Since moving to Florida about five years ago, my wife has become a massive Disney fan.

She was already before, but being just two and a half hours away from Walt Disney World means I am packing up for regular trips to the land of the mouse.

The company itself has been in focus for some time here in the Sunshine State after going to blows with Florida Governor Ron DeSantis over various issues.

Politics aside, Disney made headlines last week when CEO Bob Iger suggested the possibility of selling off the company’s television assets as they may not be aligned with the Disney business model.

Of note, Disney owns television networks ABC and sports powerhouse ESPN.

Additionally, Iger said Disney will slow down the production of television series and movies for its Marvel and Star Wars franchises.

As a big Star Wars nerd, that kind of hit me in the feels.

All of this is an effort to pare back $5.5 billion in costs.

Today, I’ll focus on these suggested cuts, what it means for Disney and use Adam O’Dell’s proprietary Green Zone Power Ratings system to tell you if The Walt Disney Co. (NYSE: DIS) is a good candidate for your portfolio.

Cord-Cutting Continues to Increase

Full disclosure: I cut the cord (aka stopped subscribing to cable television) more than a year ago.

It’s been one of the best decisions I ever made.

Yes, the cost savings is one thing, but I found traditional television boring. I want to watch what I want to watch when I want to watch it.

In 2014, Insider Intelligence reported 100.5 million households in America had cable in their homes. By 2027, that number is expected to be trimmed by more than half.

More Americans are moving away from cable to streaming platforms such as Netflix, Disney+ and Hulu.

So maybe Disney dumping cable television holdings like ABC and ESPN isn’t a bad idea.

Disney Stock Rating

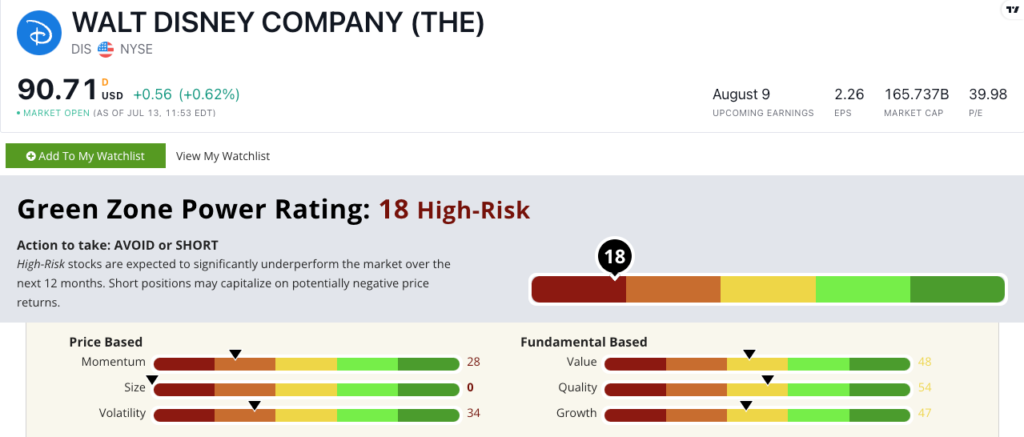

DIS rates 18 out of 100 on Green Zone Power Ratings. We view it as “High-Risk” and expect it to significantly underperform the broader market over the next 12 months. (If you’re looking for every stock that rates “High-Risk in Adam’s system, click here for information on how to access his weekly Blacklist now.)

The stock is neutral across the board on our fundamental factors (Value, Quality and Growth). That means its price-to ratios, returns and sales growth are on par with the media and publishing industry.

Where the stock really gets hit is on our price-based factors (Momentum, Size and Volatility).

From its August 2022 high, DIS has fallen around 27%, earning it a 28 on Momentum. And that drop in share price has come with a good bit of Volatility (34).

The current market cap of DIS is $165.2 billion … making it a massive stock (with a 0 rating on Size). Our research shows that stocks of larger companies tend to lag the returns of equally rated smaller ones.

Bottom line: While the idea of trimming off ABC and ESPN makes a lot of sense, Disney stock has struggled.

Right now, our Green Zone Power Ratings system tells us those struggles have translated into DIS being a stock you should avoid.

Side note: I think scaling back Star Wars content is dumb. There … I said it.

Stay Tuned: What’s Next for the Nasdaq

Tomorrow, Adam is going to walk through the slated changes coming for the Nasdaq and what that means for you as an investor.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets