We think of $5 stocks as new companies — but that’s not always the case.

Companies can start trading at any price. Alphabet Inc. (Nasdaq: GOOGL) first traded at $100 in August 2004 and is just one of the great stocks that never traded below $5.

Tesla Inc. (Nasdaq: TSLA) is another example. The stock never traded below $14.98, which occurred in July 2010. (This won’t be reflected in a typical TSLA stock chart today since they don’t account for stock splits or other corporate actions.)

That might sound trivial, but it creates misunderstandings. Without accurate data, how is anyone supposed to be objective in their stock analysis?

Adam O’Dell understands and avoided this problem when he researched stocks that traded below $5 per share. Adam was searching for what made some of these smaller stocks the biggest winners. Including stocks that never actually traded below $5 in his research would have skewed the data.

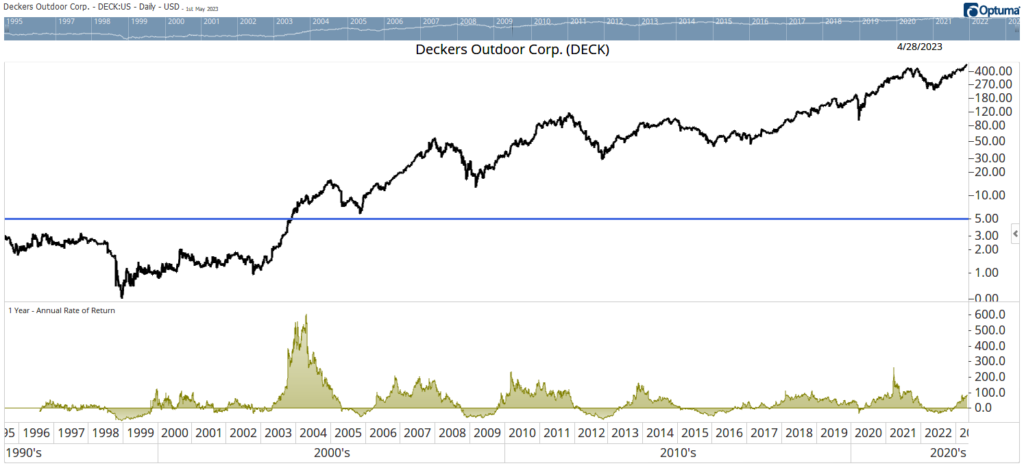

You can see why analysts may ignore this problem in the chart of Deckers Outdoor Corp. (NYSE: DECK) below.

How DECK Went From $5 to $477

This chart I have today is not as pretty as analysts like to see. It uses a log scale, which tend to smooth out more volatile and heavy swings, to account for the large price gains over time. It also unsplits shares to show where trades were actually made.

Deckers makes UGG, Teva and other casual shoes — and it’s one of the greatest stock stories in history.

DECK Crossing $5 Triggered a Massive Price Spike

It’s averaged returns of 16.5% a year since it began trading in 1993. This shoemaker turned every $1,000 invested when it started trading into more than $61,000, almost quadrupling the $15,400 in returns for the SPDR S&P 500 ETF (NYSE: SPY) over that time. DECK is now trading for more than $475.

As a company, the secret to Deckers’ success is its products. People like the shoes the company makes.

That contributes to DECK’s success. But the stock really benefited from its move above the $5 threshold.

You can see DECK’s one-year return at the bottom of the chart. The annual return peaked at 588% about six months after the stock crossed the $5 mark in 2003.

I’ve highlighted that pattern with Monster Beverage Corp. (Nasdaq: MNST) before. There is often a sharp acceleration in an uptrend when a stock moves above $5.

The reason for that is simple to understand: Large Wall Street firms are finally buying shares after sitting on the sidelines and waiting patiently.

And that’s exactly what happened with DECK.

By 2003, everyone knew what UGGs were — and institutional analysts saw the potential.

It’s natural for analysts to look up companies that make popular products. They saw the financials were strong, but they also couldn’t buy it yet. As Adam has mentioned, Wall Street generally avoids buying shares trading below $5 due to arbitrary rules and the headache of extra paperwork.

So DECK went on a watchlist. As it neared $5, analysts started telling their largest clients to get ready to buy. Some placed orders to buy as soon as it crossed $5. Others waited to be sure it wouldn’t drop back below $5 and force a sale.

The results of all this talking, watching and waiting are in the chart. DECK soared once it hit $5. It’s now trading 9,400% higher 20 years later!

And we don’t have to wait to buy into a similar opportunity like Wall Street does. As individuals, we can buy at any price. And Adam has been analyzing a large swath of small-cap stocks with potential to be the next DECK or MNST.

His small handful of highest-conviction recommendations are trading below that $5 line right now — but he doesn’t expect that to be the case for long. He believes these stocks have the potential to gain 500% over the next year.

For more details on his $5 stocks, click here.

Until next time,

Mike Carr

Senior Technical Analyst