In manufacturing, precision is key.

When I was reporting on the manufacturing sector in South Carolina, I had the opportunity to visit a lot of incredible operations, including:

- BMW Manufacturing Co.

- Michelin North America.

- BorgWarner Inc.

I also spoke with the workers at those plants.

From my reporting, I learned that, despite the fascination with automation and robotics, there is still a human element to manufacturing.

And companies struggle with human error.

From the precise size of a tire to the specific sizes of parts for your car’s Bluetooth interface, product measurements have to be correct down to the millimeter.

That’s where my selection for this week comes in.

A Precise Manufacturing Play

Today, I chose a company that provides three-dimensional measuring hardware and software.

Three-dimensional measuring allows technicians to immerse themselves in the look and feel of a chip, tire, engine … whatever.

And this company is a leader in the world of 3D measuring.

FARO Technologies Inc. (Nasdaq: FARO) is based in Lake Mary, Florida and creates products like its FARO Arm, a portable 3D measurement arm. The Faro Focus is a laser scanner that creates a virtual template that operators use to position components.

FARO markets its products globally and to a variety of manufacturing sectors … including the automotive sector.

Manufacturing took a substantial hit in 2020 thanks to the COVID-19 pandemic.

Lockdowns forced plants around the world to shut down for months at a time.

This affected FARO Technologies as well.

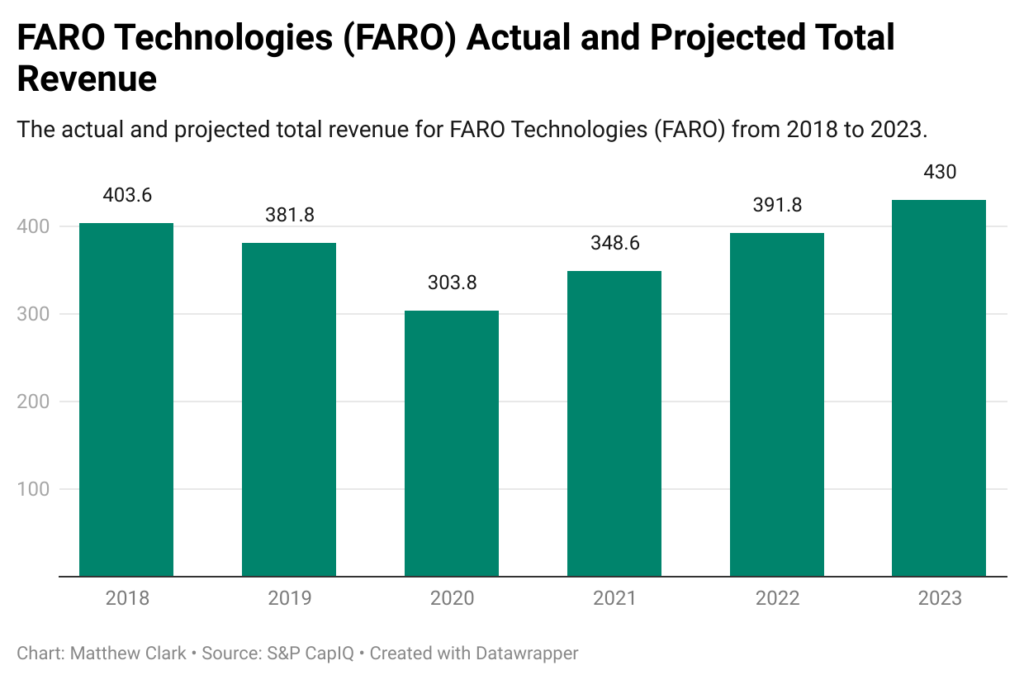

FARO‘s total revenue for 2020 was $303.8 million — a 20% decline from the year before.

However, as lockdowns end and production picks back up, FARO expects a quick recovery from the down year.

For 2021, the company is projected to bring in $348.6 million in total revenue — very close to its 2019 figures.

That is expected to jump to $391.8 million by 2022 and $430 million by 2023.

That’s a 41% increase in total revenue from 2019.

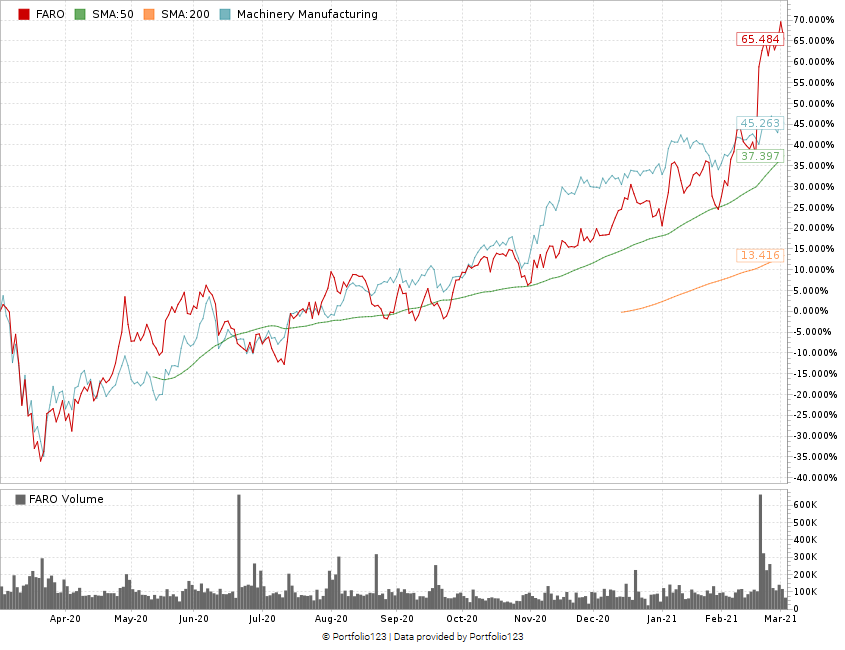

FARO’s stock has already recovered nicely from the March 2020 crash.

FARO (Red) Grows 154% in 12 Months

It hit a 52-week low of $36.28 back in March 2020.

But FARO gained 62% in the months that followed before soaring higher in February to more than $92 per share — a 154% increase from its March 2020 low.

And I don’t see its momentum stopping any time soon.

FARO’s Green Zone Rating

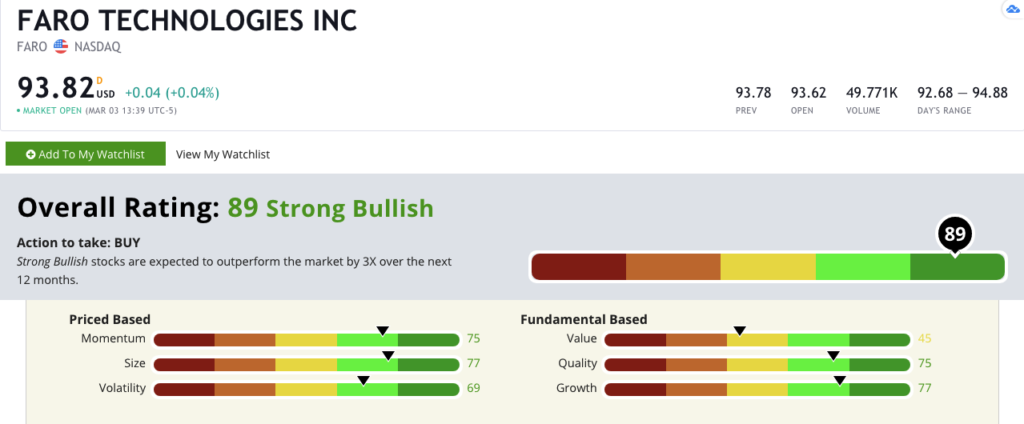

FARO Technologies Inc. rates an 89 overall on Adam O’Dell’s six-factor Green Zone Ratings system, which means we are “Strong Bullish” on the stock and expect it to outperform the broader market by three times over the next 12 months.

Faro Technologies Inc.’s Green Zone Rating on March 9, 2021.

FARO rates in the green on five of the six metrics we account for. Here’s a breakdown of the stock’s top scores:

- Growth — FARO rates a 77 on growth, which means it makes a good growth play with strong upward movement and little downtrend. The company is expected to expand in the coming months, and its performance since the beginning of the year indicates strong potential.

- Size — FARO rates a 77 on size, which means it’s larger than only 23% of stocks we rate. It’s competitive and strong enough to survive in the market, but its products are niche and can dodge competition.

- Momentum — FARO rates a 75 on momentum, meaning its expected performance in the coming year indicates a strong future for the company.

Bottom line: Manufacturing is making a big comeback. Manufacturers are going to rely heavily on FARO’s 3D-measuring technology to get production lines working at levels that weren’t possible before.

To realize the potential for three times the market’s returns in the coming months, you need to get into FARO Technologies now.

Safe trading,

Matt Clark

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.

P.S. Check out The Bull & The Bear podcast every week for more picks from Adam, Charles and me. You can listen on Apple Podcasts, Spotify, Amazon and Google Podcasts. You can also catch episodes on our YouTube channel here.