Tesla Inc. (Nasdaq: TSLA) is a technology company that creates electric vehicles and energy storage products. But how does Tesla stock rate?

Tesla’s mission is to accelerate the world’s transition to sustainable energy.

The company was founded in 2003 by a group of engineers who wanted to prove that electric cars could be better than gasoline-powered cars.

Today, Tesla makes some of the most popular and technologically advanced electric vehicles on the market.

Tesla’s stock is one of the most closely watched on Wall Street, and the company continues to innovate with new products and services.

Tesla’s Clean Energy Efforts

Tesla has become a household name in recent years, and there’s good reason for it. It’s an American electric vehicle (EV) and clean energy company that has since become one of the world’s most recognizable brands within the clean energy space.

Tesla’s lineup of electric cars are some of the most popular on the market — everything from their luxury Model S sedan, to the more affordable 3 and Y models.

Tesla has also taken strides to make clean energy more accessible by revolutionizing solar panel technology and introducing innovative renewable energy products.

Tesla’s Sustainable Energy Mission

Tesla has made several groundbreaking innovations in its line of EV, solar roof tiles and even battery storage solutions.

This is all part of its mission to accelerate the world’s transition to clean and renewable sources of energy.

Tesla believes that using scalable, sustainable technologies is the key to making a positive impact on the environment and ensuring a brighter future for generations to come.

Tesla Produces More Than Just Cars

Tesla is widely known for its innovative lineup of electric cars, but it produces a lot more than just cars.

It manufactures solar roofs, batteries and other energy products designed to reduce the world’s dependence on fossil fuels and create a more sustainable future.

Tesla also has its own recharging infrastructure that makes it easier to charge up EVs.

Tesla Stock: Overvalued or Good Investment?

Tesla stock is a hot topic right now, with some experts believing it is overvalued while others think it is a great investment.

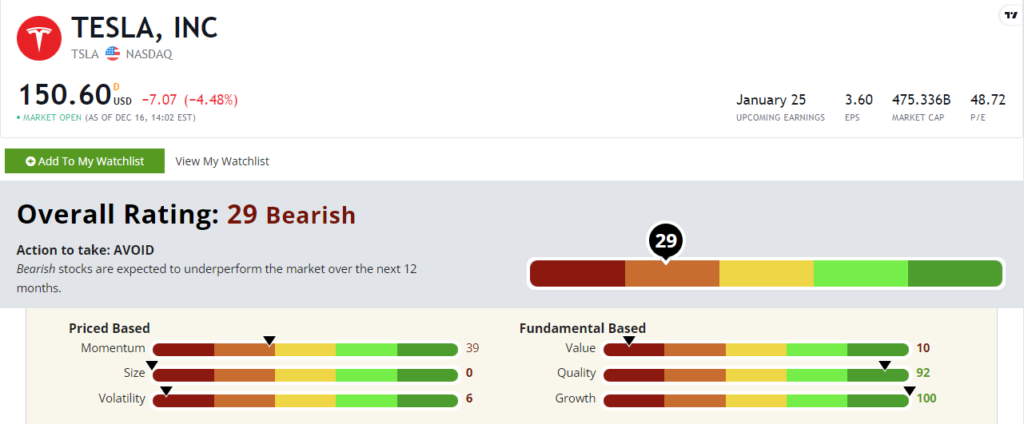

TSLA scores a 29 out of 100 on our proprietary Stock Power Ratings system.

That means we are “Bearish” on the stock and expect it to underperform the market over the next 12 months.

While it sports strong ratings in our quality and growth factors, its other factor scores drag Tesla stock down.

It’s a massive company with a market cap of $471 billion as of this report. That earns it a zero on the size factor. Don’t expect a bump like you may see with smaller stocks.

But its value is probably what’s most talked about.

It scores a 10 on our value factor. Tesla’s price-to-earnings ratio is sitting at 48.7, while its industry peers average 13.6. Its other price-to ratios are higher than its peers as well.

Bottom line: Tesla is an American EV and clean energy company that has seen a lot of success since it was founded in 2003. The company’s mission is to “accelerate the world’s transition to sustainable energy” by producing EVs, solar roofs, batteries and more.

But its stock is set to underperform the overall market for at least the next year, according to Stock Power Ratings.