Editor’s Note: Welcome to the first issue of Money & Markets Daily! In today’s issue, Chief Research Analyst Matt Clark is going to highlight a troubling trend that Wall Street is seemingly ignoring. Before you read on, take a moment to vote in our survey here if you haven’t already. It’s going to help us make this newsletter even better from here…

In March 2020, our entire South Florida office was sent home.

The COVID-19 pandemic was spreading and offices everywhere were closing in favor of remote work to curb the outbreak.

Fast-forward to today and the impacts of this mass office exodus continue to affect commercial real estate.

Despite CEO’s best attempts to bring workers back, office space utilization in the U.S. is still only around 50% of pre-pandemic levels, according to U.S. News & World Report.

Today, I’ll dive into how the commercial real estate sector is dealing with this trend and use Adam O’Dell’s proprietary Green Zone Power Ratings system to show you one stock to steer clear of.

More Headwinds in 2024

The way commercial real estate finance works is simple.

A business entity or investor takes out a loan, buys a property, leases out space and collects rent from its tenants.

A lot of the time, the rents collected are used to pay down the debt incurred from the loan to buy the property.

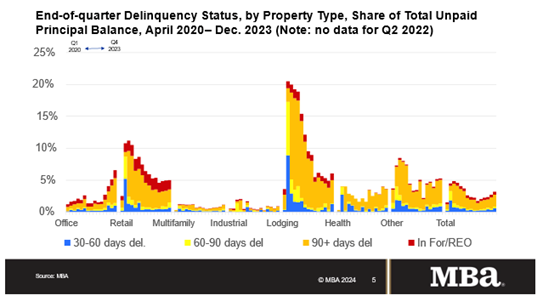

December 2023 was a telling month in commercial real estate finance.

Mortgage Bankers Association data shows the delinquency rate for mortgages backed by commercial real estate jumped to 6.5%. The report said loans backed by office properties spearheaded the increase.

This means more mortgages backed by commercial real estate were delinquent by 30 days or more in December than in November.

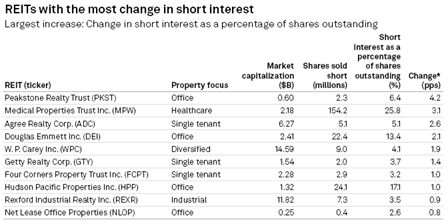

Wall Street is only starting to take notice of this alarming issue:

Investors are increasing short positions in some real estate investment trusts (REITs) because of this trend.

Of the 10 REITs with the largest increase in short interest, S&P Global reported four were office REITs.

This means that investors are betting against strong performance from these REITs.

But Wall Street is overlooking the bigger picture because overall short interest in office REITs dropped from 5.8% in November 2023 to 5.6% in December.

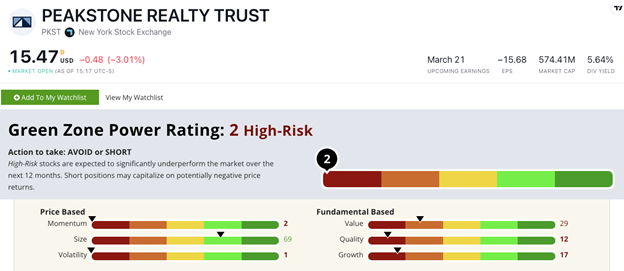

Using Adam’s Green Zone Power Ratings system, I’ve found one REIT that you should definitely stay away from … or even short.

Peakstone Realty Trust: A Commercial REIT to Avoid

The REIT with the largest increase in short interest is Peakstone Realty Trust (NYSE: PKST).

It has a portfolio of office and industrial properties across the U.S. — with properties in Las Vegas, Denver, Nashville, Charlotte and the Raleigh-Durham area of North Carolina.

According to S&P Global, traders are shorting 6.4% of PKST’s shares— an increase of 4.2 percentage points from a month ago.

Overall, PKST rates 2 out of 100 on our Green Zone Power Ratings system. That means we consider the stock “High-Risk” and expect it to underperform the market over the next 12 months.

The stock rates in the red on five of the six factors.

Most notable is its 2 on Momentum.

After reaching a recent high of $21.17 at the end of December, the stock has been in free-fall — dropping 26.6% to $15.52.

The stock is down more than 67% from its 52-week high set last year.

Bottom line: Efforts to bring American workers back to the office have largely fallen on deaf ears.

That spells trouble for investors and property owners who are now stuck with a hefty loan and fewer tenants to pay it.

I don’t believe this is the last we hear of commercial real estate falling on hard times … it’s just the beginning.

Since Wall Street hasn’t picked up on the message that commercial real estate is in trouble, you can use the Green Zone Power Ratings system to stay ahead and steer clear of this falling trend.

Until next time…

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets