Chief Research Analyst Matt Clark here, covering for Adam while he is out on assignment today.

The great thing about a systems-based approach to investing is that we can still run the numbers and see how things are stacking up using his Green Zone Power Rating system.

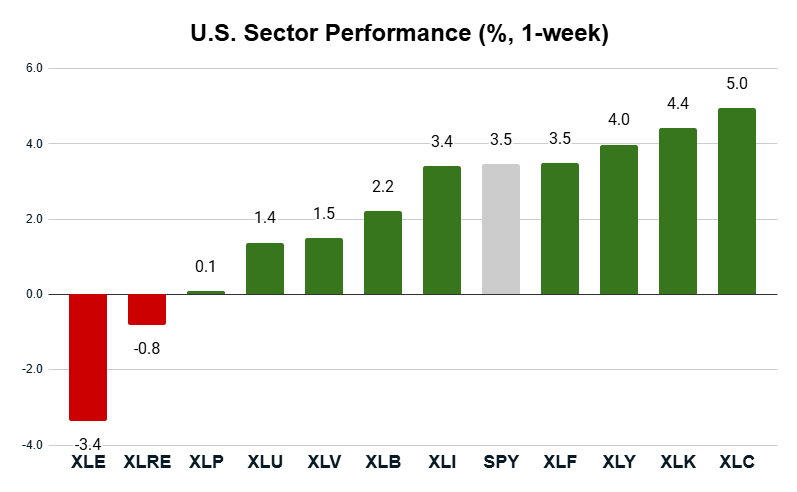

And as you’ll see in the chart below, the energy sector (XLE) reversed course, giving back its gains from the previous week as tensions in the Middle East — and oil prices — cooled.

But otherwise, it was a very bullish week with the S&P 500 reaching a new record high:

Key Insights:

- The S&P 500 (SPY) closed the week 3.5% higher.

- The communications sector (XLC) led the pack with a 5% gain.

- Three sectors beat the S&P 500, while XLF matched its performance.

- Seven sectors underperformed the S&P 500.

- Energy (XLE) lagged the rest with a 3.4% loss.

The bull market has regained steam, and it’s great to see a majority of sectors in the green. Of course, one week doesn’t make a trend.

Let’s dig deeper using Adam’s Green Zone Power Rating system…

Communication Sector Top Performers

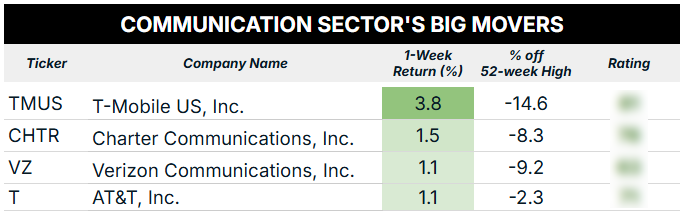

For today’s analysis, we expanded the screen to try to catch more stocks that drove sector performance. Here are the S&P 500 communications sector stocks that closed last week within 20% of their 52-week highs:

These are four of the most recognizable names in the communications sector, and they all should outperform the broader market based on their “Bullish” ratings in Adam’s system. (To look up these ratings for yourself, click here to see how you can join Green Zone Fortunes, our flagship investing service. Full access to the Green Zone Power Rating system is just one perk of many.)

But what stands out to me here is that none of these “Big Four” actually managed to beat the communication sector’s 5% gain. That tells me that investors were buying stocks that have been struggling to gain momentum in this bull market. And that’s an excellent sign for the broader market overall.

Let’s move on to last week’s lagging sector…

Energy Sector Reverses Course

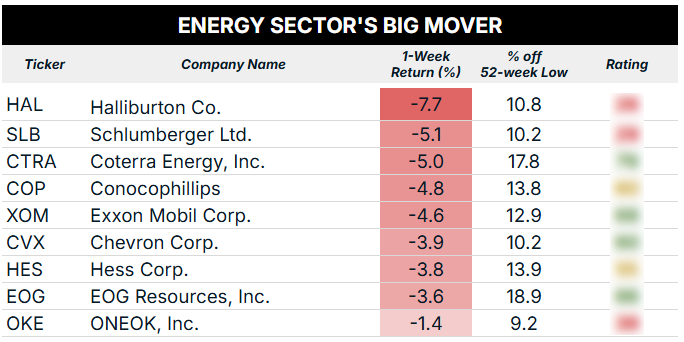

Tensions in the Middle East cooled last week as Israel and Iran agreed to a ceasefire. With the oil price sinking lower after spiking to almost $80 per barrel the week before, it’s only natural to see related energy stocks follow suit.

Here’s what this week’s screen revealed:

Some big names like Exxon Mobil Corp. (XOM) and Chevron Corp. (CVX) are still “Bullish” in Adam’s system, so this might be a speed bump in an otherwise steady climb higher.

Overall, it’s a real mixed bag of ratings. Here’s a broad breakdown of the nine stocks above:

- Four stocks rate “Bullish.”

- Two stocks are rated “Neutral.”

- Three stocks rate “Bearish.”

That tells me that being more selective when hunting for energy sector stocks is paying off in the current market environment.

Have a great holiday week!

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

P.S. Adam just sent out his June issue of Green Zone Fortunes on Friday. In this special issue, he picked eight stocks out of the model portfolio that he is confident will have a strong second half of 2025. If you’re looking for a perfect guide to start your Green Zone Fortunes investing journey, click here for information on how you can join up and read that issue now!