Debt ceiling…

These two words are starting to dominate headlines.

While the concept of the debt ceiling is straightforward, the impact of Congress and the White House not reaching an agreement on it is much more complicated.

As an investor, heed this warning from Citigroup U.S. Equity Strategist Scott Chronert:

We do not believe U.S. equities are pricing in enough event risk around a debt ceiling standoff.

He believes the market isn’t pricing in the potential for a long-standing government debt crisis.

Today, I’m going to give an overview of the debt ceiling, what happened the last time we reached the brink of a debt crisis and what you can do as an investor to prepare.

The Government’s Gotta Pay Up Too

The U.S. government has bills to pay just like you and me.

It pays those bills by selling Treasury bonds to investors around the world … essentially issuing new debt.

It spends more than it takes in, which means the Treasury Department issues more debt to pay those bills.

And the cycle continues until that debt level creeps up to the debt ceiling — the maximum amount of money the U.S. government can borrow.

That ceiling has been in place since World War I. But it’s also been suspended more than 100 times since World War II.

Now, if we hit the limit — and it’s suggested that will happen as early as next month — we aren’t out of money.

But the Treasury Department will be forced to draw out cash from the Federal Reserve to pay some of the bills.

I say “some” because the Treasury can implement what’s called “extraordinary measures” — a different way of limiting government investment and moving some of the debt subject to the limit — to keep things going.

Money Doesn’t Grow On Trees

If Congress can’t come to an agreement on raising the debt ceiling — or at least suspend it — debt default becomes a reality.

And that’s when the Treasury will be forced to pare back discretionary expenses such as transportation and education funding. It would send our economy into a tailspin.

It can also crater the market.

Remember Chronert’s warning? It isn’t based on nothing…

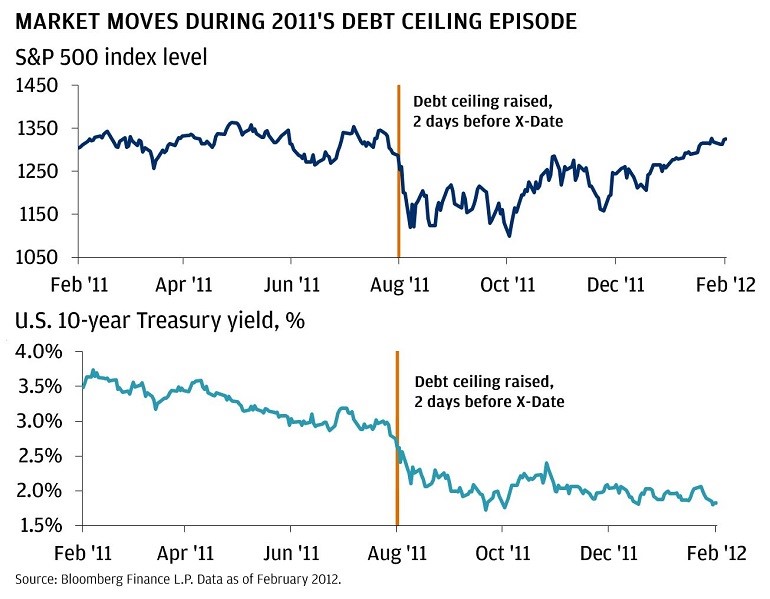

In 2011, we were on the brink — the ceiling was increased just two days before the money was all gone.

The market reaction was very telling:

As you can see from the chart above, the S&P 500 fell 15%, mainly due to Standard & Poor’s downgrading the U.S. credit rating from AAA to AA+.

And it could be even worse this time around since we’re also dealing with high inflation and interest rates. For comparison, inflation averaged 3.1% in 2011 (compared to 4.9% today), and interest rates were near zero (we’re around 5.1% today).

Bottom Line on the Debt Ceiling

In short, the U.S. doesn’t need to contend with yet another crisis right now.

As an investor, you can take some measures to mitigate a debt default. While we mostly focus on stocks here in the Stock Power Daily, some alternative assets could do well:

- Foreign currencies — it’s not exciting, but looking at the Swiss franc or the Japanese yen could help.

- International equities — you want to find strong international stocks that aren’t solely reliant on U.S. business.

- International bonds — bonds outside the U.S. could provide strong income and protection. The bank rates aren’t as high, but the exposure to U.S. debt default is minimal.

Additionally, there are stocks on the U.S. market you want to avoid. These are sectors that rely heavily on revenues from government funding. There are two sectors to pay close attention to:

- Health care.

- Aerospace/defense.

Bottom line: While history suggests lawmakers in Washington will find a solution and keep us away from a debt-ceiling disaster, diversification never hurts as this won’t be the last time we’ll face a situation like this.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets