Crescat Capital Chief Investment Officer Kevin Smith is making his case for an impending bear market due to the coronavirus outbreak, and he says investors should absolutely not buy the dip.

Smith said “the bear case for US stocks has never been stronger” and that investors should be wary of the “gravity of the situation” that markets are facing.

He also said the current situation reminds him of January 2018, when his firm was “similarly bearish” while the market kept rising — but then came crashing down in February.

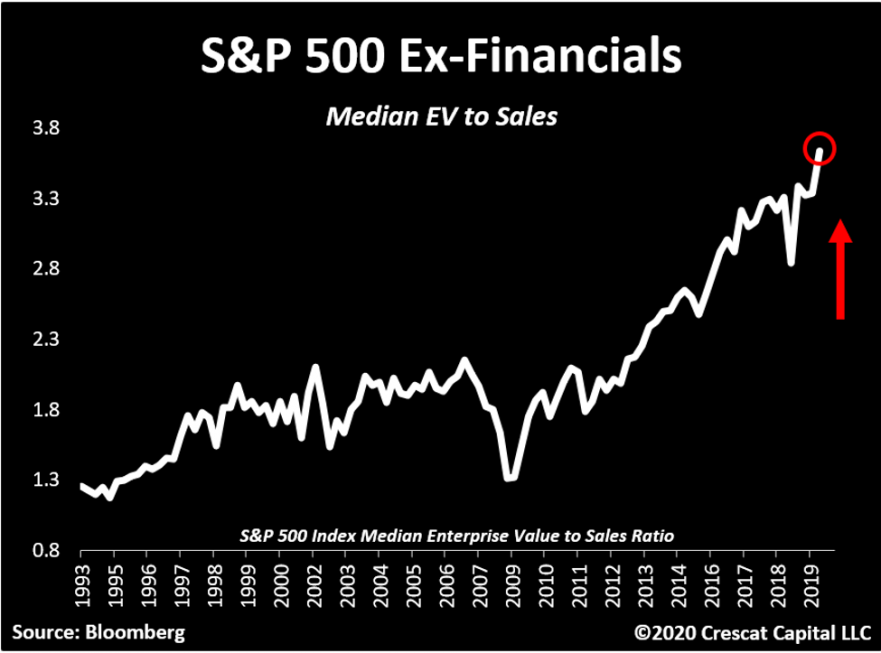

“We certainly did not predict the Coronavirus, but it may prove to be the catalyst to tip this market that is trading at truly historic valuation levels after a record long U.S. economic expansion,” Smith wrote in a note to clients. “Median EV-to-sales for the S&P 500, based on our work recently reached an insane, euphoric level of 3.6 times, two times than the tech bubble peak.”

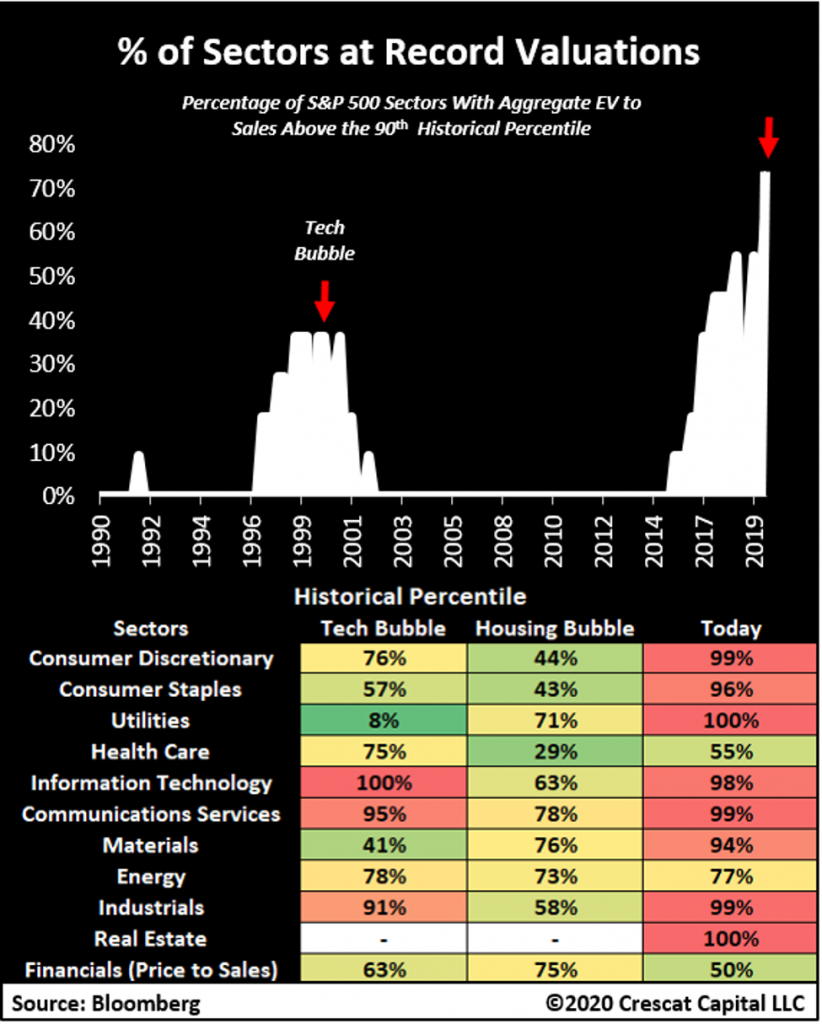

According to Smith, these charts tells the story:

“A top this month would certainly make sense to us given the recent overbought conditions, unsustainably high bullish sentiment levels, bear capitulation (not Crescat), and deteriorating macro indicators,” Smith wrote.

Per MarketWatch:

(Smith) said the median enterprise value-to-sales is one of the best ways to understand just how inflated the current stock bubble is. The ratio is seen by many, including Smith, as more accurate than other more commonly cited valuation metrics in part because it takes company debt into account.

“Investors will need a good grounding in valuation and business cycle analysis to reject the common buy-the-dip advice that is soon to become prevalent in the still early stages of what is likely to become a brutal bear market,” Smith wrote.

Crescat Capital portfolio manager Tavi Costa co-wrote the note and he points to another chart, noting current valuations are “truly insane” via tweet.

Truly insane.

The median EV to Sales ratio for the stocks is now 3.6x.

Twice as high as it was at the peak of the tech & housing bubbles.

The breath of valuations has never been so frothy.

Our in-depth research below:https://t.co/WIzrfdEDDP pic.twitter.com/erTc2BuE4g

— Otavio (Tavi) Costa (@TaviCosta) January 30, 2020

Click here to read the firm’s rather lengthy analysis in full.