Consumers have felt the pain of inflation for months.

Prices have risen, while wages haven’t.

This means consumers have to make choices.

Those choices are becoming more difficult.

While families can avoid or reduce some expenses, others are non-negotiable.

The “must pay” bills in the budget include:

- Housing.

- Utilities.

- Food.

- And transportation.

Housing costs tend to change at a slow rate, once a year for most families, as rents increase or escrow balances on mortgages adjust.

This means some families have already seen housing prices rise, while others are waiting for that hit to their budgets.

Inflation Causes Consumer Budget Shift

Utilities spike a few months a year, and many families prepare for that.

Increases tend to be smaller because utilities are regulated, and large increases are difficult for politicians to approve.

There is no buffer for other expenses.

Changes in the costs of food and transportation have been the most damaging to household finances.

Both are growing at double digits compared to a year ago.

This means more family income needs to go to necessities.

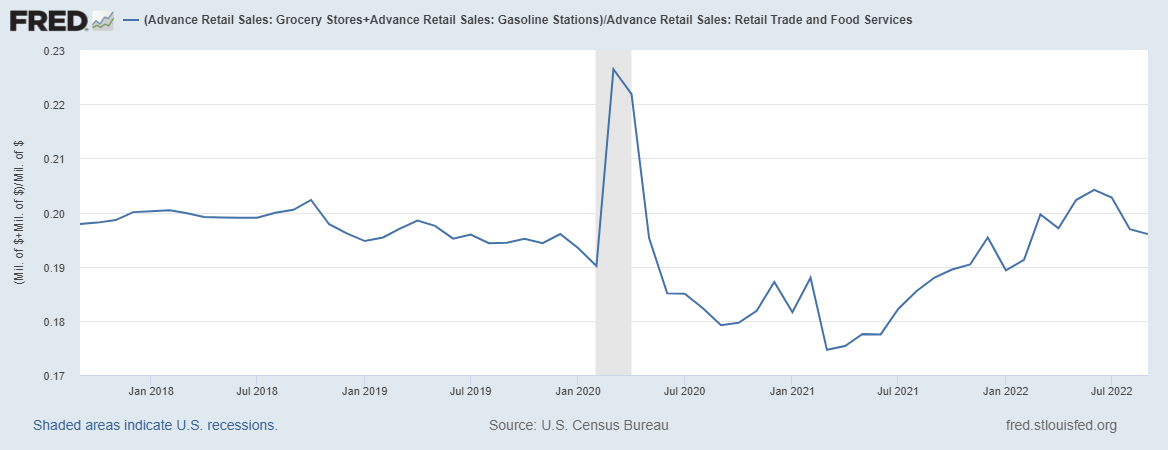

The most recent data on retail spending shows that 19.6% of household budgets go to food and gas.

Household Budget Shifts From Retail to Basic Necessities

Source: Federal Reserve.

This is about the same level as before the pandemic.

But the rate of change has been dramatic.

Dramatic Rate of Change Chokes Consumers

Families had to reduce spending on other things to spend this much on food and gas.

They had to make choices and cut spending where possible.

The rapid change in prices also affects how consumers think.

Consumers expect inflation of 5.4% in the next year.

This means cutbacks are in the plan, since few will see wages increase that much.

Bottom line: As spending on necessities rises, discretionary spending will fall.

This is important for investors to understand.

Stocks in discretionary sectors should suffer the most in the rapidly approaching recession.

Consumer staples may not deliver large gains but may lose the least as the bear market continues.

Michael Carr is the editor of True Options Masters, One Trade, Precision Profits and Market Leaders. He teaches technical analysis and quantitative technical analysis at the New York Institute of Finance. Follow him on Twitter @MichaelCarrGuru.