I’m admittedly a bit of a science geek. I’m glued to my phone for the latest details on the Artemis launch, I know the names of most muscles and bones, and I have memorized way too many strange facts about strange animals.

A scientifically minded approach has served me well in investing. And it’s not just in the obvious ways, through rigorous research and attention to hard numbers. The “softer” sciences of psychology and sociology also have a lot to teach us about investor behavior — and why some people make costly mistakes.

I recently read about a study conducted by Johns Hopkins researchers on the power of ignoring things. In a series of experiments, they had subjects scroll through a block of text looking for specific letters. One group was just given a target letter without context, and the other was given explicit instructions to ignore a certain color in their search — as in, “look for the R, but it won’t be red.”

The findings are fascinating, but unsurprising when you think about it. At first, the additional information slowed participants down — akin to someone saying “Don’t think of a pink elephant” yet the very statement itself causes a pink elephant to pop into your head. But eventually, once their brains got used to the exercise, the subjects were faster and more accurate in their search when they knew what to ignore.

There’s a certain elegance to scientific studies like this — particularly in 2022, when we are all struggling to tune out the noise and to ignore the distractions of this market.

There’s no better way to provide for the comfortable retirement you deserve than a long-term, income-oriented approach — period. We all know this. We simply need to remember it — to ignore the volatility and never-ending market punditry, and to just stick with it.

Easier said than done, I know. But believe it or not, there are still plenty of opportunities out there to build on this strategy and add new positions to your portfolio. All you have to do is ignore the noise, and look at the facts and you’ll agree.

As a case study, let me give you a prime example — via my latest pick, drugstore giant Walgreens Boots Alliance, Inc. (Nasdaq: WBA).

Walgreens is a 5.8% MVP

I’ve written in the past about my MVP strategy — that is, a focus on Management, Valuation and Payouts. The idea is that a company with these three traits can thrive in any market environment, and provide long-term total returns that outperform the broader stock market.

Walgreens Boots has these three topics covered, and then some.

Let’s start with management.

Walgreens is in the middle of a multiyear strategic initiative to emphasize higher operating margins, customer loyalty and other key operational metrics. And it’s paying off big-time, with digitization initiatives driving higher revenue and organic growth outside of brick-and-mortar operations. On top of that, at the end of its fiscal year in August, WBA announced that it had surpassed $2 billion in annual cost savings a full year ahead of its previously announced restructuring plans.

Beyond the current financial metrics, Walgreens Boots Alliance also is building a great long-term strategic partner with health clinic operator VillageMD. As of the middle of this year, WBA operates more than 120 health clinics with this partner, with a goal of opening 1,000 clinics in over 30 U.S. markets over the next five years to provide continued growth beyond its core drug store biz.

All that adds up to a great corporate strategy. Now, let’s look at valuation.

WBA stock is valued at just under $29 billion, with a forecast of $134 billion in revenue next fiscal year — giving it a rock-bottom valuation where it trades at roughly 20% of sales. By contrast, its closest peer CVS Health Corp (NYSE: CVS) trades for about 40% of sales and staples retailers like Target Corporation (NYSE: TGT) and Walmart Inc. (NYSE: WMT) trade at about 65% of sales.

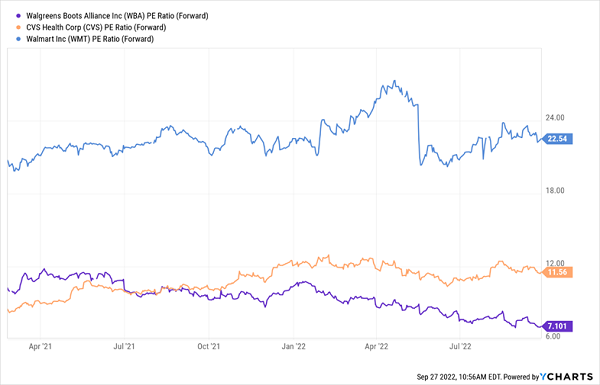

Walgreens also trades at a significant discount to future profits, with a forward price-to-earnings ratio of 7.1 while CVS trades at 11.6 times earnings and WMT is in the 20s even after recent declines.

However you slice it, WBA is the cheapest — or the most fairly valued, depending on your point of view.

Now let’s look to our last category on the checklist: dividend payouts.

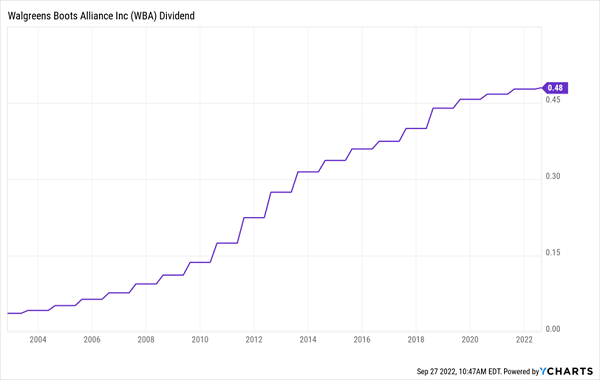

On top of a tremendous current yield of 5.8%, Walgreens has been paying dividend for almost nine straight decades — including increasing its payout in each of the past 47 years to make it one of Wall Street’s vaunted Dividend Aristocrats.

The icing on the cake: Prescription drugs and consumer staples tend to be more stable in their sales than discretionary expenses, and you have a perfect recipe for a stable dividend stock that can deliver over the long haul.

Sure, times are tough right now. And yes, WBA stock is caught up in the volatility, too. But why ignore these positive factors, and instead focus on the latest empty headlines? Why overlook what’s important, simply because of what’s right in front of you?

To learn more about generating monthly dividends as high as 8%, click here.