Hey folks, Adam here…

It’s time for another Tuesday edition of What My System Says Today!

The goal of this newsletter is to share with you a unique piece of analysis based on the systems that drive Green Zone Fortunes, my flagship premium newsletter.

We’ll run a “Sector Spotlight” piece every Tuesday. Here’s how that works:

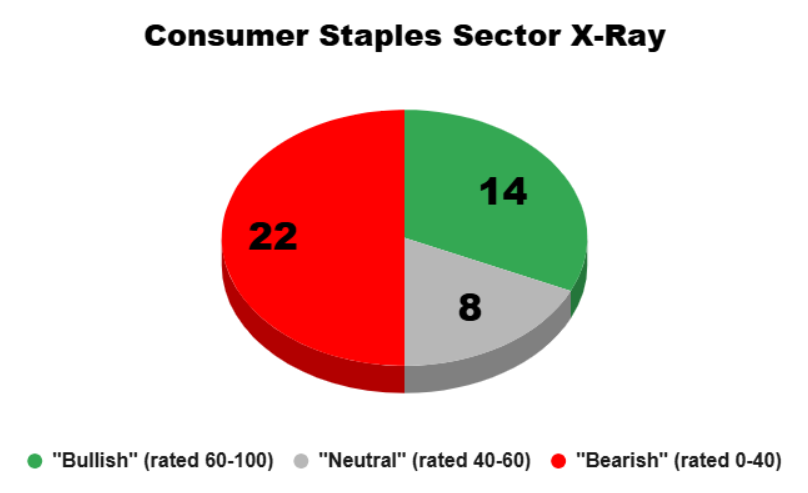

- I’ll “X-Ray” a specific sector of the S&P 500, letting you know how many of the stocks within the sector are currently rated “Bullish,” “Neutral,” or “Bearish” on my Green Zone Power Rating system. You’ll see this analysis in the pie chart below.

- I’ll show you which Green Zone Power Rating factors the sector’s stocks rate well or poorly on. Specifically, we’ll be looking at Momentum, Volatility, Value, Quality and Growth.

- I’ll point you toward valuable opportunities and point out pitfalls you should do your best to avoid.

Today, we’ll take a close look at the consumer staples sector … and I think you’ll quickly see why investors have gravitated here during this incredibly volatile market environment.

Let’s dig in…

Consumer Staples: The “Steady Eddies”

Here is a quick reminder of why we do these sector X-rays in the first place…

It’s not enough to know which direction the sector is trending in. We also need to look “under the hood” to determine why we’re seeing strength or weakness and assess whether that situation is likely to be sustained.

We do that in two steps…

Step #1 in assessing a sector’s strength is done simply by noting the general direction of its trend — is it “up” or “down”?

Step #2 involves judging the individual stocks within the sector, which is generally called “breadth” analysis. Most of the time, if a majority of individual stocks within a sector are sending a “bullish” message, a bullish trend in the sector’s market prices can be trusted.

As we saw in yesterday’s issue, every major U.S. sector suffered losses last week. However, the decline of the consumer staples sector, at -2.4%, was the mildest of the 11 major sectors we track, and it was only a quarter of the hefty sell-off we saw in the S&P 500.

With this negative short-term price trend as a backdrop, it’ll be interesting to see how the 44 consumer staples sector stocks in the S&P 500 look when viewed individually through the lens of the factors that underpin my Green Zone Power Rating system.

First, we’ll simply consider my system’s Overall rating, which can broadly be categorized into one of three buckets:

- Bullish (rated 60 – 100).

- Neutral (rated 40 – 60).

- Bearish (rated 0 – 40).

The pie chart below effectively “x-rays” the 44 consumer staples stocks (XLP) in the S&P 500, asking how many of them currently rate Bullish, Bearish or Neutral.

Have a look…

Key Insights:

- Only 14 stocks currently rate “Bullish” (60-100).

- 8 stocks currently rate “Neutral” (40-60).

- Exactly half — 22 of 44 — rate “Bearish” (0-40).

While this snapshot doesn’t appear as “bullish” as you may have expected, there are three things you should keep in mind…

First, the consumer staples sector has only recently begun outperforming the market, so I’ll be watching for improvement in the sector’s bullish/bearish/neutral breakdown in the weeks ahead.

Secondly, investors often flock to the consumer staples sector when they feel the most cautious and uncertain about the future. If the pendulum swings back to a greater appetite for risk-taking, the recent outperformance by staples stocks could fade alongside that change.

Third, there’s no such thing as a “perfect” sector or stock. There are always trade-offs between a sector’s “pros” and “cons.” We’ll explore those a bit more as we dig deeper into the characteristics of this sector…

Investors Flock to Staples … Do They Know What They’re Buying?

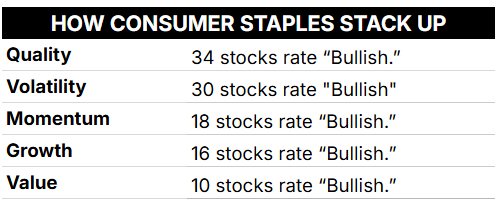

We looked at the consumer staples sector’s Overall Green Zone Power Ratings above. Now, we’ll drill down into my system’s individual factors.

We’re simply asking: “How many S&P 500 consumer staples stocks rate ‘Bullish’ (60-100) on Momentum … on Volatility … on Value … and so on?

This analysis gives us a feel for the dominant characteristics of the sector’s component stocks.

Listed in order, from the factor with the most “bullish” stocks down to the factor with the least number of bullish stocks, here’s how the consumer staples shape up today:

Here’s how I’m characterizing the sector as a whole:

Quality companies … whose stocks are not very volatile … but you’ll still have to pay a premium to own them, based on the low number of them that rate bullish on my system’s value factor.

In fewer words:

Quality, but not cheap, “Steady Eddie” stocks.

And you know what?

In this environment, in particular, I’m not surprised to see investors willing to pay higher valuations for stocks that are far less volatile than the broader market!

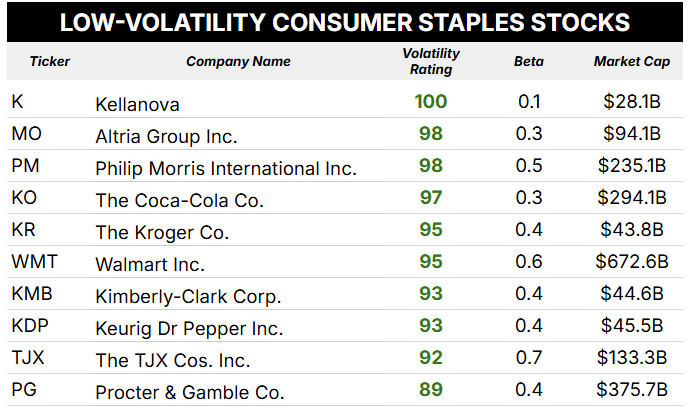

While my system relies on multiple volatility metrics to arrive at a composite volatility rating, a stock’s “beta” is a quick-and-dirty judge of this concept.

In simple terms, any stock with a beta greater than 1.0 is considered a “high-volatility” stock … and stocks with betas less than 1.0 are considered “low-volatility” stocks.

I asked my team to put together a table of consumer staples stocks that rate “bullish” on my system’s volatility factor. You can see that all 10 of them sport betas well below that 1.0 line in the sand.

Have a look:

With just a quick scan of the names of these companies … can you get a sense of why these “Steady Eddie” stocks are likely to attract investors who are worried about the future?

Of course, as I alluded to above, not all low-volatility stocks are good values. And if you overpay for a “Steady Eddie,” you’re unlikely to do as well as you were expecting.

At the end of the day, low-volatility stocks in the consumer staples sector can provide a lot of stability to your portfolio in times of turmoil … but the best stocks to own over the long run are the “well-rounded” ones that rate highly on a majority of my system’s six individual factors and, of course, earn the coveted “bullish” or “strong bullish” overall ratings.

That’s where you’ll position yourself to beat the market by 2X to 3X through a full cycle of bear and bull markets!

To learn more about how we do that at Green Zone Fortunes click here.

To good profits,

Editor, What My System Says Today