Glencore (OTC: GLNCY) is one of the world’s largest diversified natural resource companies. Does that mean Glencore stock is a good buy for 2023 and beyond?

It has interests in energy, metals, minerals and even agricultural products.

The company operates in more than 40 countries around the world, with a primary focus on emerging markets.

In this blog post, we’ll take a look at the current state of Glencore’s business, its outlook for the future, and even how it rates within our proprietary Stock Power Ratings system.

What Does Glencore Do?

Glencore primarily engages in commodity trading and production across multiple sectors.

The company sources its commodities from some of the world’s largest suppliers, which allows it to deliver these vital resources to customers quickly and reliably.

The company also has a strong presence in mining operations, including:

- Copper.

- Zinc.

- Lead.

- Nickel.

- Thermal coal.

- And iron ore.

On top of all of that, Glencore is active in oil production and refining through its majority stake in Rosneft Oil Company.

Glencore also owns several storage facilities around the world that are used to store commodities before they are shipped out to customers or sold on spot markets.

These facilities help reduce costs by allowing Glencore to take advantage of favorable market conditions when selling their commodities.

Finally, the company has a large financial services arm that provides loans and other financial services to customers who need funding for their operations or investments.

Glencore’s Outlook for 2023 and Beyond

Glencore expects that demand for its products will remain strong over the next few years as global economic growth continues to pick up steam.

Demand for commodities such as copper and zinc are expected to remain high due to increased investment in infrastructure projects around the world.

Additionally, demand for oil is expected to increase as governments loosen restrictions to keep supply up while Russia’s oil exports are under scrutiny.

Its agricultural commodities are also expected to remain stable as new technologies improve farming yields while reducing costs. Higher inflation can also mean more profitability as companies pass higher costs on to consumers.

All of this is reflected in Glencore stock’s score within our system.

Glencore Stock Power Ratings

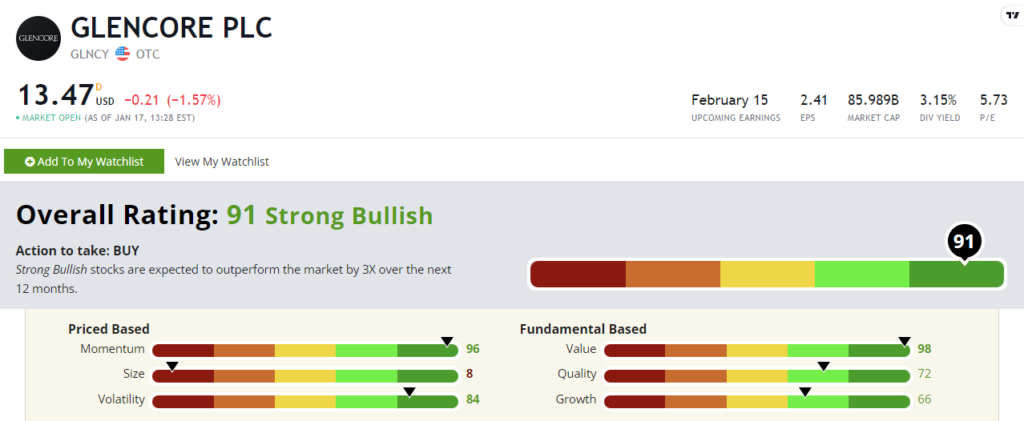

GLNCY scores a “Strong Bullish” 91 out of 100 within Stock Power Ratings. That means we expect the stock to 3X the broader market’s performance over the next 12 months.

Commodities, and the stocks related to them, have been dirt-cheap for a long time after falling out of favor with investors. That’s why Glencore stock sports an incredible 98 on our value factor rating.

But what I really want to focus on is GLNCY’s momentum (96) and volatility (84). Adam O’Dell, our chief investment strategist, has talked about an ongoing commodities bull market for years now.

And that’s playing out with GLNCY. In the last year, the stock has gained 20% while the broader S&P 500 has lost 12.6%!

That’s “maximum momentum” higher during a broader bear market.

Bottom line: Glencore is one of the most diversified natural resource companies in the world with a strong presence across multiple sectors including energy, metals, mining operations and financial services.

Demand for Glencore’s products is expected to remain strong. And Stock Power Ratings shows Glencore stock is set to outperform.