A few weeks ago, my wife declared:

“I want to go to our community pool every day to exercise.”

She followed that up by telling me it wouldn’t be hard. It only takes 20-some times before it becomes a habit.

I had to look that up because it didn’t seem plausible that doing something roughly 20 times would make it a habit.

It turns out that it doesn’t (although I am not going to tell my wife she was wrong).

Studies show it can take 30 to 60 repetitions for something to stick, which is likely why many of our New Year’s resolutions fail.

I bring this up because we all have habits, but none more prominent than our web browsing activity.

What platform we use, how we search and what websites we browse are now ingrained in our daily activities.

A recent court ruling threatens to throw those web habits out of whack. Today, I’ll break down that ruling and show you what Adam’s Green Zone Power Ratings system tells us about the stock largely impacted by the decision.

The Great Google Antitrust Case

On Monday, a district court judge ruled that Google, operated by Alphabet Inc. (Nasdaq: GOOGL), has an illegal monopoly on web searches.

This means that by controlling 90% of the online search market and 95% of the search market on smartphones, Google has eliminated any chance of competition.

Since 2015, Google has dominated the global search engine marketplace … and it’s never been close.

Its closest competitor is Microsoft Corp.’s Bing, which holds a paltry 3% of the total market.

Google has paid billions of dollars over the years to ensure its search engine is the default on smartphones and operating systems. If you’re a Mac user, you may use Safari, but the browser defaults to Google’s search.

Essentially, the judge concluded that Google had been forced on us.

And after establishing its early search engine dominance years ago, Google has raked in billions in ad revenue that it can use to force any competition out.

Now, we’re left wondering if any remedies would impact Google’s bottom line the way pundits and the media think it will.

The problem is that Google has become such a habit that even if you took away automatic access, we’d still go to Google to look something up. (We all know and use the tagline: “Just Google it”).

Over the years, Google has built up such a huge database for its search engine that any competitor will have to spend billions to match its search capability.

Plus, this case is going through the slog of the U.S. justice system (it was filed in 2020 and just received its first ruling, which Google will appeal), so it will take years before we reach any real conclusion.

No matter the outcome of this monopoly ruling, I don’t see Google losing its status as the king of search.

So, how does its stock look now?

Green Zone Journey: Alphabet Inc.

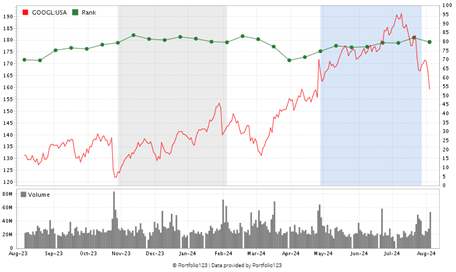

Alphabet Inc. (Nasdaq: GOOGL) currently rates a “Bullish” 80 out of 100 on Adam’s Green Zone Power Ratings system.

That “Bullish” rating means we expect the stock to outperform the broader market by 2X over the next 12 months.

The stock rates above 90 (considered “Strong Bullish”) on Momentum, Quality and Growth. It’s “Bearish” on Size and Value.

The ongoing push into tech stocks, thanks to AI, has kept Google’s rating on solid footing. Over the last 12 months, the stock has gained 22% — even accounting for the tech sell-off and Monday’s unfavorable court ruling.

And Adam’s system has flagged this as “Bullish” for a while now…

GOOGL Has Been “Bullish” For the Last 12 Months

The company still has stronger returns and margins than its industry average. Its one-year earnings-per-share growth rate is 27%.

These are reasons why the stock remains in “Bullish” territory on Adam’s system.

What it all means: The combination of the stock market sell-off and the judge’s monopoly ruling did push GOOGL lower to start the week.

Investor rotation into Big Tech — especially Magnificent 7 — stocks since 2022 has pushed already inflated valuations to sky-high levels… and investors started to cool their heels and sell off in July.

But the fact remains that we aren’t going to stop Googling.

From an investment perspective, Adam’s Green Zone Power Ratings system says GOOGL is set to beat the broader market handily from here.

Until next time…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets