If you’re interested in energy stocks, you’ve probably checked out Diamondback Energy (Nasdaq: FANG). Let’s see how Diamondback stock rates.

Here’s a quick overview of the company and its recent financial results.

Spoiler alert: Things are looking pretty good for Diamondback right now. Strong oil prices mean the company is on track to have a banner year in 2022.

Read on for more details.

How Diamondback Energy Got Started

Diamondback Energy started back in 2007 with a focus on crude oil development.

Over the years, it has become a top player across multiple business lines including oil and natural gas production activities in all major United States shale locations.

Perhaps most impressive of all is Diamondback’s support for renewable energy projects. It has played an integral role in turning shale basins into renewable resource hotspots.

What Diamondback Energy Does

Diamondback Energy is an oil and gas exploration, production and development company that provides energy solutions across the nation.

Focused on finding oil and natural gas resources in key shale formations, Diamondback uses innovative technologies to explore, evaluate, develop and produce these resources safely and efficiently.

Diamondback has a regional focus on drilling activities in the Permian Basin of West Texas and New Mexico — one of the most prolific oil-producing locations in the U.S.

Diamondback Stock Power Ratings

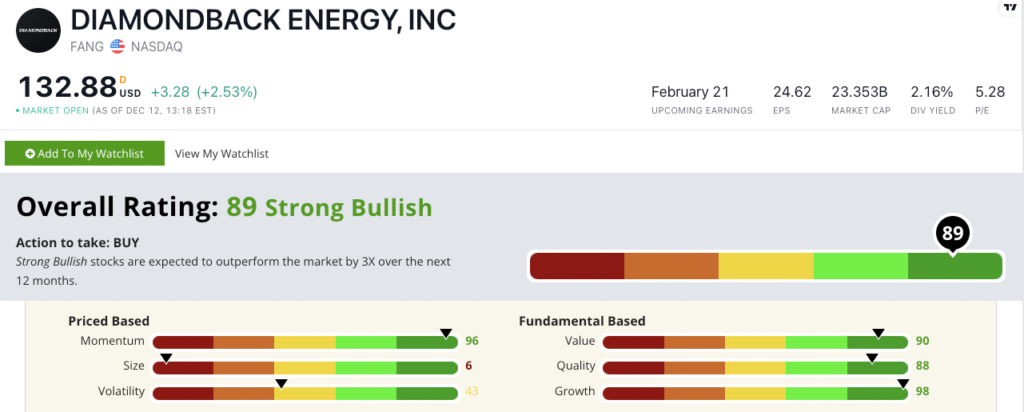

Overall, Diamondback Energy rates a “Strong Bullish” 89 out of 100 on our proprietary Stock Power Ratings system.

FANG is projected to outperform the broader market by 3X over the next 12 months.

FANG’s scores highest on our growth factor at 98.

The company’s one-year annual sales growth rate is 141.6% while its earnings-per-share growth rate is 143%.

Diamondback Energy is also a strong value stock. Its price-to (earnings, sales and book value) ratios are all in line with the fossil fuel exploration industry averages.

On our quality factor, Diamondback Energy earns an 88.

This is thanks to positive returns on assets, equity and investment.

Its gross margin is 83.7% compared to the industry average of 67.5% — telling us the company knows how to turn a profit.

The Outlook for Diamondback Stock

Diamondback Energy is formulating plans and strategies that will enable the company to remain competitive while striving for success.

Diamondback Energy is actively investing in new technologies, offering innovative solutions that are catered toward the future of energy production.

The company is also leveraging cutting-edge engineering advancements to further develop its drilling capabilities and increase returns on investments.

Diamondback Energy’s aspirations prioritize sustainability as well as profits; the organization understands that both goals must be achieved in tandem. Diamondback Energy has its sights set on fulfilling these fundamental objectives to provide customers with quality products while contributing positively to the environment.

We’ll see if that translates into more gains for Diamondback stock in the future.

Do you own FANG stock? Email StockPower@MoneyandMarkets.com and let us know how its worked out for you.

P.S. Adam O’Dell is watching the oil market closely. He sees a “Super Bull” forming in the coming months.

And when it hits, he expects this No. 1 stock to soar 100% higher in just 100 days. Click here to sign up for his upcoming presentation.