The copper market is poised for a boom. A boom that could be heard around the world. And yet, copper miners are trading near belly-scraping levels. I’ll give you the scoop, along with an easy way to play it.

What will drive copper higher? A convergence of forces, on both the supply and the demand side.

On the demand side, two megatrends feed into the bullish copper story. One is the boom in electric vehicles (EVs). The other is rip-roaring growth in alternative energy — solar and wind power.

Both EVs and solar/wind use a lot of copper. A typical EV contains 10 times more copper than a conventional vehicle. And as for solar, copper is vital to powering photo-voltaic (PV) systems and the energy storage systems that let you use solar power when the sun ain’t shining. A well-designed solar PV plant might use approximately 9,000 pounds of copper per megawatt of peak capacity.

The solar photovoltaic market in Europe grew 104% this year. Wow! In the U.S., the amount of solar power is expected to more than double in the next five years. Globally, the solar energy market is projected to grow at a compound annual growth rate (CAGR) of 20.5% from 2019 to 2026, to reach $223.3 billion.

Meanwhile, the global wind turbine fleet could consume over 5.5 million metric tons of copper by 2028. That’s according to a new analysis by Wood Mackenzie.

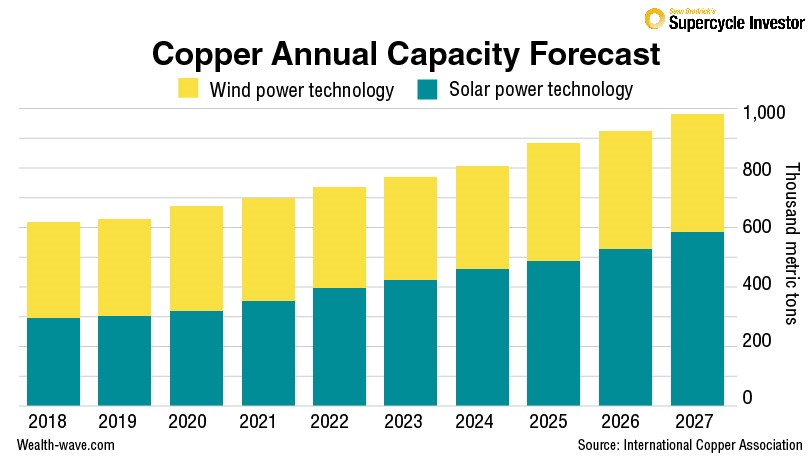

And that led Navigant Research and the International Copper Association to publish this chart of forecast annual demand for copper in just solar and wind.

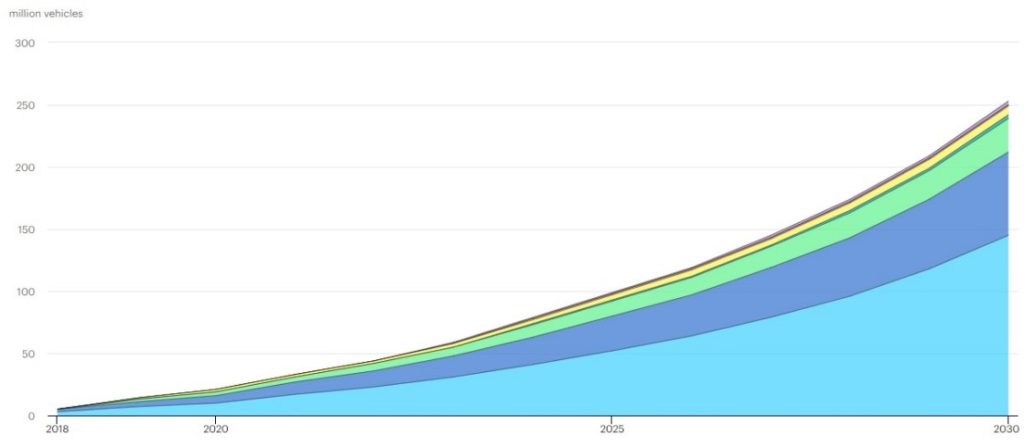

That’s a strong trend! Meanwhile, the International Energy Agency put out a chart earlier this year projecting that global EV growth would look like this …

Source: IEA

As I said, both these industries need a lot of copper. These megatrends are massive, and nigh unstoppable.

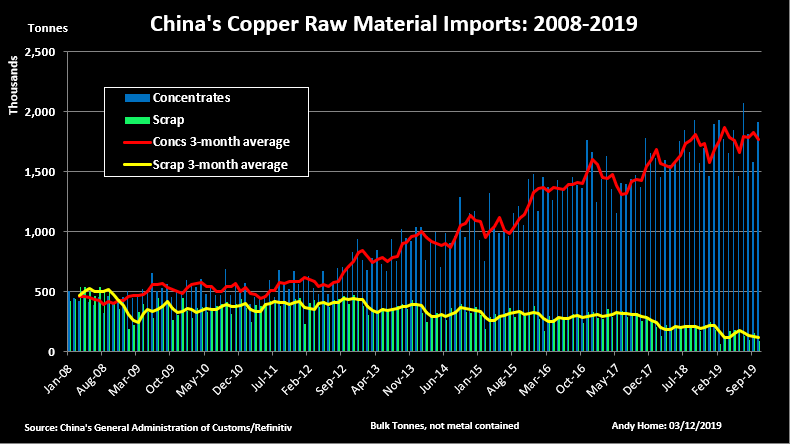

To be sure, copper is useful for all sorts of reasons. China leads the way in copper demand. Here’s a chart from Reuters, a picture worth a thousand words …

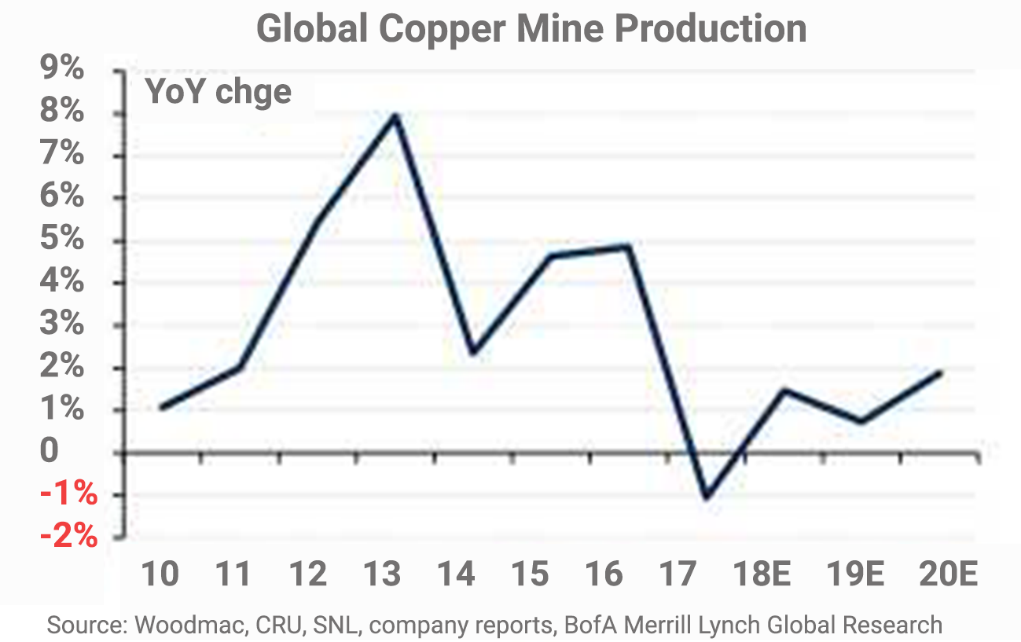

Well, with demand ramping up, supply better be doing the same, right? Only it’s not. In fact, thanks to problems at Freeport-McMoRan’s Grasberg mine in Indonesia, supply has fallen this year. This chart from the Financial Times tells the story …

The folks who made the chart expect production to rise in 2020. Really? Considering the troubles in major copper-producer Chile, I wouldn’t count those copper eggs before they hatch.

In fact, 80% of the world’s copper supply is concentrated in just five mines: Escondida, Cobre Panama, Quebrada Blanca, Spence and Kamoto. Let me tell you a lesson I learned from hard experience: something always goes wrong in mining. The next outage at a big copper mine could be rocket fuel for prices.

So, it’s no surprise that Jeffries raised its copper price forecasts for the first time in a year. I don’t think they’ll be the last to raise price targets, either.

How Do You Play Copper for Potentially Big Bucks?

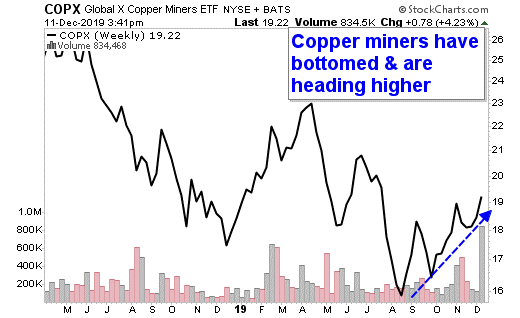

There is an easy way to play a potential rise in copper prices. That’s by using the Global X Copper Miners ETF (NYSE: COPX). This fund has an expense ratio of 0.65% and is a truly global fund. It holds copper producers from Canada, Britain, China, the U.S., Australia and more.

Take a look at the chart …

You can see that COPX has bottomed. But it’s still close to its lows. Pullbacks can be bought.

Or, you can drill down to find companies that are overlooked gems. I recently recommended one such company to my Supercycle Investor subscribers. It’s a tiny company with a copper-rich project in Alaska. A road is currently being permitted for the project. When that comes through, I expect this stock to take off.

Do your own research on whatever you buy. But don’t waste too much time. Recent months have been a great time to be in gold miners and explorers. All the evidence tells me that copper could be the next metal on the launch pad.

All the best,

Sean