It’s the new year, and that means people are trying to stay healthy. Many opt for sparkling water, such as LaCroix. How does LaCroix’s distributor, National Beverage stock (Nasdaq: FIZZ) rate?

National Beverage, one of the leading beverage companies in the U.S., had a turbulent 2022.

Its stock swung wildly throughout the year but is now pretty much back where it last January.

Let’s look at what FIZZ does and how it scores within Stock Power Ratings to see if 2023 could be a repeat performance.

What National Beverage Is All About

National Beverage is a publicly traded company that produces and distributes a variety of beverages including carbonated soft drinks, energy drinks, flavored waters, juices, mixers and more.

It is most well-known for its popular Shasta brand of soft drinks. The company also owns several other brands including:

- Faygo.

- Everfresh Juices.

- Rip It Energy Drinks.

- And LaCroix sparkling water.

National Beverage’s Recent Performance

In 2020, National Beverage reported an impressive 8% increase in net sales despite the economic downturn caused by COVID-19.

This was largely due to increased demand for their products from consumers staying home during the pandemic.

However, this growth was not without its challenges; rising costs for ingredients and packaging materials put pressure on profit margins throughout 2020. Despite these issues though, National Beverage remains well-positioned to capitalize on the increasing demand for beverages.

Since then, FIZZ has steadily raked in more money. It increased revenue by 4.9% to $1.1 billion in 2021. Last year, that number jumped another 5.3% to $1.16 billion.

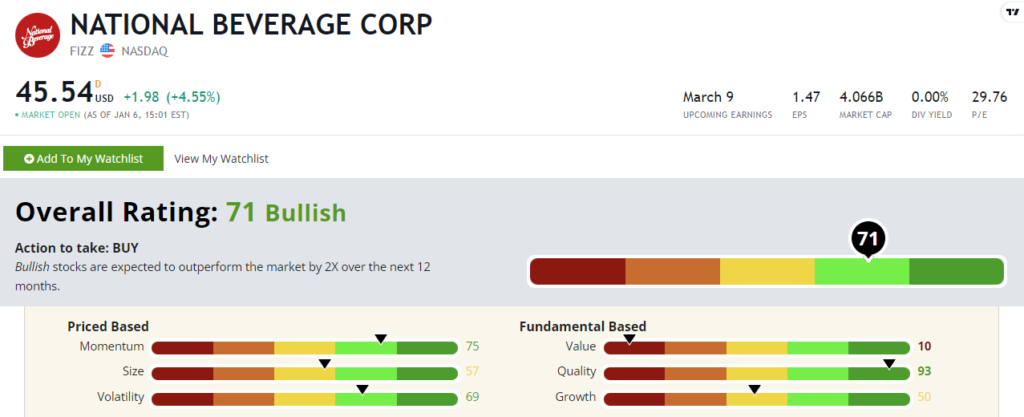

That’s why National Beverage stock rates a fantastic 93 out of 100 on our quality factor within Stock Power Ratings. (Check out the rest of its scores below.)

Looking forward to 2023, National Beverage is expecting continued growth in revenue as it expands into new markets both domestically and internationally.

It also made significant investments in its manufacturing capabilities which will lead to more production at lower costs while still maintaining high quality standards.

It’s also investing heavily in marketing campaigns aimed at increasing brand awareness among consumers. That should result in even higher sales numbers over time.

But how does the stock rate?

National Beverage Stock Power Ratings

Looking at our proprietary Stock Power Ratings system, National Beverage stock rates a “Bullish” 71 out of 100. That means it’s expected to outperform the broader market by 2X over the next 12 months.

I want to focus on FIZZ’s momentum.

I mentioned it ended up right back where it started a year ago after 12 months of volatile trading, but when the stock gains traction, short-term gains (or losses) come quick.

That’s partly why it rates a 75 out of 100 on the momentum factor.

Bottom Line: Overall, National Beverage stock is set to outperform the market, according to Stock Power Ratings, but it could be a wild ride along the way.

Are you buying FIZZ, or do you already own it? Maybe you’ve banked a big win short-term trading it over the last few years.

Let us know how you’ve done investing in National Beverage stock by sending an email to StockPower@MoneyandMarkets.com.