It was a pretty good weekend.

It wasn’t too bad, aside from turning the heater on for the first time in six years and having smoke billow out of the vents.

I cleaned the house after our dust-burning debacle, hung out with the family and watched the Kansas City Chiefs eke out a win against the Buffalo Bills.

But, oh, what a difference a day can make.

Late last week, China’s DeepSeek released an upgrade to its AI reasoning model that performed in line with OpenAI’s ChatGPT in third-party tests. In some cases, it even outperformed!

According to DeepSeek, its language model only cost about $6 million to develop — far less than some of its American competitors.

That slammed the proverbial brakes on the strong market run to start 2025.

The S&P 500 closed down 1.5% on Monday, while the Nasdaq fared worse, falling nearly 3%. Stocks recovered slightly on Tuesday, but volatility is still high.

The sell-off was concentrated in piping-hot AI-related stocks, with the biggest “Magnificent Seven” tech stocks losing more than $1 trillion of their combined market cap by Monday’s close.

But what if I told you there was more (way more) to it than that?

Strap in…

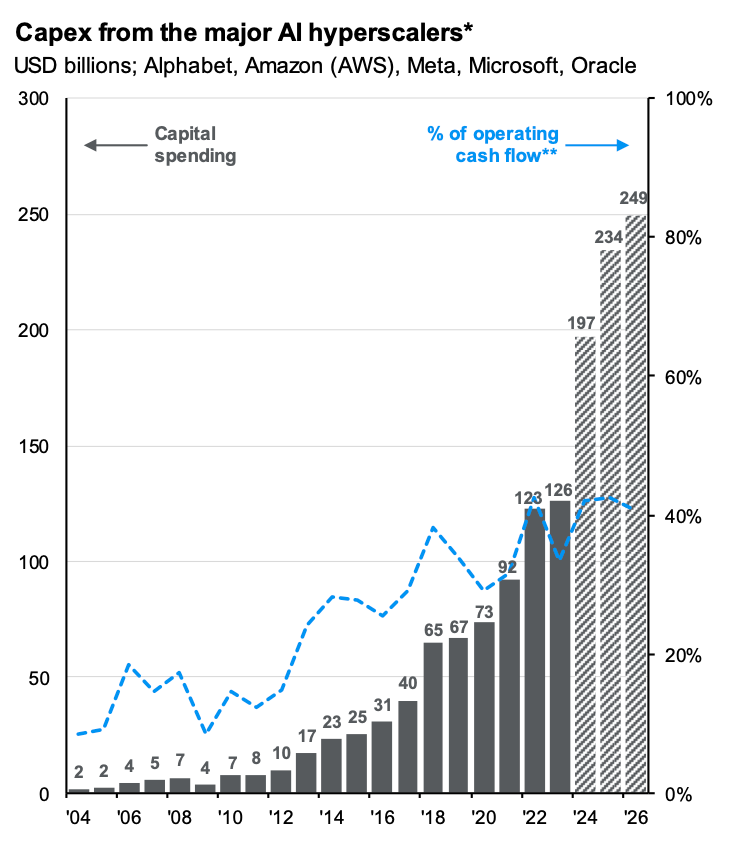

Chart of the Week: AI Spending

All of these AI-related stocks were in a tailspin because Wall Street and its crystal ball projected massive spending on AI infrastructure.

Heck, even President Donald Trump announced $500 billion in private sector investment to build AI infrastructure in the U.S.

So Wall Street has gone all-in on the prospect that company profits will shoot through the roof.

They weren’t wrong (kind of):

S&P Global projected that five AI hyperscalers — Microsoft Corp. (MSFT), Meta Platforms Inc. (META), Amazon.com Inc. (AMZN), Oracle Corp. (ORCL) and Alphabet Inc. (GOOGL) — will spend almost $500 billion in capital expenditures between this year and next.

That is based on the costs of developing, building and powering the AI infrastructure here in the U.S.

But this is where things get a little dicey…

Does DeepSeek Have an AI Edge?

DeepSeek’s AI model, which is apparently faster and cheaper than what companies like OpenAI offer, has raised many questions.

Not the least of which is why Big Tech dropped the equivalent of Greece’s GDP on AI in 2024.

It also calls into question the dominance the U.S. has projected in the realm of artificial intelligence.

Now, I know it’s China, but if they were able to build out AI faster and cheaper, it’s clear that America isn’t going to have a clear path to AI dominance.

The other problem — more market-related — is the fact that the S&P 500 and Nasdaq remain so heavily dependent on the AI stocks that drove them to new highs in the first place.

When NVDA is routed the way it was on Monday — shedding $590 billion from its market cap in one day — it impacts the entire market.

What we need is more diversity in market gains. Whether this comes from a particular sector like financials or a different class, say, small caps — the more diverse and broader the market gains are, the less likely we’ll see a repeat of Monday’s rout.

One day doesn’t make a trend, but we must keep a close eye on this. And that’s precisely what we’ll continue to do here in Money & Markets Daily.

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets