A bit ago, my friend Jeff was in tremendous pain.

His physician informed him he had excess tissue enlarging his prostate gland.

Instead of the usual painful surgery followed by a long recovery, a surgeon performed an ablation.

It was a minimally invasive procedure that used low-energy radio frequencies to remove the excess tissue.

While Jeff feels 100% better, his story put me on track for the stock I’ll share today.

Using Chief Investment Strategist Adam O’Dell’s proprietary six-factor Stock Power Ratings system, I found a “Strong Bullish” medical technology stock that manufactures minimally invasive medical devices:

- Its recent quarterly revenue was 36.7% higher than a year ago.

- The stock jumped 32% since the middle of July.

- It’s 9% off its 52-week high.

And this medical technology stock will continue its strong performance in 2022 and beyond.

Here’s why.

Advanced Medical Technology Stock Leads Industry

Medical technology has advanced leaps and bounds from where it was a decade ago.

Virtual reality, artificial intelligence, genomics (aka DNA science) and other advancements are still in their infancy.

This industry is only going to grow from here:

The chart above shows the revenue generated from medical technology worldwide.

In 2014, the industry recorded $379.7 billion in revenue.

Medical data firm Evaluate expects that to grow more than 56% by 2024.

Bottom line: Continued advancements in medical technology will push the industry to new records in the coming years.

High Growth + Strong Momentum: EDAP TMS S.A.

Surgeons are always looking for ways to simplify procedures. They want to do them with as few incisions as possible.

EDAP TMS S.A. (Nasdaq: EDAP) is a French company that has developed these techniques since 1979.

It’s focused on developing devices for urological disorders (like kidney stone removal and prostate problems).

These devices ensure the most relief with the least amount of invasive surgery.

In 2020, EDAP’s total annual revenue was $40.9 million.

The company expects to gain 82.4% more in revenue by 2024.

Let’s look at how this medical technology stock has performed.

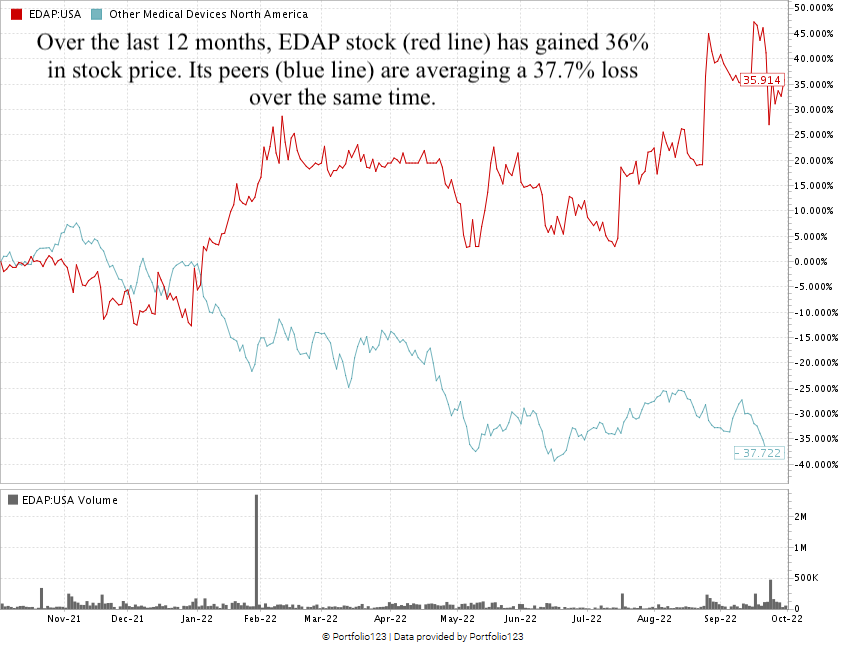

EDAP Trading 9% Off 52-Week High

Since the middle of July 2022, EDAP stock has jumped 32%.

EDAP continues to outperform its other industry peers — which are down over 12 months.

EDAP shows the “maximum momentum” we love to see in stocks.

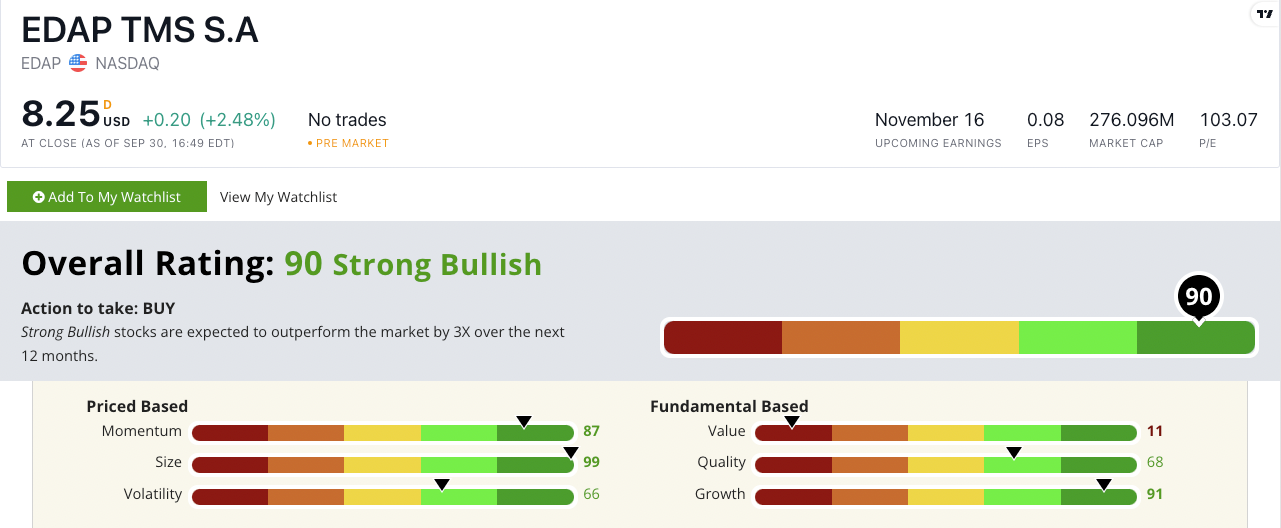

EDAP TMS’ Stock Power Ratings

Using Adam’s six-factor Stock Power Ratings system, EDAP TMS S.A. stock scores a 90 overall.

That means we’re “Strong Bullish” on the stock and expect it to beat the broader market by at least three times over the next 12 months.

EDAP’s Stock Power Ratings in October 2022.

EDAP rates in the green on five of our six factors:

- Size — With a market cap of $276.1 million, EDAP is the perfect size to produce even stronger gains. It scores a 99 on size.

- Growth — EDAP scores a 91 on growth, with a one-year earnings-per-share growth rate of 138.3% and a 20.7% growth in sales from its last quarter.

- Momentum — EDAP stock is up 32% since the middle of July and has weathered the recent stock market sell-off better than most. It scores an 87 on momentum.

- Quality — Returns on assets, equity and investment are all negative in the overall medical device industry. But EDAP boasts positive gains on all three metrics. It scores a 68 on quality.

- Volatility — EDAP’s recent climb has met little resistance. It scores a 66 on volatility.

EDAP’s nice run higher since July shows the “maximum momentum” we love to see in stocks.

But that has pushed its value rating down a bit to 11.

Bottom line: Every day, there are new advances in medical technology.

And the demand for more new technology will grow as we continue to find new and innovative ways to treat ailments.

This is why EDAP is a must-have for your portfolio.

While EDAP innovates on the medical devices side, Adam O’Dell, our chief investment strategist, is focused on the genomics mega trend.

And you can learn about his No. 1 stock to invest in this mega trend by watching his “Imperium” presentation.

Click here to do so now and find out why Adam’s highest convictions within medical innovation lie in genomics.

Safe trading,

Matt Clark, CMSA®

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He is a certified Capital Markets & Securities Analyst with the Corporate Finance Institute and a contributor to Seeking Alpha. Prior to joining Money & Markets, he was a journalist/editor for 25 years, covering college sports, business and politics.