Inflation has been running at four-decade highs for months now.

At first, it felt like a novelty.

You might’ve said: “Gee, it’s been a while since I’ve seen real inflation!”

But after months with no clear end in sight, it gets uncomfortable quick.

If you’re at or near retirement, this is even more true.

Price hikes are never easy to take, but you can absorb the majority of them in your prime working years. You get raises or cost of living increases that keep up with inflation.

But when you’re retired and living on a fixed income, you can’t depend on a promotion to stay ahead.

That’s why dividend growth is more important than raw yield.

With precious few exceptions, stocks with higher yields come with lower growth rates. That means that the solid payout you see today will lose value with each passing year.

But stocks with long histories of raising their dividends well above the rate of inflation make you richer with each passing year.

Dig Into a Growth Dividend ETF

For a one-stop shop, you could try a broad exchange-traded fund (ETF) like the Vanguard Dividend Appreciation Index Fund ETF (NYSE: VIG). VIG is a collection of stocks that have raised their dividends for at least 10 consecutive years.

But I like to dig deeper.

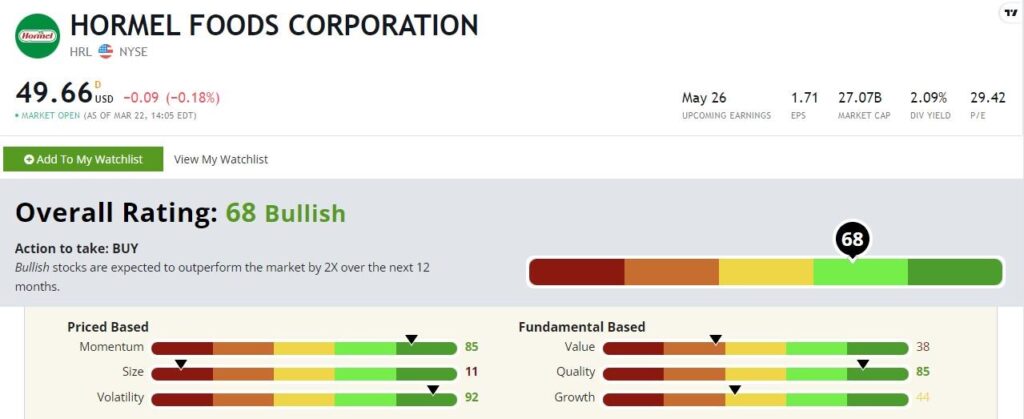

I ran VIG’s holdings though our Green Zone Ratings system to find a dividend workhorse I believe is better equipped to stay ahead of inflation: the packed foods giant Hormel Foods Corp. (NYSE: HRL).

Hormel faces inflationary pressure like anyone else, as it depends on volatile commodities for its inputs. But the company also has experience in keeping its costs under control by passing those costs onto shoppers.

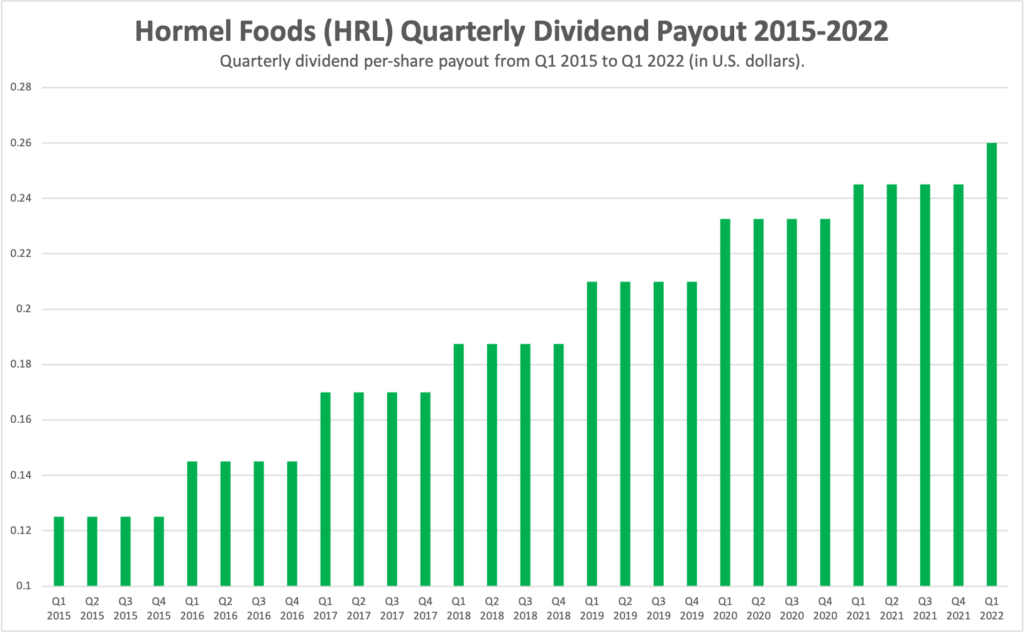

At 2%, Hormel’s dividend isn’t the highest yield on the market. But the company has also raised that dividend by 108% over the past seven years!

Hormel’s Green Zone Rating

Hormel rates a “Bullish” 68 on our Green Zone Ratings model, which means it’s poised to double the market’s return over the next 12 months.

Let’s get into the details.

Volatility — It’s been a volatile year. Between the Fed’s planned interest rate hikes and the Russian invasion of Ukraine, we’ve seen the highest volatility in years. So it’s nice to have a no-drama stock like Hormel in the mix. Hormel rates a 92 on our volatility factor, meaning it’s less volatile than all but 8% of the stocks in our universe.

Quality — Remember when I said that Hormel has a history of passing on cost increases? That is the result of strong branding, which ties into the stock’s impressive quality rating of 85. Profitability drives this rating, and strong branding is key here. Its brands include household names like Applegate, Skippy, Planters and even the original Spam!

Momentum — Investors want quality stocks right now, and that’s evident in Hormel’s high momentum rating of 85. While I wouldn’t expect Hormel to be a high-momentum stock forever, this outperformance has several more months to run.

Growth — Hormel is a mature company with mature brands. Still, it rates a 44 on growth, which is right around average for the stocks we rate.

Value — HRL isn’t as cheap as it could be with a value factor rating of 38. That’s normal for low-volatility, high-quality companies. Investors are OK with paying up for solid stocks.

Size — Hormel is one of the largest branded food companies in the world, with a market cap of $27 billion. That’s why it rates an 11 on size. That’s OK. While a low size score hurts the company’s overall rating, it gives us a degree of stability we’re not getting in a smaller company.

Bottom line: HRL isn’t going to make you rich quick. But its “Bullish” rating within our system means we should see some nice returns over the next year.

On top of that, I expect Hormel will help anyone stay ahead of inflation in retirement.

To safe profits,

Charles Sizemore, Co-Editor, Green Zone Fortunes

Charles Sizemore is the co-editor of Green Zone Fortunes and specializes in income and retirement topics. He is also a frequent guest on CNBC, Bloomberg and Fox Business.