

CMC’s price has started to take off as investors see Biden’s infrastructure plan inch closer to fruition.

CMC Stock Up 162% Off March 2020 Lows

The stock price is up more than 104% in the last 12 months and 162% from its March 2020 low of around $11 per share.

New infrastructure spending is only going to push that stock price higher.

In our Green Zone Ratings system, Commercial Metal’s stock rates an 87 out of 100, making it a “Strong Bullish” play.

CMC is positioned to outperform the broader market by three times over the next 12 months.

And the faster an infrastructure plan is approved by Congress, the faster those gains will be realized.

Let’s look a little deeper at the positives:

- Value — With a price-to-earnings ratio of 13.33, Commercial Metals stock’s value is far better than the industry average. It’s other price-to ratios are also much better than the rest of the industry. CMC rates a 98 on value.

- Quality — CMC has increased its sales, earnings and assets over the last five years, earning it an 89 on quality.

- Volatility — Its upward trajectory has come with very little downward movement. It earns a 72 on volatility.

- Growth — The company has a three-year annual sales growth rate of 12.5% and its first-quarter 2021 sales were on pace (or even better) than its quarterly sales in 2020. CMC earns a 71 on growth.

The company earns a 44 on momentum primarily because our data looks backward. Doing so shows a flat pattern to the company’s stock.

But that pattern has changed dramatically for the good.

CMC ranks a 38 on size with a market capitalization of $3.45 billion.

Bottom line: Both Republicans and Democrats are anxious to use infrastructure improvements to jumpstart the U.S. economy.

The right infrastructure bill could see bi-partisan support and move through Congress relatively quickly.

When that happens, projects will start fast, and companies like Commercial Metals Co. will see results just as fast.

Getting in now is a sure-fire way to see three times the gains of the broader market before any bill is passed.

P.S. If you want another chance to invest in the Biden infrastructure boom, check out Green Zone Fortunes. Adam and Charles Sizemore’s November stock selection rates a 97 out of 100 in Green Zone Ratings and it’s up almost 40% since that recommendation.

To find out more about this stock and many others, check out Green Zone Fortunes here. Each month, you’ll receive their highest-conviction stock selections along with guidance on when to buy and sell. You’ll also receive insight into using momentum, Adam’s favorite Green Zone metric, to “buy high and sell higher.” Check out the details on Adam’s Millionaire Master Class here to see how you can join Green Zone Fortunes today!

Safe trading,

Matt Clark

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.