DocuSign Inc. (Nasdaq: DOCU) is a leading e-signature and digital transaction management platform. Is DocuSign stock a good buy as we head into 2023?

During the height of the COVID-19 pandemic, DocuSign grew its business at a rapid pace as companies and individuals rely more on digital solutions for signing documents and completing transactions.

As such, DocuSign’s stock soared from its IPO in 2018 through 2020. But what should you know before buying DocuSign stock in 2023?

We’ll get into the details and consult our proprietary Stock Power Ratings system to find out more.

DocuSign’s Growth Potential and Competition

DocuSign’s primary revenue stream comes from subscription-based plans that offer additional features like branding options, data storage and integration with other platforms.

The company also recently launched a new product called “DocuSign Rooms for Real Estate” that helps real estate agents securely manage transactions online.

As millions of Americans worked remotely due to COVID lockdowns, DocuSign grew its customer base and increased its revenue streams.

But competition is growing within the e-signature space.

Products like Adobe Sign and Hello Sign are both vying for market share with their own digital signature platforms.

While these companies may not pose an immediate threat to DocuSign right now, they could eventually become serious competitors if they continue to gain traction among consumers.

The Risks of Investing in DOCU

Of course, there are always risks associated with any investment — and investing in DocuSign stock is no exception.

For example, the company relies heavily on its recurring monthly plans for revenue; if customers start to drop off or switch to another platform due to competitive pressures or changing trends, then this could have a negative impact on the DocuSign stock price.

Additionally, any major security breach or changes in regulations could put a damper on investor interest as well.

And our Stock Power Ratings system shows DocuSign stock may struggle for gains in 2023.

DocuSign Stock Power Ratings

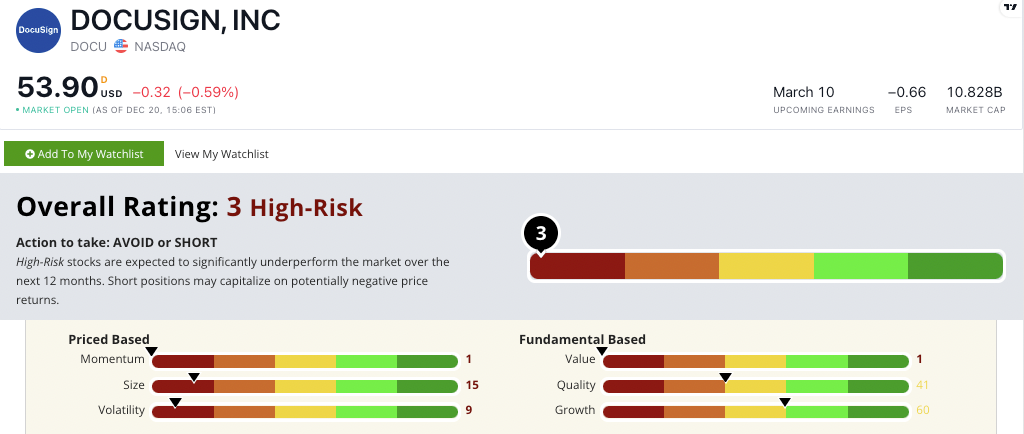

DOCU scores a 3 out of 100 on our proprietary Stock Power Ratings system.

That means we consider the stock “High-Risk” and expect it to significantly underperform the market over the next 12 months.

Short positions on DOCU may capitalize on potentially negative price returns.

DocuSign stock gets hit the hardest on our value factor … where it scores a 1.

With negative price-to-earnings and price-to-cash flow ratios, the company is struggling to make any money. And its way overvalued after investors bid the price up during the COVID-19 pandemic.

The stock also earns a 1 on our momentum factor due to a more than 60% drop in its stock price from December 2021 to December 2022.

The bottom line: While there is certainly potential for growth within this industry thanks to more customers needing its innovative products, investors should also keep tabs on competitors within this space.

It’s also important to check out our Stock Power Ratings system to get the full picture of a stock before you decide to invest.

Would you buy DocuSign stock right now? It looks risky, but maybe you are thinking about shorting the stock as it heads lower. Let us know by emailing StockPower@MoneyandMarkets.com.