Most folks have a tough time buying stocks at their highs.

We have Warren Buffett’s “buy low, sell high” adage in the backs of our minds. And nobody likes the feeling of potentially “overpaying” for anything.

M&M Chief Investment Strategist Adam O’Dell

But as is often the case with successful investing, what feels uncomfortable is typically the right thing to do… the thing that will actually lead you to profits!

My Cycle 9 Alert subscribers have seen this play out time and again, ever since we opened the options-trading service in 2012.

Rule No. 1 of my Cycle 9 strategy is: Only buy stocks that are already trending higher.

Rule No. 2 is: Only buy stocks that are already showing market-beating momentum.

Taken together, you might suspect these rules lead us to buy stocks and ETFs that are trading at or near their “highs.”

Indeed, that’s exactly what we do!

Well, to be precise, we buy options on stocks and ETFs that are often near their highs.

Essentially, Cycle 9 Alert is all about “buying strength.” We position ourselves in stocks and ETFs that have already proven to have market-beating strength… and then we wait for the stock or ETF to make a bullish breakout — to new, even higher highs!

For instance, right now we’re buying strength in the health care sector — specifically in the biotech and life sciences spaces.

Here’s a chart of the SPDR Biotech ETF (NYSE: XBI) that I showed my Cycle 9 readers on May 6, as I recommended a bullish play on the sector:

Even though I warned readers it would feel uncomfortable buying at the highs… the potential for a bullish breakout showed the ETF could easily climb 30% higher in the months ahead (giving us the chance to at least double our money on the options play I recommended).

Since then, this diversified biotech-sector ETF has continued its bullish breakout, gaining more than 7% against the S&P 500’s gain of 2.5% in the same time.

And since we made an options play on this bullish biotech breakout, my Cycle 9 Alert readers are already up 50% on their positions.

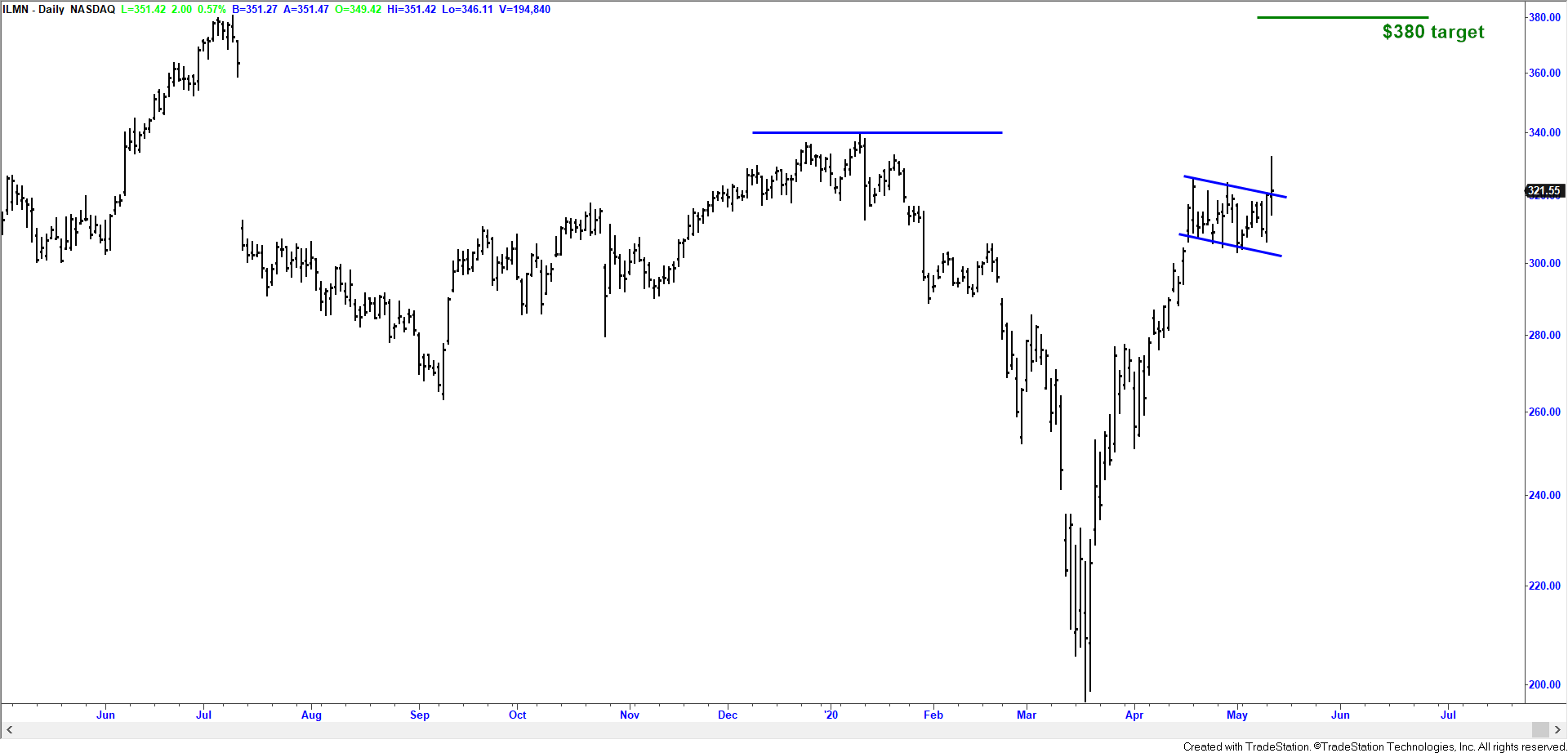

The bullish breakout in biotech stocks was shifting in early May. So I followed up that broad-sector play with another bullish recommendation… this one on an individual stock in the innovative field of genomics (which can generally be thought of as a subset of the biotech industry).

That stock was also trading near its highs, making it a “scary” buy. My Cycle 9 system assured me, though, that the stock’s trend and momentum had it poised for a bullish breakout ahead.

And once I saw a classic “flag” pattern in the stock’s chart, I knew it was a high-probability play for a significant bullish breakout and rally… to as high as $380, from our roughly $320 entry level.

Have a look…

Now, we’ve only been in this bullish breakout trade for a week and a half now. But already it’s going nicely so far — shares of the stock are up more than 9% and the option contracts I recommended buying are selling for 44% more than our recorded entry price.

Indeed, that’s often how bullish breakouts work.

You have to get into the stock while it’s at or near its highs — where it feels uncomfortable buying, and where, perhaps, lesser investors simply can’t pull the trigger on their desire to get in.

But then once the stock breaks to new, higher highs… well, that’s when everyone gets FOMO and just has to get in, before it’s “too late.” And that further pushes prices higher, handing fast profits to those of us who got in before the rush.

Of course, you won’t catch every bullish breakout just right. And we’ve certainly had our fair share of duds in Cycle 9 Alert through the years.

But that’s fine. That’s investing, no matter the strategy!

And when you pair a “strength-buying” strategy like the one I use in Cycle 9 Alert, with options… you get exactly what you need to limit the risk of catching a dud while positioning yourself for big, fast profits.

When you follow the type of option trades I recommend in Cycle 9, your risk is completely limited but your profit potential is completely unlimited. That’s an “asymmetry” we routinely use to our advantage.

And when we combine that options-specific advantage with my time-tested “strength-buying” Cycle 9 strategy, you truly get a high-powered — and safe — way to play lucrative bullish breakouts… whether they’re in the health care and biotech sectors, or anywhere else!

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets

• Using his unique blend of technical and quantitative analysis, Adam’s sole focus is to find and bring you investment opportunities that return the maximum profit with minimum risk.

Editor’s note: Chief Investment Strategist Adam O’Dell’s Cycle 9 Alert joins his Green Zone Fortunes service right here on MoneyandMarkets.com in our “Premium Content” section. Check out any of the links and sign up today!