As market uncertainty pushes equities back and forth, defensive stocks are seeing nice bounces and to profit, investors can look toward a few consumer staple stocks to buy.

The market is up. The market is down. It seems to change daily with every headline.

And having millions of Americans locked down due to the coronavirus pandemic just adds fuel to that fire.

But, as an investor, there are several ways to profit from market swings. One such way is to look for stocks that provide what everyone needs, no matter what the conditions are on Wall Street, a la Amazon.com Inc. (Nasdaq: AMZN).

That leads us to consumer staples. These are companies that provide what we need on a near-daily basis. The best thing is that these kinds of investments work in just about any market condition.

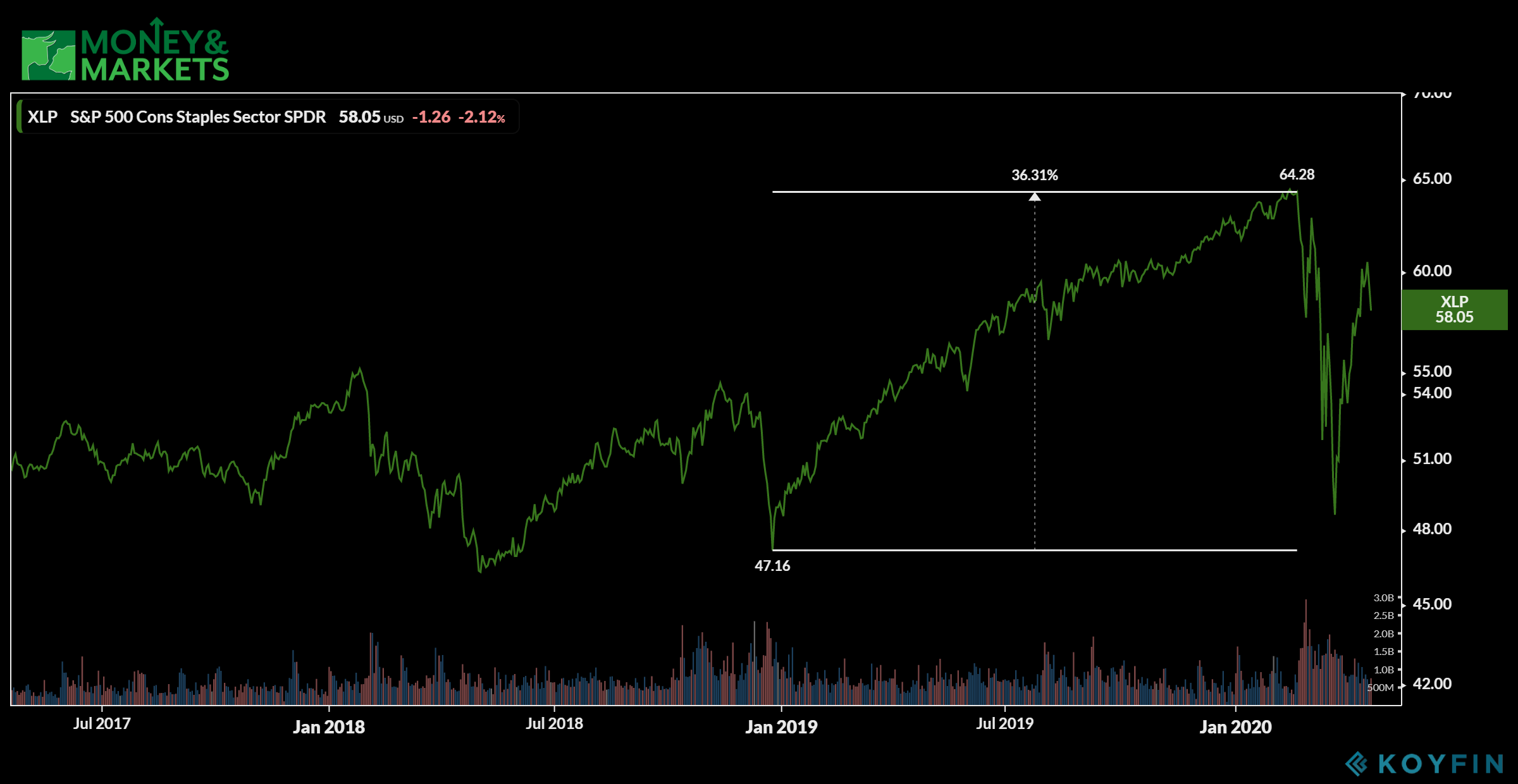

In 2019, the S&P 500 Consumer Staples Sector SPDR (NYSEARCA: XLP) — an exchange-traded fund tracking the consumer staples market — jumped more than 36% to a new 52-week high. After the February-March 2020 drop, it has ticked back up to near that high.

3 Consumer Staple Stocks to Buy Now

1. Sprouts Farmers Markets

Market Capitalization: $2.4 billion

Annual Sales (2019): $5.6 billion

60-Month Beta: 0.04

5-Year Revenue Growth: 89.9%

Annual Dividend Yield: 0.00%

The first company on our list specializes in selling natural and organic foods, mostly in the United States.

Sprouts Farmers Markets (Nasdaq: SFM) is based in Phoenix, Arizona, and offers a wide variety of fresh food along with vitamins and supplements. The company has 341 stores across 22 states.

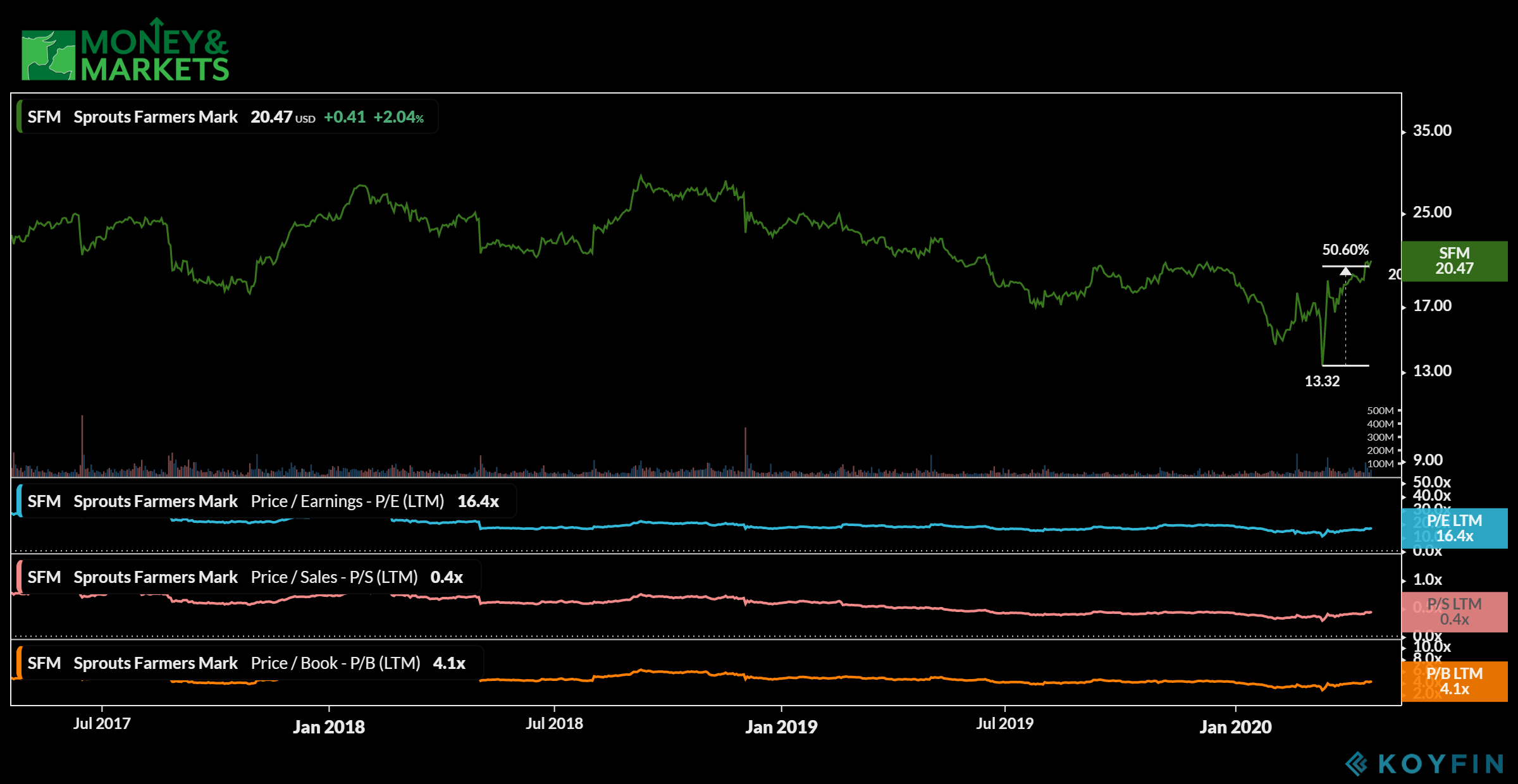

It took a hit back in March, along with everyone else, when the market crashed due to the COVID-19 pandemic. However, it has jumped more than 50% after hitting that low. At around $20 per share, it’s already up past its 200-day moving average of $18

Sprouts also is a solid value with an earnings-per-share ratio of 16.4. On top of that, its price to sales is 0.4 and its price to book is 4.1.

To battle the pandemic, Sprouts recently announced it was expanding its grocery pickup service in partnership with Instacart. That will be rolled out to all of its stores by early May.

Its value and a nice rebound despite market panic make Sprouts Farmers Markets one of the consumer staple stocks to buy now.

Editor’s note: Money & Markets Chief Investment Strategist Adam O’Dell likes Sprouts as well, and he has a piece coming about the stock this Monday. Check back then for O’Dell’s full take on the company.

2. Mondelez International

Market Capitalization: $73.2 billion

Annual Sales (2019): $25.8 billion

60-Month Beta: 0.7

5-Year Revenue Growth: -24.4%

Annual Dividend Yield: 2.23%

If you like cookies, cream cheese, gum or coffee, chances are you have bought a product made by our next company.

Mondelez International Inc. (Nasdaq: MDLZ) produces staples like Oreo and Nabisco cookies, Maxwell House coffee and Kraft cheeses, dinners and dressings.

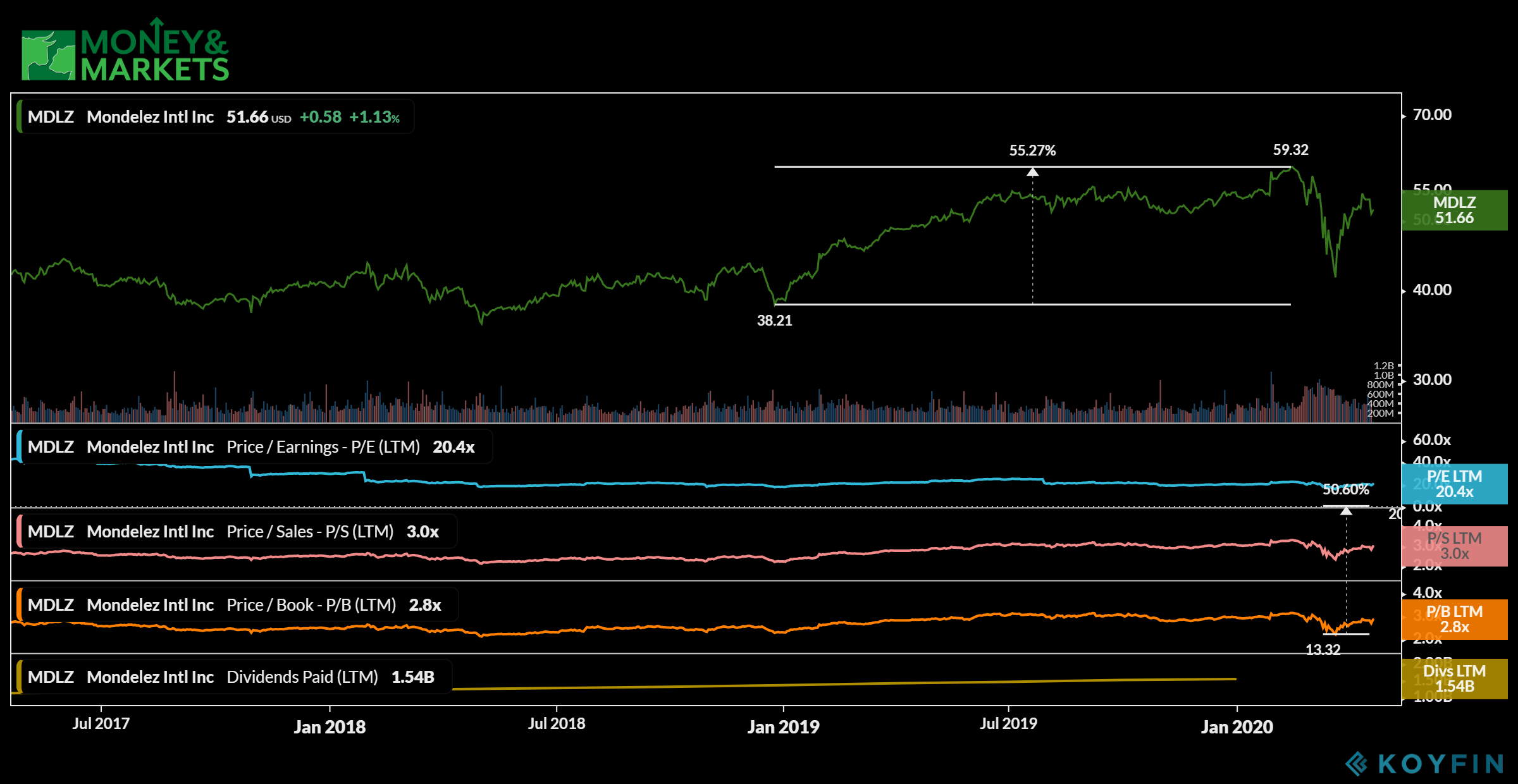

As with Spouts, 2019 was a great year for Mondelez as the company’s share price moved 55% higher from December 2018 to February 2020 — where it reached a new 52-week high of $59 per share.

Despite the ensuing crash across all markets, the company has rebounded to just over $51 per share — offering growth potential of $8 per share.

The value of Mondelez is also sound with price to earnings of 20.4. Its price to sales is 3 and its price to book is 2.8.

Another benefit of owning Mondelez shares is the company pays a quarterly dividend. Based on its March 2020 dividend payment of $0.28 per share, its annual dividend yield is 2.23%.

The value is good and adding a dividend makes it even better. That’s why Mondelez International Inc. is one of the consumer stocks to buy now.

3. Target Corp.

Market Capitalization: $53.5 billion

Annual Sales (2019): $78.1 billion

60-Month Beta: 0.65

5-Year Revenue Growth: 7.57%

Annual Dividend Yield: 2.47%

Despite the coronavirus lockdown keeping millions of Americans at home, many still must venture out to shop for essential goods.

One place people are shopping is Target Corp. (NYSE: TGT). The company has more than 1,8000 stores covering all 50 states and employs more than 350,000. Many stores offer groceries in addition to traditional Target items like clothes, home furnishings, decor and electronics, making them a true one-stop-shop for many people.

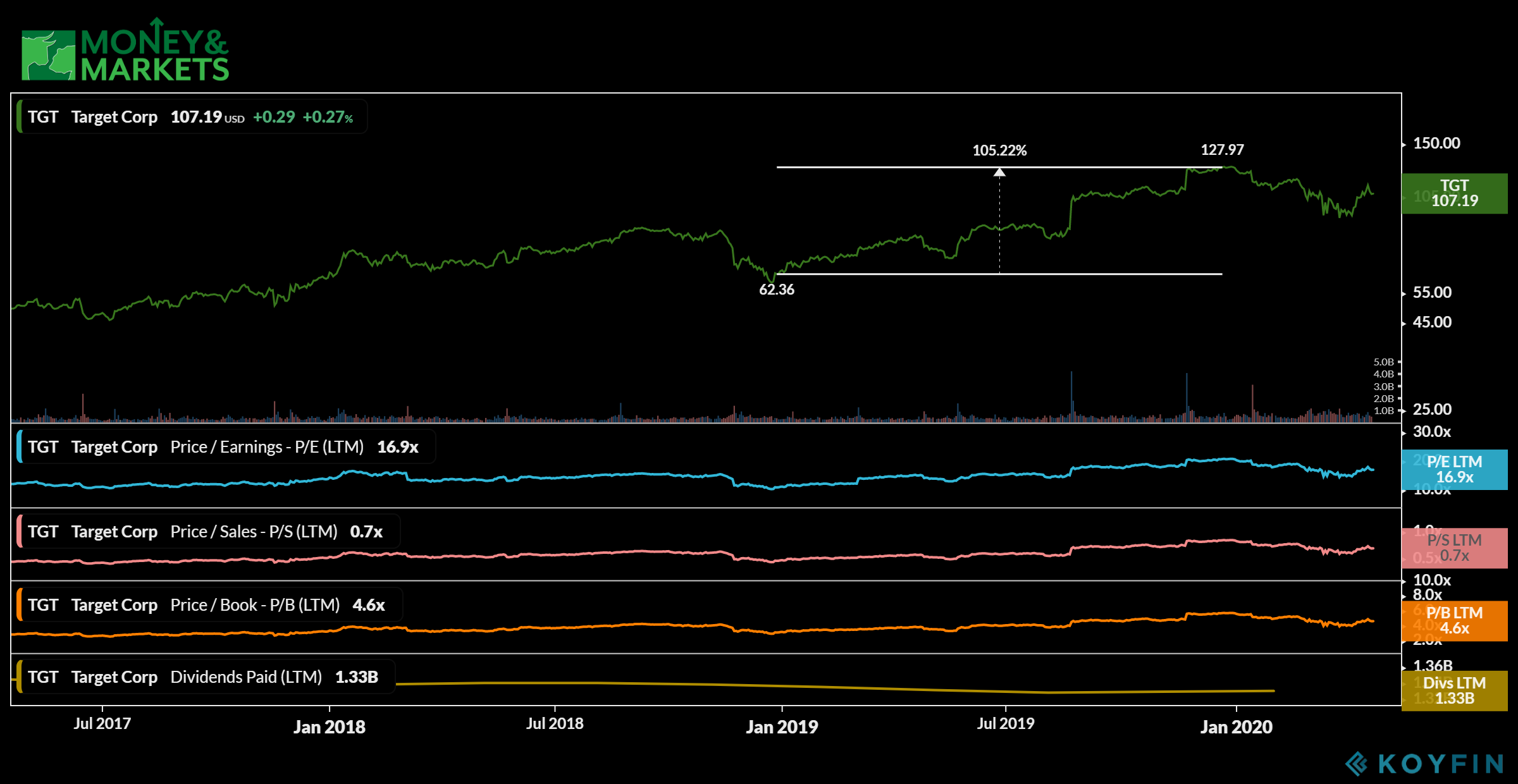

Target shares saw a nice bump in 2019, jumping 105% from the end of December 2018 to December 2019. It also didn’t drop nearly as much as about 95% of the rest of the market in March 2020.

Since the March crash, the company has started to trend upward again — only $20 off its 52-week high.

In its most recent quarterly report, Target announced a 3.4% jump in sales from 2018 to 2019 and a 10.6% jump in quarterly earnings per share.

Despite its size, Target remains a good value for investors with a price to earnings of 16.9, a price to sales of 0.7 and a price to book of 4.5.

Like Mondelez, Target also offers a solid quarterly dividend. It recently declared a quarterly dividend of $0.66 per share. That makes its annual dividend yield of around 2.4%.

Target is one of those consumer staples that seem to perform well under just about any kind of market condition. When the market is up, Target does well. When it’s down, it’s still a solid performer.

That’s why Target Corp. is one of the consumer staple stocks to buy now.

From stores to products, solid consumer staple companies provide what we all need at any given time, no matter what is going on with Wall Street.

These three companies are among the strongest in the sector. That’s why they are the consumer staple stocks to buy now.