About 20 years ago, I was a spry young lad in Kansas.

I had a pretty good job and was living it up as a bachelor.

But something was missing.

Then, I got a call from a headhunter. A newspaper in Florida wanted me for an editorial position.

It was a dream come true.

I always wanted to live in Florida and escape the snow and doldrums of the Midwest.

So, I jumped on a plane and flew to the Sunshine State.

After some wining and dining, I had a great feeling about the job.

However, once we discussed pay, my heart sank. It was about the same as I was making in Kansas, but the cost of living in Florida was more than double.

The publisher of the paper responded to my inquiry about pay with one phrase that I’ll never forget:

“What Florida doesn’t pay on your check, we make up for in sunshine.”

Yeah, but sunshine doesn’t pay the bills. I had to decline the offer.

It was for the best because 20 years later, I landed a great job and still ended up in South Florida.

And the publisher of that paper was right about the sunshine, bringing me to the second of our “5 Holiday Investments” to make before 2021.

In July, Money & Markets Chief Investment Strategist Adam O’Dell used his proprietary Green Zone Ratings system to uncover a stock that benefits from the sun … and his readers boast open gains of 71.5% from this stock so far!

The Great Solar Tipping Point

The 2020 U.S. presidential election has been one of the most contentious in recent history, but its outcome has set the country on a clear path.

The new Biden administration has pledged to create a carbon pollution-free power sector in the U.S. by 2035.

That means a greater commitment to the increased use of alternative energy, including solar.

And it’s not just the U.S. making this kind of commitment.

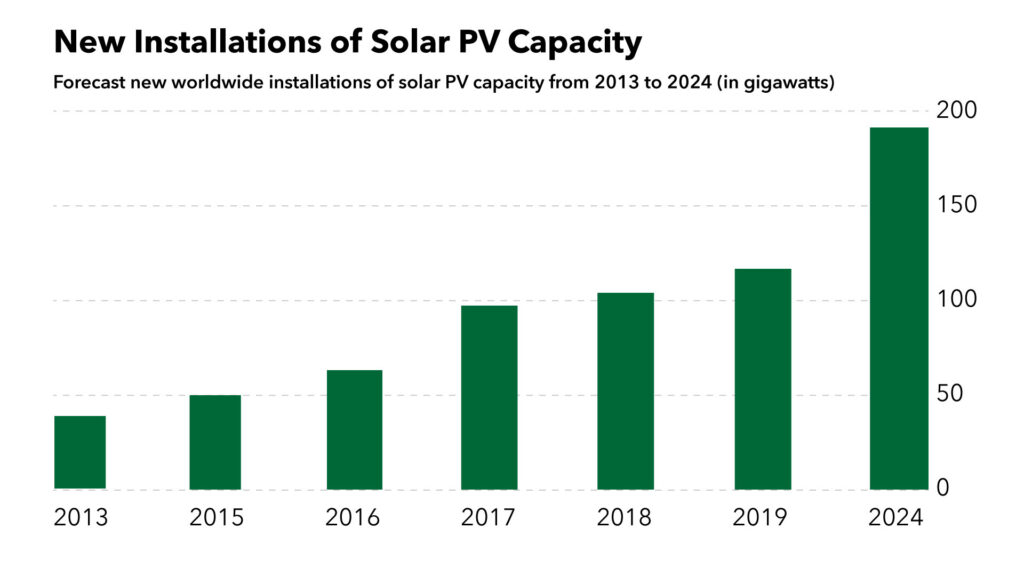

Data source: SolarPower Europe.

As the chart above shows, the global installation of solar photovoltaic (PV) cells will increase by more than 64% from 2019 to 2024 after growing more than 207% in the last seven years.

Today, solar energy only accounts for 3% of the world’s total electricity generation.

That means a ton of growth potential for solar companies.

Adam found one company poised to be a leader in the solar industry.

This Solar Stock Giant Has Momentum on Its Side

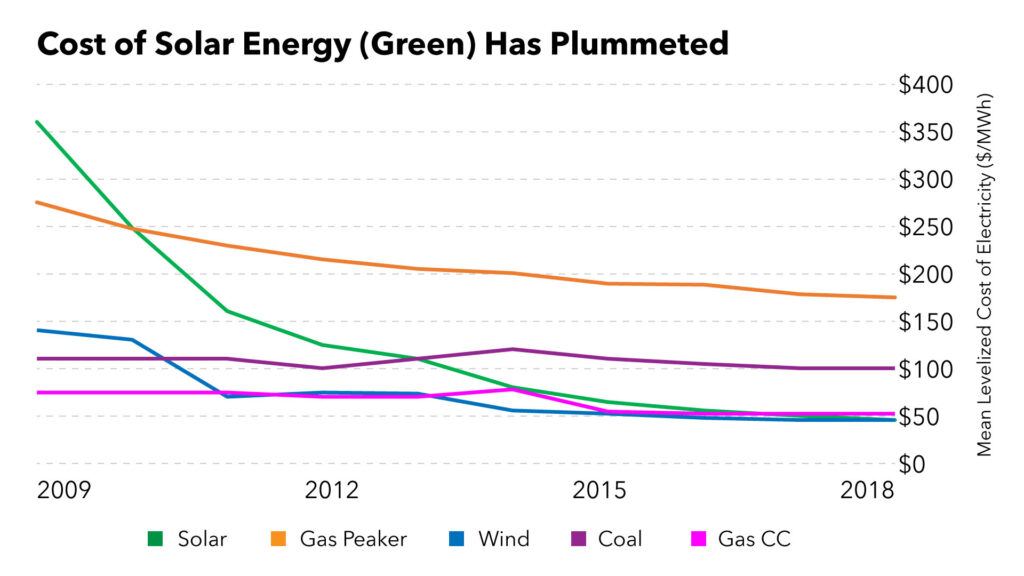

The cost to produce solar-powered energy has dropped more than 85% in the last decade.

As you can see in the chart below, at $50 per megawatt-hour (MWh), it’s much cheaper to produce solar power (green line) than gas (orange) or coal (purple).

This is a big reason countries look to solar power to produce more zero-carbon emissions.

This industry will dominate investment markets for decades to come. And Adam identified one Green Zone solar stock that is head and shoulders above the rest.

This stock ranks a 69 overall on Adam’s six factor Green Zone Rating system. That means we are bullish and expect it to outperform the market by two times over the next 12 months.

One of the most important factors we look at is momentum. This stock ranks a 96 on Momentum — meaning only 4% of all other stocks rated better.

When Adam recommended the stock in July, its Momentum rating was 73. So, its momentum is now stronger. That’s a great sign the share price will continue to grow.

This stock’s Value is also strong at 83 on the Green Zone scale.

The bottom line is this: The stock Adam recommended is a fantastic value with strong momentum that will benefit from the growing shift in solar energy production.

This “holiday pick” is reserved for a special group of our paid readers so I can’t tell you the name of the stock.

What I can tell you is that it’s up more than 71% since Adam recommended it.

Because we expect this “holiday pick” will surge even higher after Inauguration Day, we recommend getting into position before the end of the year. However, the research for this particular stock is reserved for Adam’s paid Green Zone Fortunes community.

To claim the exciting details on this stock (plus 3 more!), go here now before it’s too late. For a limited time, you can join this elite group right now, plus access Adam’s Millionaire Master Class report for just $1.

Don’t delay. This incredible opportunity could expire any day now.

Until next time…

Safe trading,

Matt Clark

Research Analyst, Money & Markets

Matt Clark is the research analyst for Money & Markets. He’s the host of our podcast, The Bull & The Bear, as well as the Marijuana Market Update. Before joining the team, he spent 25 years as an investigative journalist and editor — covering everything from politics to business.