Some attribute the following quote to Albert Einstein:

”Compound interest was the eighth wonder of the world.”

No one can pinpoint the place or time he said it, and the first report of the quote came in a New York Times blurb nearly 30 years after his death.

Still, I like to imagine the world’s greatest physicist sitting at some dive bar in New York with a massive beer mug in front of him, explaining the virtues of compound interest in his thick German accent to the confused shmuck sitting next to him.

At any rate, you may already have a good idea about how compound interest works. Here’s a quick rundown before we jump into something even better: dividend compounding.

Compound Interest Explained

Compound interest is exactly what it sounds like: interest earned on interest you already earned.

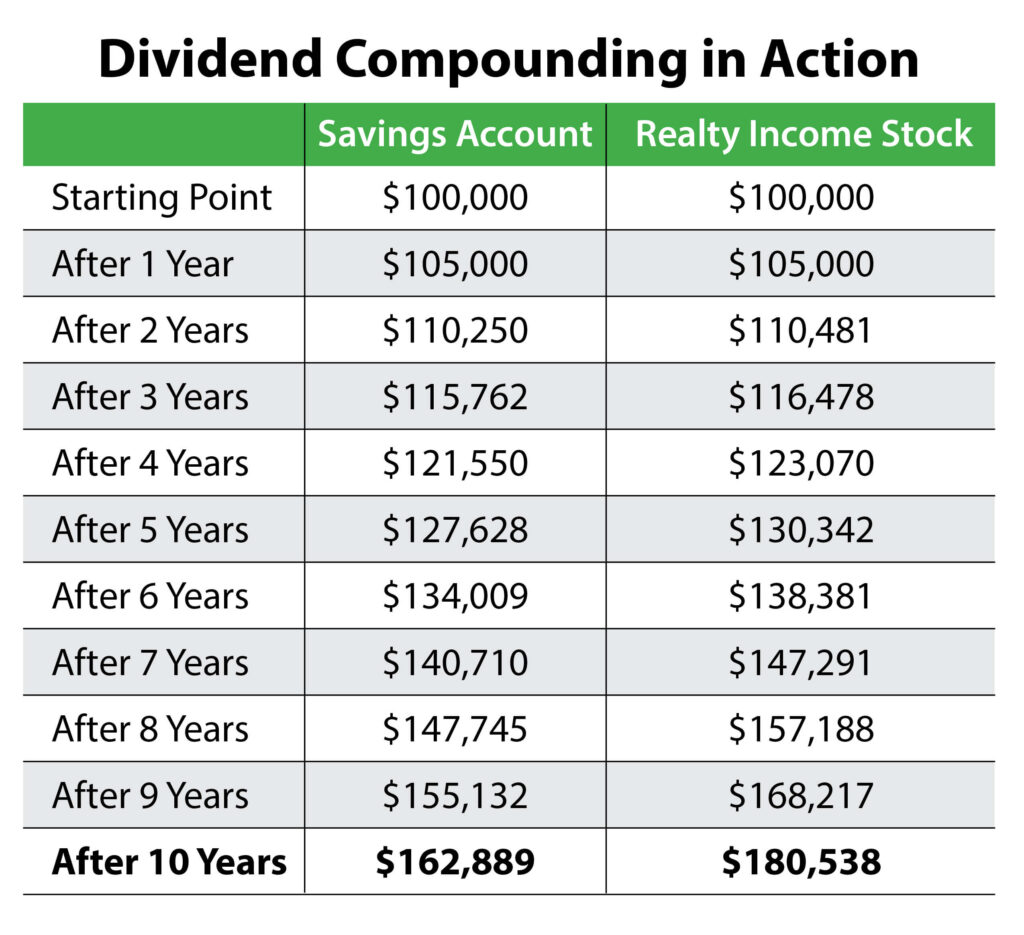

Let’s say you have a savings account that accrues 5% interest per year. You deposit $100,000. A year later, you have $105,000.

You made $5,000.

Well, by the end of year two, you don’t have $110,000. Instead, you have $110,250, thanks to the earned interest on that $5,000 in profit from year one.

You made $5,250 in year two.

Your interest also collects interest, which then collects even more interest. It snowballs (aka compounds).

If the story stopped here, it would be a good one! But with dividends, it gets even better due to dividend growth.

How Dividend Compounding Sends Gains Into Overdrive

We’ll use one of my all-time favorite dividend compounders, best-in-class retail landlord Realty Income (NYSE: O).

At current prices, Realty Income yields close to 5%. For our modeling purposes here, we’ll assume a dividend yield of exactly 5%.

Realty Income has grown its dividend at a compound annual rate of 4.4% on average since 1994. To keep this exercise simple, we’ll assume that the dividend grows at a constant 4.4% every year and that all dividends are reinvested in new shares.

We’ll start with exactly $100,000 in Realty Income stock, which creates some fractional shares, and assume that all dividend hikes happen at the end of the year.

It’s a model — don’t sweat the details!

Here’s where it gets fun.

At the end of the first year in this model, you’d have the same $5,000.

But at the end of year two, the dividend growth starts to kick in, and you’d have $5,481 in income versus $5,250 in the savings account.

By year 10, you’re pulling in more than $12,000 in annual income versus $7,756 in the savings account example!

You can see that dividend compounding in action in the table below.

That’s the power of dividend growth and compounding.

Keep in mind, this was a simplistic model. The real world will always look a little different.

Stock prices fluctuate, and this will have an impact on the number of shares you’re able to buy when you reinvest the dividends. Realty Income also pays its dividends monthly, not annually, meaning the compounding effect is even better.

But the takeaway is clear.

If you want to turbocharge your income stream over the long haul, reinvesting the dividends of a serial dividend-raiser and allowing compounding to work its magic is the way to go.

It is the eighth wonder of the world, whether Einstein said it or not!

Note: I have everything you need to start up — or bolster — your income portfolio now. Time to put dividend compounding into action!

We’ve expanded our scope in Green Zone Fortunes, and we now offer an entire income model portfolio. You can see what some of my absolute favorite dividend-paying stocks are and add them to your portfolio right now.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.