As Congress debates multitrillion-dollar spending plans, a number of questions hang over Washington. Representatives ask how much they’ll get for their favorite programs. Bureaucrats ask how much their budgets will grow.

It seems no one is asking the most important question: Who will pay for the spending?

Yes, there will be some new taxes that offset a portion of the cost. But there is no debate over the fact that the Treasury will have to issue trillions in new government debt. There are no obvious buyers for that debt.

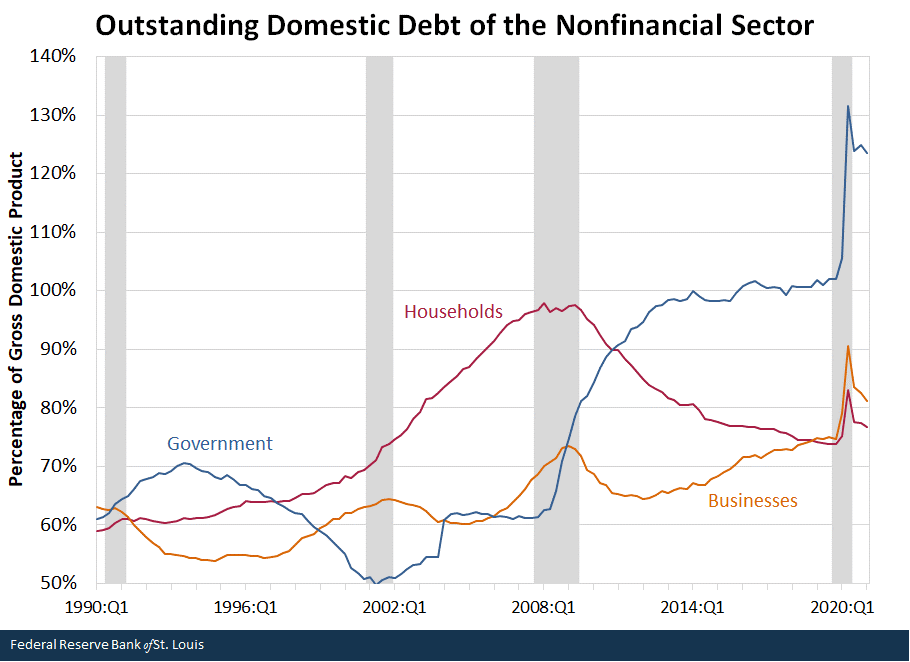

The chart below shows the government debt, non-financial businesses and households as a percent of GDP.

Source: Federal Reserve.

Government debt tops 120% of GDP. Households, as a group, have deleveraged since the Great Recession ended in 2009. Businesses took advantage of low interest rates to borrow more.

As government debt climbs even higher in the next few years, households are likely to continue avoiding debt, as are businesses. Households aren’t willing to pay the higher interest rates that the Federal Reserve is expected to start delivering next year.

Congress Needs to Find Lenders for Government Debt

Higher interest rates will cost the government billions of dollars, and they will have to borrow that amount. This will force the debt-to-GDP ratio higher, which presents another problem. A higher debt-to-GDP ratio is risky, and the increased risk will push interest rates even higher.

Fortunately for the Treasury, the government may be the only major borrower in the debt markets in the coming years. Households learned to live within their means. Businesses have borrowed at low rates to fund share buybacks, a transaction that won’t make sense at higher rates.

As Congress debates how much to spend, they should consider where the lenders will come from. For now, there is no obvious source of trillions of dollars.

Michael Carr is the editor of True Options Masters, One Trade, Peak Velocity Trader and Precision Profits. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.

Click here to join True Options Masters.