I had a garden in my backyard as a kid.

We grew our own food — everything from tomatoes to corn.

One reason we were able to grow plants year in and year out is because the fertilizer we used was rich in nutrients.

Grand View Research estimates that the annual revenue from agriculture chemicals in the U.S. will increase 18.4% from 2020 to 2025.

Today’s Power Stock is a leader in producing nitrogen fertilizer for the agriculture industry: CVR Partners LP. (NYSE: UAN).

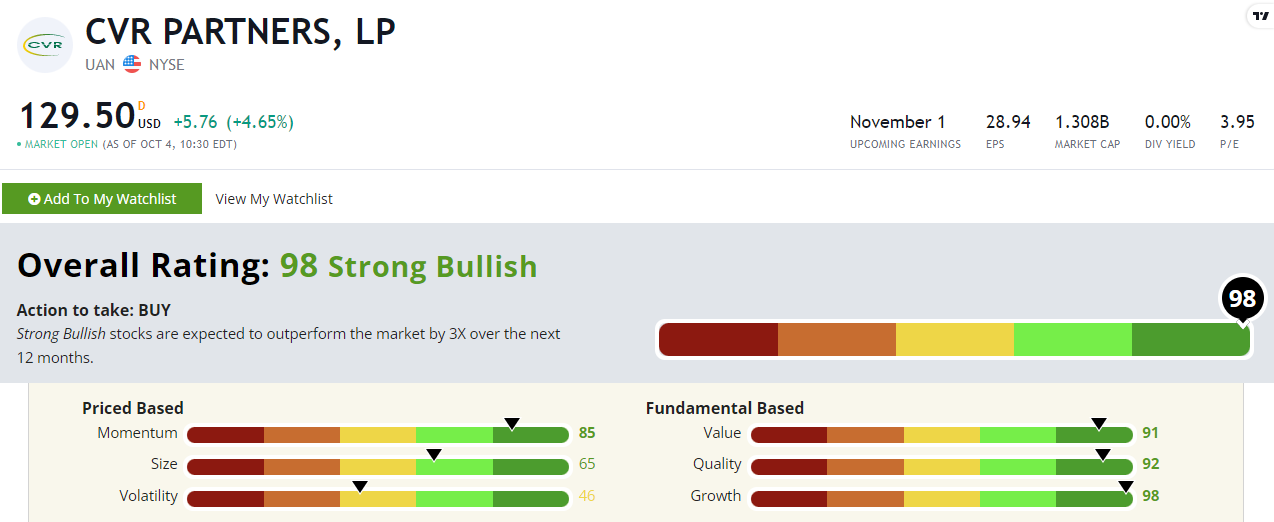

UANs Stock Power Ratings in October 2022.

CVR Partners specializes in making low-cost nitrogen fertilizer used to make plants and crops lush and green.

UAN scores a “Strong Bullish” 98 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

UAN Stock: Top-Notch Growth and Value

CVR Partners had an outstanding fiscal first quarter.

Here are two high points:

- Reported sales of $244 million — a 76.8% year-over-year increase.

- For the first six months of the year, company sales were up 134.7% over the same period last year.

These sales figures show why UAN is a top-notch growth stock — scoring a 98 on that factor in our Stock Power Ratings system.

It’s an outstanding value stock with a price-to-earnings ratio more than three times lower than the industry average.

UAN’s price-to-cash flow ratio is 3.2, compared to the industry average of 9. This tells us the stock is inexpensive relative to its peers.

The stock earns a 91 on our value factor.

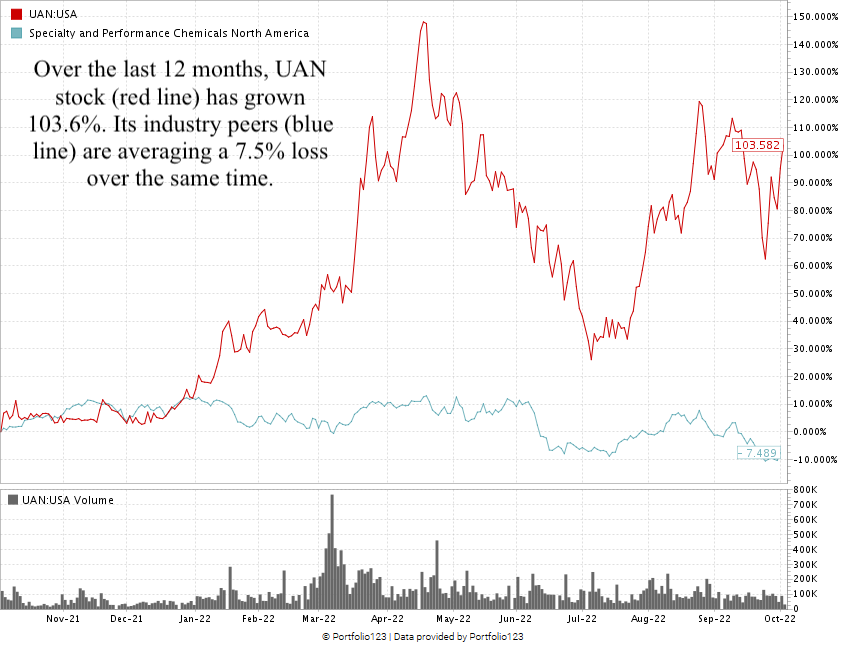

Created in October 2022.

Over the last 12 months, UAN stock is up 103.6%. Its specialty and performance chemical industry peers are averaging negative 7.5% over the same time.

The broader market sell-off pushed UAN down. But I have high conviction it will make another run at its 52-week high.

CVR Partners stock scores a 98 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

The takeaway: Fertilizer is a critical part of any farm or garden.

UAN is a leader in providing nitrogen-based fertilizer for farms and green thumbs alike.

That makes it a strong contender for your portfolio.

Bonus: CVR Partners stock comes with a 17.5% forward dividend yield.

Stay Tuned: South American Company Redefines Banking for Its Country

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on a company bringing something Americans take for granted, online banking, to a market where over 80% of transactions are still done in person.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.