From my home in South Florida, two gas stations are within walking distance.

Another five are minutes away, and they’re building two more nearby.

Whether you need to fill up your tank or buy a quick drink, convenience stores are the place to go:

This chart shows the annual revenue of gas stations in the U.S.

From 2020 to 2024, the industry’s revenue will increase 20.9% — with a majority of those sales coming from gasoline.

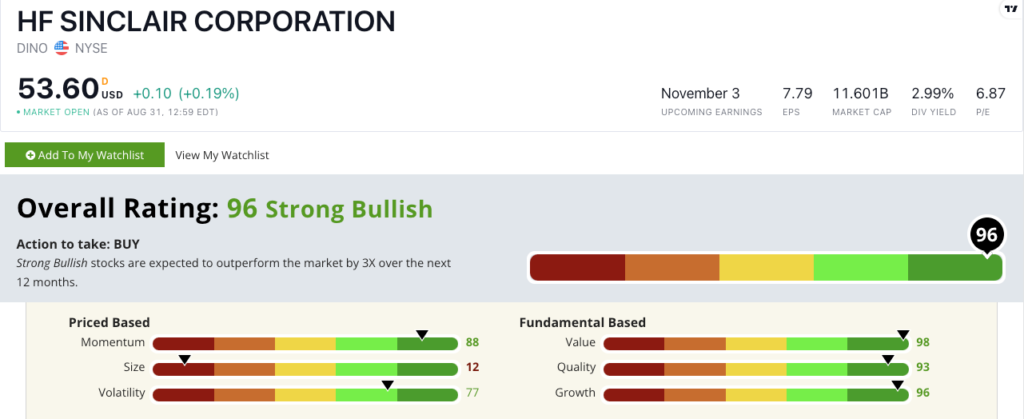

Today’s Power Stock is an $11.6 billion company that makes and sells gasoline, jet fuel, oil and renewable diesel to gas stations across the U.S.: HF Sinclair Corp. (NYSE: DINO).

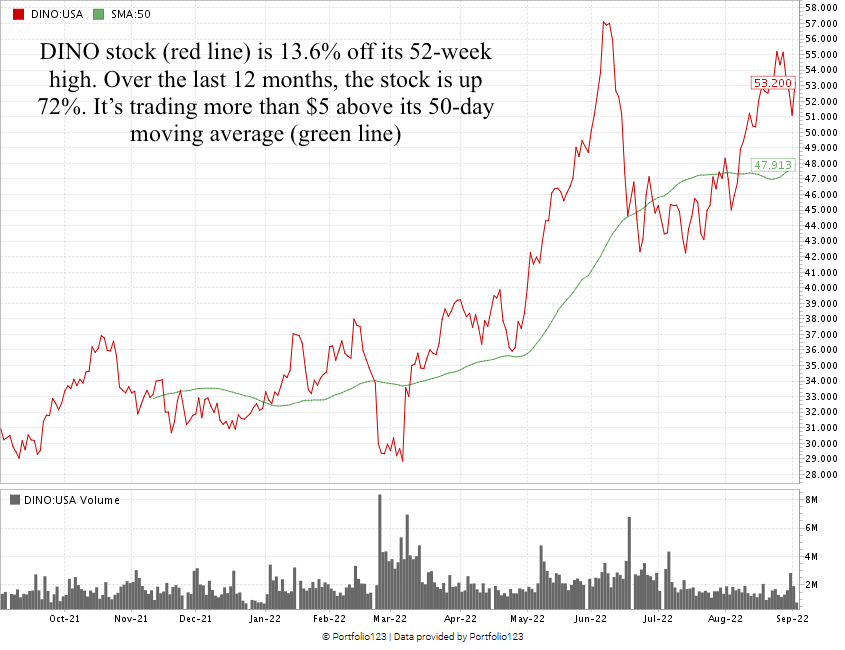

DINO Stock Power Ratings in September 2022.

HF Sinclair supplies fuel to more than 1,300 branded gas stations. It also sells oil and other lubricants across more than 80 countries.

Fun fact: HF Sinclair gets its ticker from its logo — a brontosaurus.

DINO scores a “Strong Bullish” 96 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

DINO Stock: Top-Notch Fundamentals + Solid Momentum

HF Sinclair just reported a monster second quarter.

High points include:

- Net income of $1.2 billion — a 623.1% increase over the same quarter a year ago.

- The company started production of renewable diesel at its New Mexico refinery.

That massive increase in quarterly income shows why DINO scores a “Strong Bullish” 96 on growth in our Stock Power Ratings system.

It’s also a strong value stock, rating a 98 on the metric.

The company’s price-to-earnings ratio is a reasonable 6.9. The downstream energy industry average, for comparison, is 8.7.

DINO’s price-to-book value is almost half its competitors’. This tells us the stock is a bargain compared to its peers.

Over the last 12 months, DINO stock is up 72%.

From a July 2022 low to the end of August, the stock ran up 26.3%.

It’s poised for another run at its 52-week high.

HF Sinclair Corp. stock scores a 96 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Gas stations seem to pop up on every corner. The convenience — and the demand for gas — make DINO a strong contender for your portfolio.

Bonus: The company’s 3% forward dividend yield pays $1.60 per share, per year just to hold the stock.

Stay Tuned: Top Fast-Food Hot Dog Chain

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify.

Stay tuned for the next issue, where I’ll share all the details on an excellent American fast-food restaurant with roots in Brooklyn, New York.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.