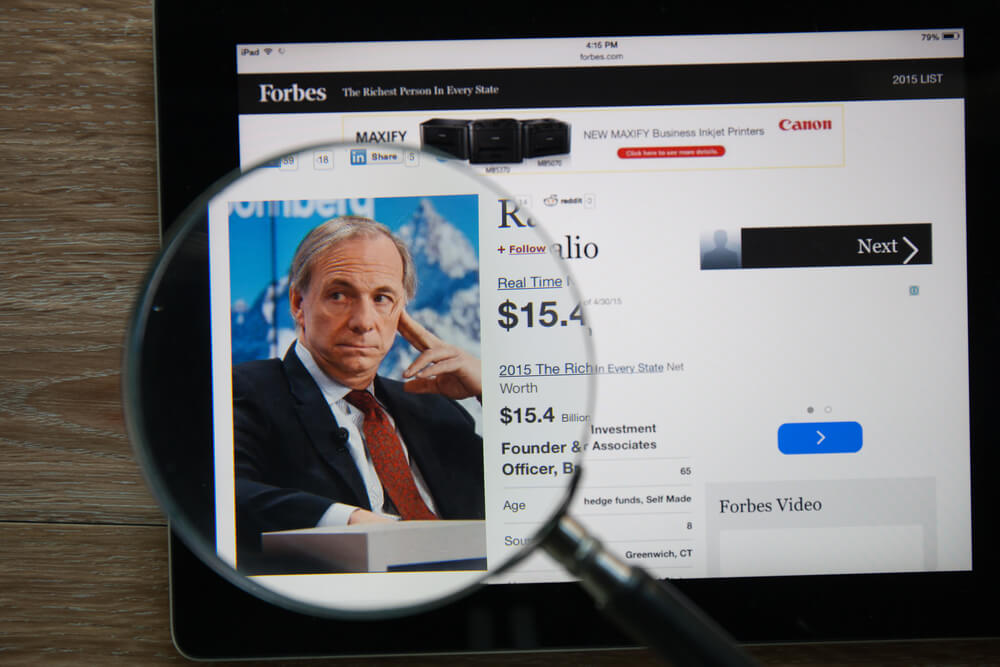

Billionaire Bridgewater Associates founder and investor extraordinaire Ray Dalio gave an interview with CNBC where the host asked him to divulge his two best pieces of advice for the average investor.

“The biggest mistake of investors is to think that those markets that went up recently and did really well recently are better markets, rather than more expensive markets.”

Dalio said the biggest mistake investors make oftentimes amounts to FOMO — fear of missing out. Just because a particular stock has had a big week, month or year and it might be wildly popular, that doesn’t necessarily make it a good buy. In fact, by the time you decide to buy — because it’s wildly popular — it likely could be overbought and too expensive.

“The first is to rectify the biggest mistake of investors: The biggest mistake of investors is to think that those markets that went up recently and did really well recently are better markets, rather than more expensive markets,” Dalio explained. “And so, don’t make the mistake of thinking those things that have gone up are better, rather than more expensive. If you can eliminate that, you’ll do well.”

The next point Dalio, who also is known to give life and investing advice to his 330,000-plus Twitter followers, mentioned is proper portfolio diversification. Diversifying a stock portfolio simply means not keeping all of your eggs in one basket.

“The next thing is to know how to diversify well because through diversification, you can reduce your risk without reducing your returns,” he said.

To have your portfolio properly diversified, you should have assets that play off each other, meaning that if one moves down, it’s correlating stock or stocks will move up. One way to achieve this is through exchange-traded funds, or ETFs, and mutual funds.

Essentially, having a diversified portfolio means having a variety of investments that can yield higher returns while also lowering risks.

Bridgewater Associates is the largest hedge fund in the world, founded by Dalio in 1975 and is currently managing about $160 billion in assets.

Editor’s note: With the new year upon us, have you set any goals, such as better diversifying your portfolio, for 2020? Do you have any additional advice for the average investor? Share your thoughts below.