The company pioneered commission- and fee-free investing so that anyone who wanted to try investing for the first time could give it a shot.

It was unheard of at the time.

But these days, this company bleeds cash.

Today, I’m sharing the “High-Risk” stock Robinhood Markets Inc. (Nasdaq: HOOD).

With our Stock Power Ratings system, you can get to the heart of a company’s stock movement and financial picture to figure out if you should buy or sell.

A quick look helps you see the real picture of a company.

And Robinhood’s looks ugly.

HOOD Stock’s Roller-Coaster Journey

When Robinhood launched its initial public offering in 2021, HOOD stock rose 102.2% in a matter of days.

Since reaching that top in August 2021, HOOD has been in free fall.

The company offers a free stock-trading platform that allows users to trade stocks, cryptocurrencies and options.

Despite saving users money on trading fees, this company has yet to improve its own bottom line.

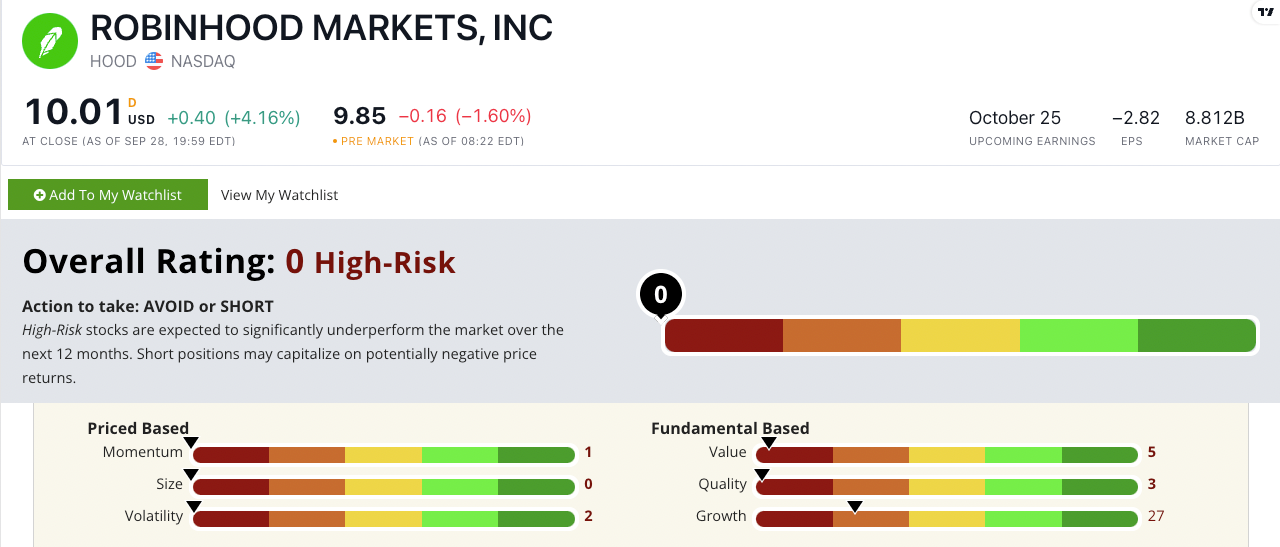

HOOD’s Stock Power Ratings in October 2022.

HOOD stock scores a “High-Risk” 0 out of 100 on our Stock Power Ratings system, and we expect it to underperform the broader market over the next 12 months.

HOOD Stock: No Momentum + Very Low Value and Quality

I usually tell you exciting figures about impressive company performance.

That’s not the case for HOOD:

- In its recent quarterly report, the company recorded a 6% loss in total net revenue from the same quarter a year ago!

- Its total net loss for the quarter was $295 million.

That is why HOOD scores a 27 on growth.

It also scores in the red on our other five metrics.

HOOD has negative price-to-earnings and price-to-sales ratios, meaning it’s not making money. It scores a 5 on value.

The company has a horrible return on equity of negative 96.5% and a return on investment of negative 29%, earning it a 3 on quality.

The company bleeds cash, and it’s considerably overpriced compared to its peers.

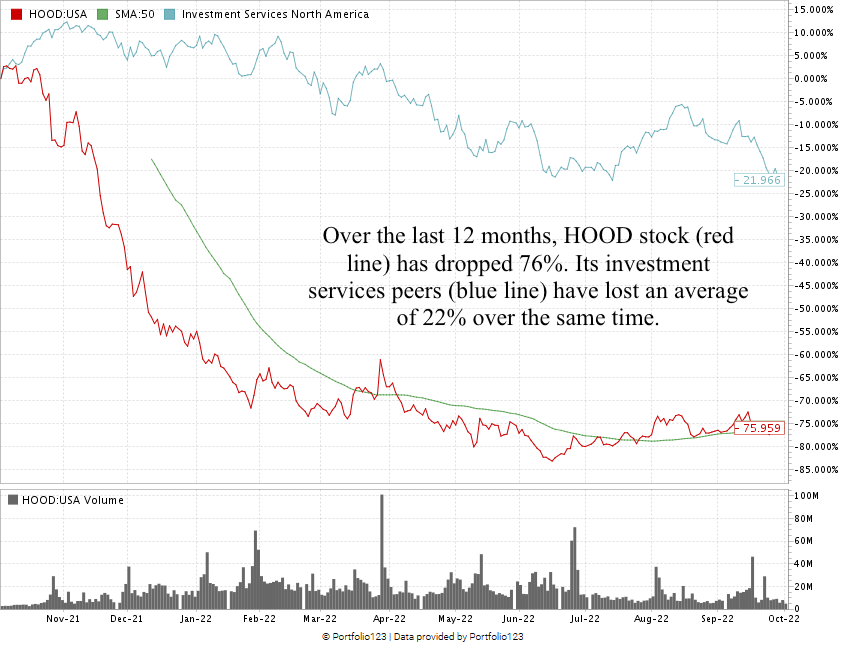

Created in October 2022.

It’s been a rough 12 months for HOOD. The stock has fallen 76%.

That’s almost four times lower than its investment services sector peers.

Robinhood stock scores an atrocious 0 overall on our proprietary Stock Power Ratings system.

That means we consider it “High-Risk” and expect it to underperform the broader market.

Its revenue is slumping.

Its net margins are in the red by double digits.

And a quick look at our Stock Power Ratings system shows that despite being a trading services trailblazer, HOOD is a Stock to Avoid.

Stay Tuned: Top Agriculture Stock

Tomorrow, we’re returning to our original Stock Power Daily format.

Stay tuned — I’ll share all the details on a nitrogen fertilizer producer that’s crushing its peers by 10 times!

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. I’d love to hear what you thought about my “Stock to Avoid” article today. Was it valuable? Would you like us to continue sharing “High-Risk” stocks on occasion, so you know what to stay away from?

Would you prefer that we only share “Bullish” and “Strong Bullish” stocks?