I went to my friend Mark’s house to relax and hang out by his pool last weekend.

He was firing up his grill when I noticed something was missing.

He had brisket burgers (which smelled fantastic sizzling on the grill), but no hot dogs.

“I forgot to get them,” he told me.

After five seconds of sheer astonishment, I jumped in my Jeep, drove to the nearest grocery store and bought hot dogs and buns.

No outdoor grilling experience is complete without both hamburgers and hot dogs.

This chart shows the size of the global hot dog and sausage market from 2019 to 2025.

Over that time, the value will increase 27.2%.

Today’s Power Stock is a household name in the hot dog business: Nathan’s Famous Inc. (Nasdaq: NATH).

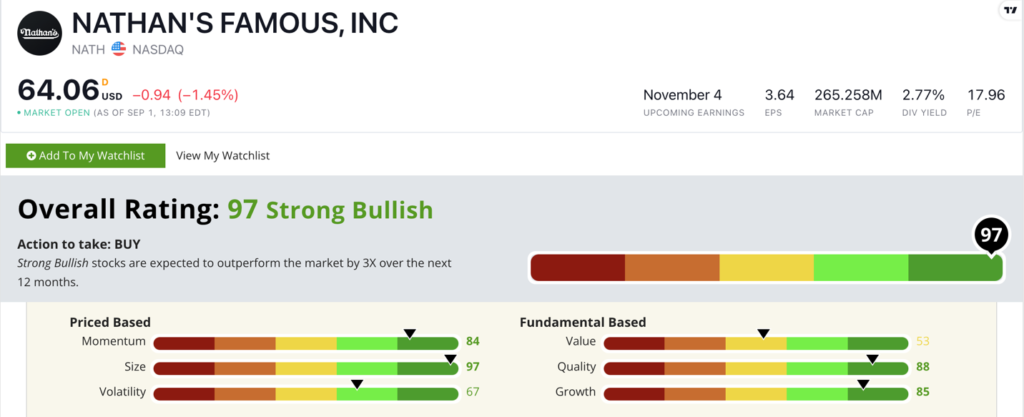

NATH Stock Power Ratings in September 2022.

In addition to hosting its international hot-dog-eating contest every July 4, Nathan’s operates branded fast-food restaurants that showcase its world-famous all-beef hot dogs.

Nathan’s Famous stock scores a “Strong Bullish” 97 out of 100 on our Stock Power Ratings system, and we expect it to beat the broader market by 3X in the next 12 months.

NATH Stock: Ideal Small Size + Solid Quality

Here’s what stood out to me from Nathan’s Famous’ most recent earnings report:

- Revenue of $39.7 million is a 26.8% increase over the same time a year ago!

- Sales from its hot dogs increased $7.1 million compared to the same quarter last year.

With a market cap (share price times number of shares) of $264 million, NATH is a microcap stock. (Small-cap stocks are anywhere from $300 million to $2 billion.)

Nathan’s stock scores a 97 on our size factor.

If we’re considering stocks with similar ratings on the other five factors, we generally prefer smaller stocks because they outperform their larger counterparts.

Nathan’s is also a high-quality stock, rating an 88 on that metric.

Its operating margin is an impressive 25.1%. Its industry peers, on the other hand, average under 1%.

Nathan's return on investment is 27.4%, while its peers’ average is a modest 1.7%.

After broader market headwinds pushed NATH to a 52-week low in May, the stock took off.

It climbed 44% to its 52-week high in August.

The stock is now just 4.9% off that high, and I’m convinced it will get there and keep going.

Nathan’s Famous Inc. stock scores a 97 overall on our proprietary Stock Power Ratings system.

That means we’re “Strong Bullish” and expect it to beat the broader market by at least three times in the next 12 months.

Going to the ballpark or grilling in the backyard isn’t complete without a hot dog.

With an expanding market and a household name, NATH is an excellent stock for your portfolio.

Bonus: The company’s forward dividend yield of 2.8% means it will pay you $1.80 per share, per year just to own the stock.

Stay Tuned: Excellent MLP Stock

Remember: We publish Stock Power Daily five days a week to give you access to the top companies that our proprietary Stock Power Ratings identify!

Stay tuned for the next issue, where I’ll share all the details on a top master limited partnership.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

P.S. Love Stock Power Daily? Don’t forget to check out The Stock Power Podcast, where I dive deep into one of our “Strong Bullish” Power Stocks and tell you why you should consider it for your portfolio.

Best of all? This is a separate stock from the ones I share five days a week in Stock Power Daily!

Check out the podcast on our YouTube channel or your favorite podcast provider.