Hey folks, Adam here …

Almost everything my team and I do here at Money & Markets is data-driven.

We build battle-tested systems …

Which ingest millions (if not billions) of data points each and every day …

Which, in turn, deliver to us actionable insights …

Which we’re eager to share with YOU!

So, to reflect the unique value we strive to bring to you each day, we’ve revamped your daily newsletter …

Welcome to your first daily issue of What My System Says Today!

Each day, Monday through Friday, my team and I will design, distill and deliver a unique piece of analysis based on the systems we use daily at my flagship newsletter, Green Zone Fortunes.

This is your “peek behind the curtain” at what we do and the tremendous benefits you can gain by leveraging a data-driven system to navigate a market (and world) that’s increasingly full of “noise.”

Today, our first Monday issue will:

- Show you which sectors performed strongly (and poorly) last week …

- Offer a “Top 10” list of strong stocks, according to a simple momentum screen, and …

- Offer a list of 10 “worst” stocks we recommend you avoid.

Let’s dig in!

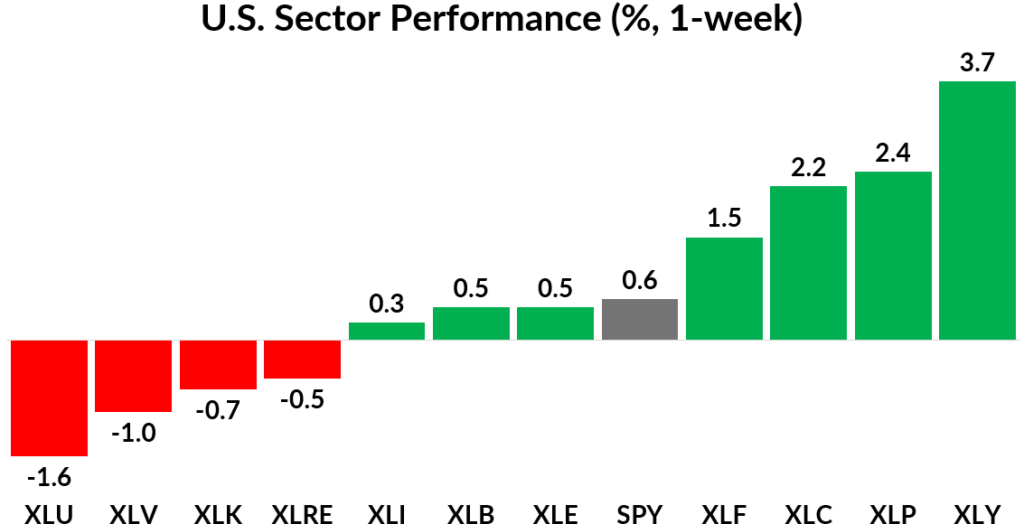

Key Insights:

- The S&P 500 (SPY) returned 0.5% for the week.

- 4 out of 11 sectors outperformed the S&P 500.

- 7 out of 11 sectors showed positive returns this week.

- Consumer Discretionary (XLY) was the top-performing sector (+3.6%).

- Utilities (XLU) was the worst-performing sector (-1.6%).

Let’s dig into the best and worst sectors from the week and see what my Green Zone Power Ratings system says.

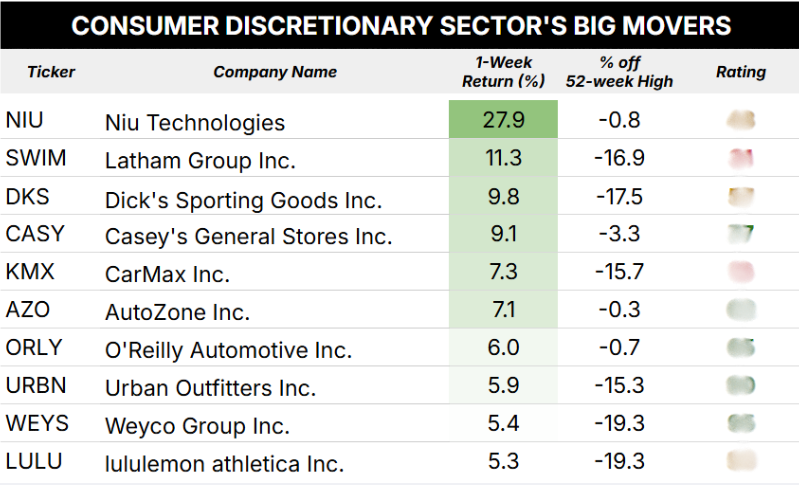

Consumer Stocks Gained

The Consumer Discretionary sector (XLY) managed a solid 3.6% gain last week, and one stock soared above the rest … psst; it wasn’t Tesla (TSLA), but another “electric vehicle” company.

To construct this table, my team and I ran a scan of all consumer discretionary stocks that closed last week within 20% of their 52-week highs. Of those stocks, you’re seeing the top performers from last week.

Buying top-performing stocks … from a top-performing sector … while they’re flirting with “new highs” territory …

Well, that’s a classic “momentum” strategy.

At the top is Niu Technologies (NIU), a Chinese consumer products company that makes electric scooters and e-bikes. It’s a small stock with a market cap of only $313 million.

I wouldn’t call Tesla (TSLA) a direct competitor of NIU, but I’ll note that TSLA did not qualify for today’s top stocks list because it’s not even remotely close to its 52-week high, making it a far less attractive momentum play than NIU is.

If NIU piques your interest, you’ll have to join us at Green Zone Fortunes to see the whole picture.

All told, five of the 10 stocks above rate “Bullish” or better in Green Zone Power Ratings. (Click here to join Green Zone Fortunes and find all of these ratings and more!)

Meanwhile, on the other side of the coin, we have the Utilities Sector…

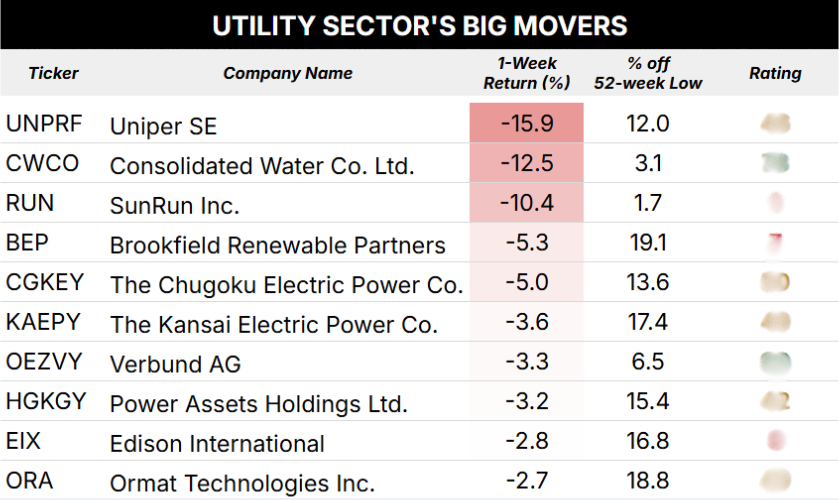

Utilities Lagged

The broader Utilities Sector (XLU) fell -1.6% last week, with three stocks suffering double-digit declines.

To construct this table, my team and I ran a scan of all utility stocks that closed last week within 20% of their 52-week lows. Of those stocks, you’re seeing the worst performers from last week.

Shorting the worst performing stocks … from a poorly performing sector … while they’re flirting with “new lows” territory …

That’s also a classic “momentum” strategy.

Of course, if you consider yourself a “long-only” investor … that’s perfectly fine. You can use the analysis above as your “don’t touch” list.

Of note: Green Zone Power Ratings was already flagging three of these stocks (RUN, BEP and EIX) as “Bearish” or worse heading into last week.

While the utilities sector fared poorly last week, it is known as a relatively “safe” sector to invest in … I have highly rated utilities stocks in my Green Zone Fortunes portfolio. Click here to gain access today.

Well, that’s a wrap for this inaugural Monday edition of What My System Says Today! I hope you find it helpful to know which sectors are on the rise and which are falling behind as you head into the week.

Otherwise, enjoy your Monday and look for the next edition of What My System Says Today to land in your inbox tomorrow!

To good profits,

Adam O’Dell

Editor, What My System Says Today