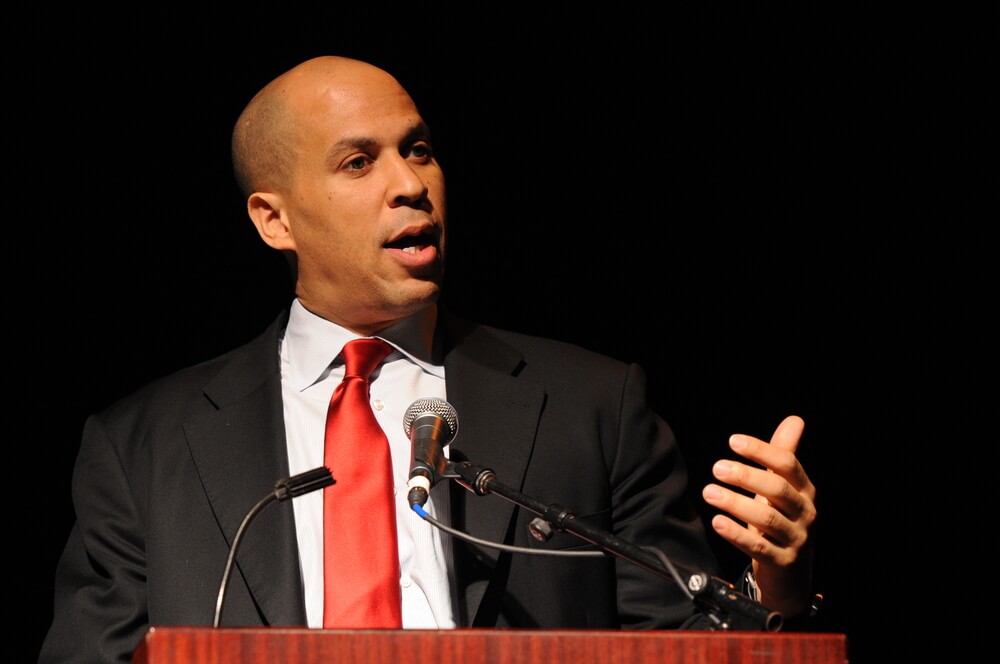

With the 2020 Democratic hopefuls trying to outdo each other to see who can give away the most free stuff, Sen. Cory Booker plans to address racial and wealth inequality by giving up to nearly $50,000 to the country’s poorest children by the time they turn 18.

The American Opportunity Accounts Act, otherwise known as the “baby bonds” bill, seeks to reduce income inequality, which disproportionately affects people of color, by giving each child born in the U.S. money that can be used to pay for things like college or to buy a house.

The bill was previously introduced to little fanfare in 2018, but it’s being reintroduced with Democrats now in control of the House of Representatives.

“I’m very confident that this will get through the Senate over time,”Booker said. “Obviously, not with (Senate Majority Leader) Mitch McConnell here right now. I think especially in the House that this is the kind of bill that will get a lot of attention and support.”

The bill works by giving every child born in the U.S. a $1,000 savings account, and the federal government would deposit up to $2,000 each year into the account, dependent upon the family’s financial situation. The less income the family makes, the larger the deposit would be each year.

The money would be put into “low-risk” accounts managed by the Treasury (because the government never mismanages money, of course). The bill assumes about a 3% annual return.

By the time the poorest children — families of four with incomes less than $25,100 — reach age 18, would receive $46,215 (in 2019 dollars). The richest children — families of four with incomes above $125,751 — would receive about $1,681.

The children wouldn’t be able to touch the money until age 18, and even then it can only be used on “purchases that can help build future wealth, such as buying a home, tuition or classes to develop new skills,” according to Yahoo Finance.

The devil in the details: tax hikes

According to Booker, the baby bonds will cost taxpayers upward of $60 billion a year, paid through a variety of taxes, including by restoring the 2009 estate tax rules, which tax estates at 45% with a cap on exemption at $3.5 million.

It also would require a new surtax on “extremely large” estates, and closing the “step up basis” loophole in the tax code. The loophole eliminates an heir’s tax liability on capital gains of property value during the heir’s lifetime.

“We already use our tax code right now to move hundreds of billions of dollars to give people of wealth more wealth,” Booker said. “This is in line with something we already do, and now we are doing it for people that don’t have much overall.”