I trust you’ve seen television ads for personal DNA tests, such as 23andMe or Ancestry.com.

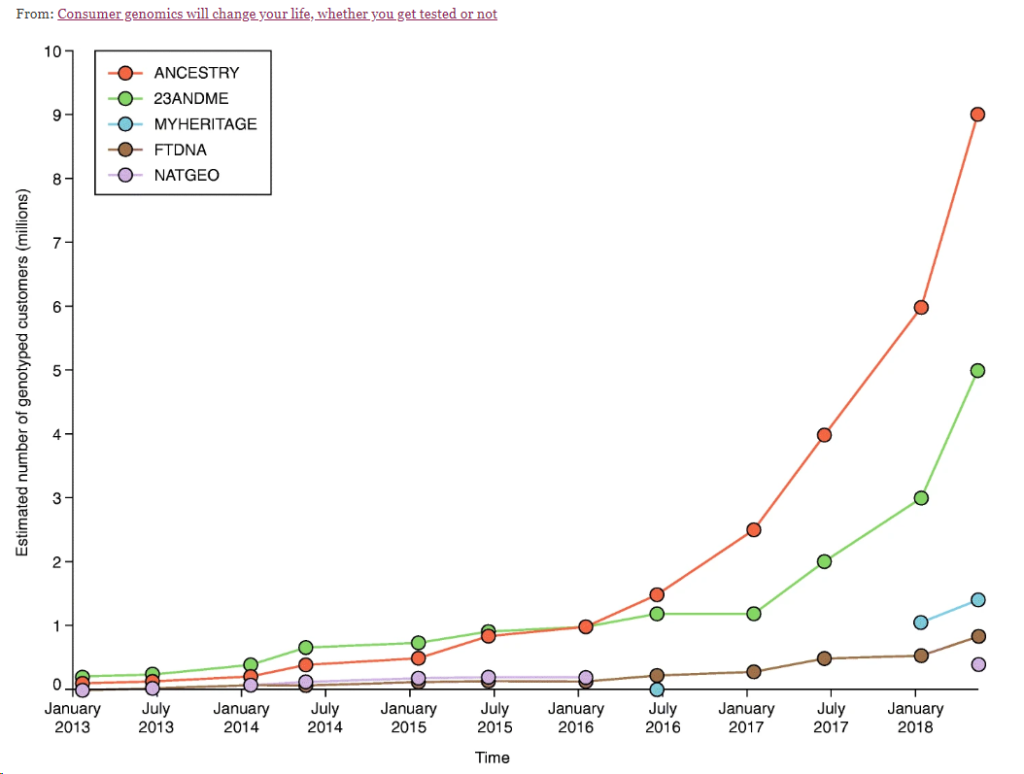

These have grown exponentially in recent years. Have a look…

In just three years, Ancestry went from 1 million customers to 10 million! Yet, the market for this type of testing isn’t nearly saturated. In fact, experts expect another 10-fold increase through 2021!

All told, the direct-to-consumer DNA testing market is already worth over $1 billion per year. And it’s expected to more than quadruple, to $4.6 billion, by 2025.

But as I see it, this isn’t where investors can make the biggest bucks when it comes to playing the massive DNA (aka “genomics”) trend.

In fact, the direct-to-consumer segment of the total genomics market is just a drop in the bucket of the broader global genomics market. Today, that market is worth nearly $19 billion a year, and it’s set to grow to $36 billion over the next four years.

As a former medical student, this industry fascinates me. And in my premium service, Green Zone Fortunes, I’ve identified one company that’s at the forefront of the genomics revolution and is set to rake in a massive share of those billions.

Growth Mirrors Semiconductors Over 20 Years

I’ll show you why in a moment.

First, though, realize that several factors drive this industry’s massive growth, including:

- Substantial increases in the number of government-funded genomics projects.

- A growing list of real and potential applications for genomics.

- Perhaps most important of all, the decreasing cost of DNA sequencing.

On that point, the decreased cost of DNA sequencing explains why the genomic revolution is NOW a “go!”

What cost $100 million in 2001 … $10 million in 2007 … $10,000 in 2011 … and just $1,000 last year … will cost only $100 by 2023! That’s a massive decline in cost over 20 years!

Tech-savvy readers may recognize the character of that rapid decline in price: It mirrors the declining cost of semiconductors over the last 30 or so years.

In short, the number of transistors manufacturers could fit on a silicon computer chip grew exponentially between 1980 and 2010.

And the cost of those silicon chips fell exponentially over those years. Together, these technology trends paved the way for the powerful computers we all carry around in our pockets today — our smartphones!

Well, get this…

In an interesting twist of fate, the silicon chip is set to once again become a massive technological game-changer … not in the semiconductor industry this time, but in biotech the sector.

Factory of the Future

The company I recommended to my Green Zone Fortunes readers back in May 2020 runs what it calls the “Factory of the Future.”

In short, this company manufactures specific DNA sequences — on silicon chips.

It’s a proprietary, groundbreaking technology I haven’t seen a single other company even mention! And it allows this company to pack 10,000 times more DNA into the same space as traditional techniques.

It can then ship those DNA sequences to research and development customers all over the world … who then use those DNA “chips” to discover and develop novel treatments for everything from heart disease to cancer to COVID-19. (More on that in my piece tomorrow.)

All told, this pioneering company offers the largest selection of high-quality synthetic DNA of anyone in the market.

And thanks to its leveraging of proprietary software, an advanced robotics-driven manufacturing process and stellar customer service (including a seamless e-commerce ordering system) — it has managed more than 140% annual increases in its customer base over the past four years.

It’s grown its revenues by an average of 188% per year over the last three years!

10X Growth Ahead

Now, I realize what you may be thinking: With growth rates that impressive, this company must be all over the news. Or, worse, its stock price is already too far gone to invest in it yourself.

Fortunately, though, this small company is still mostly flying under the radar! And I think its stock price could go as much as 10X higher over the next several years … as it grows from a little-known small-cap stock into a household name, mentioned in the same breath as large-cap biotech and pharmaceutical stocks such as Gilead and GlaxoSmithKline.

Get this…

When I first recommended my Green Zone Fortunes readers buy this stock back in May, the company was worth just $1.3 billion, and its stock traded for $40 a share.

Today, this company is worth $5.8 billion. And its shares sell for north of $140!

That’s right: My Green Zone Fortunes readers are sitting on a 240%-plus profit in this stock, and we haven’t even been in it for a year yet!

Ultimately though, I think this $5.8 billion company will soon grow into a $58 billion biotech juggernaut, joining the ranks of the largest players in the space, including Moderna, Vertex and Regeneron.

And that’s why, even though my early subscribers are already up massively on this play, I think you should get into it, too, ASAP. I’m convinced this stock could be up between 500% and 1,000% over the next three to five years.

I know that sounds hard to believe. But here’s the thing: I haven’t even told you half of this company’s story yet.

While it is the market-leading pioneer in making DNA available for health care research and development, its expertise in manufacturing DNA on silicon chips sets it up for a windfall of billions in the data-storage industry.

And when I tell you tomorrow about the companies it just partnered with to advance its proprietary DNA-storage technology … you’ll understand exactly why this company will lead a revolution in the data storage field and rake in massive amounts of revenue along the way.

If you’re already convinced that this DNA company is a stock you need to buy ASAP, go here now! You’ll claim all the research behind this “holiday treat” I’ve shared with you today (and so much more!).

You can get exclusive access to my Millionaire Master Class special report today for only $1.

And if you want to find out more about this DNA pioneer, please make sure to join me tomorrow in Money & Markets for the rest of the story!

To good profits,

Adam O’Dell

Chief Investment Strategist, Money & Markets