Foreign investors are flocking to the U.S. corporate bond market, and it looks like demand will remain at exorbitant levels through 2020.

What’s driving the demand?

Investors from other countries have found U.S. corporate bonds (high-grade debt) so appealing because of over $11 trillion in negative-yielding securities in other parts of the world, according to analysts watching the markets, such as Pacific Investment Management CIO of global credit Mark Kiesel.

“There’s simply not enough high-quality, income-producing assets to meet the demand,” Kiesel said in a recent Bloomberg interview. “That’s the reason that credit did so well this year. It wasn’t just the fact that the Fed and other central banks cut rates. The fact is that there’s just that much demand.”

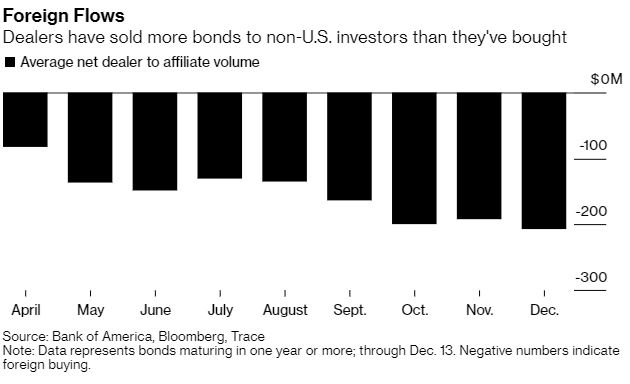

Blue-chip company bonds in America returned more than 14% in 2019, which was the most in a decade, and while no one is predicting a repeat on the same level in 2020, analysts are projecting solid, single-digit gains, even with a market that is fairly pricey. And it’s all going to be driven by foreign investors who had already purchased $114 billion in bonds through the third quarter of 2019, according to the Federal Reserve.

The Canadian Imperial Bank of Commerce has found that central banks around the world cut interest rates around 90 times over the past year alone. The Fed cut its benchmark interest rate in the U.S. three times in 2019 to a range of 1.5% to 1.75%, which is high compared to Japan and Europe, which are floating at or even below 0% rates.

“It’s very hard for the average foreign investor to survive — we’re still at a point now where it’s max desperation,” Bank of America Corp. head of high-grade credit strategy Hans Mikkelsen said. “Basically there’s only one game in town for foreign investors, and that’s the U.S. corporate bond market.”

Demand for U.S. corporate bonds, which currently average about a 2.87% yield, should remain high as interest rates continue to decline, like many are forecasting. Absolute yield on company bonds in Europe and Japan are only hitting 0.46% to 0.47%, which is driving more and more investors out.

“They are being pushed out of Japan,” Mizuho Financial Group Inc. U.S. Macro Strategist Tetsuo Ishihara said of institutional investors in Japan. “There’s nowhere else to go.”